CFD Dominance Crushes Traditional FX

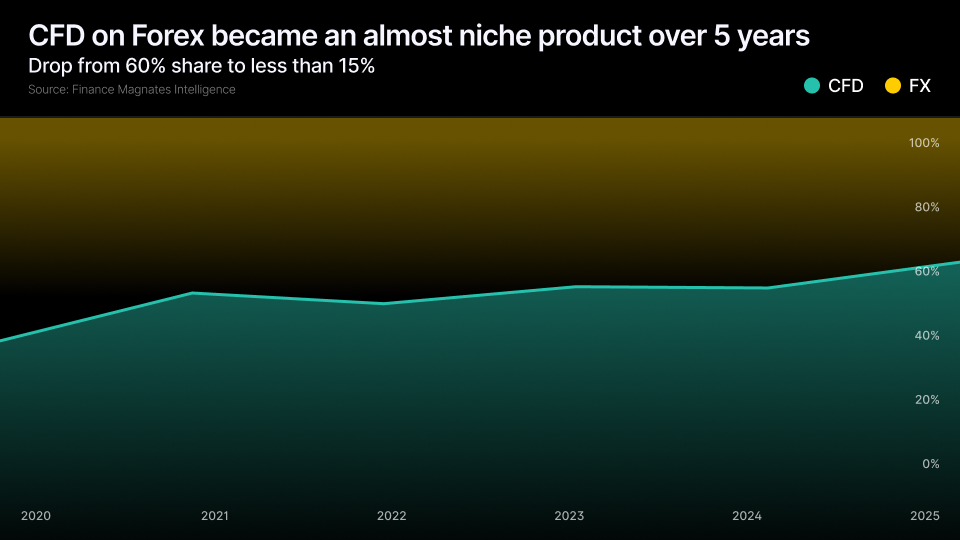

The forex market share plummeted by 76% in relative terms, dropping from 57.9% in 2020 to a mere 14.0% in 2025. This represents a loss of nearly 44 percentage points in just five years. CFD trading absorbed this exodus, more than doubling its share from 41.1% to 86.0% during the same period.

The crossover happened rapidly between 2022 and 2023, when CFD volumes jumped from 41.8% to 64.7% in a single year. This looks like a fundamental market restructuring driven by changing trader preferences and product innovation.

Mobile Platforms Conquer Desktop Trading

The shift to mobile-first trading proved equally visible. Mobile trading share increased 61.5% in relative terms, rising from 40% in 2020 to 64.6% in 2025. Desktop trading collapsed by 41% relatively, falling from 60% to just 35.4% of market share, according to Finance Magnates Intelligence data.

The mobile revolution crossed the 50% threshold between 2020 and 2021, earlier than the CFD takeover. By 2025, nearly two out of every three trades originated from smartphones rather than traditional desktop platforms.

.png)

XTB Case Study

XTB's transformation illustrates the broader industry shift. In 2019, 80% of new European Union clients opened their first position in CFDs. By 2025, that figure crashed to just 7%. Stocks captured 38% of first trades, investment plans took 28%, and ETFs secured 27%.

The broker's client asset composition reflects this product revolution. Stock positions reached 15.1 billion zlotys by year-end 2025, nearly doubling from 7.9 billion twelve months earlier. Exchange-traded funds climbed even faster, jumping 110% to 12.1 billion zlotys. Combined, these two long-term investment products now account for 60% of total client assets.

CFD positions grew just 26% to 12.7 billion zlotys, falling to third place in the asset breakdown. This marks a complete reversal for a product that once dominated XTB's entire business model and revenue structure.

"The transformation of XTB from a CFD broker to a modern FinTech entity providing a universal investment application has been progressing in recent years," the company stated in its preliminary 2025 results. The fintech now manages over 174,000 tax-advantaged retirement accounts across Poland, Britain, and France.

| Year | Shares | ETF | Investment Plans | CFDs |

|---|---|---|---|---|

| 2019 | 18% | 2% | 0% | 80% |

| 2020 | 35% | 3% | 5% | 57% |

| 2021 | 42% | 14% | 15% | 29% |

| 2022 | 33% | 18% | 18% | 31% |

| 2023 | 50% | 18% | 19% | 13% |

| 2024 | 35% | 26% | 26% | 13% |

| 2025 | 38% | 27% | 28% | 7% |

Why Traders Abandoned Traditional FX

.jpg)

The data supports this behavioral transformation. Gold-linked CFDs alone accounted for 38% of all derivative trading volume at XTB in 2025, followed by the Nasdaq 100 index at 28%. Traditional currency pairs no longer define the retail trading experience.

These trading shifts haven't hurt broker performance, however. In Q4 2025, for the first time ever, five firms from the CFD sector achieved volumes exceeding $1 trillion. According to Finance Magnates Intelligence data, the leader was IC Markets with $1.8 trillion.

The number of active accounts also matters significantly. We started the year with just over 5 million and ended it with nearly 7 million. Total volumes jumped from $19 trillion in Q3 2024 to nearly $30 trillion in Q3 2025.

If this pace continues, we estimate that the number of active CFD traders in 2026 will reach nearly 8.4 million.