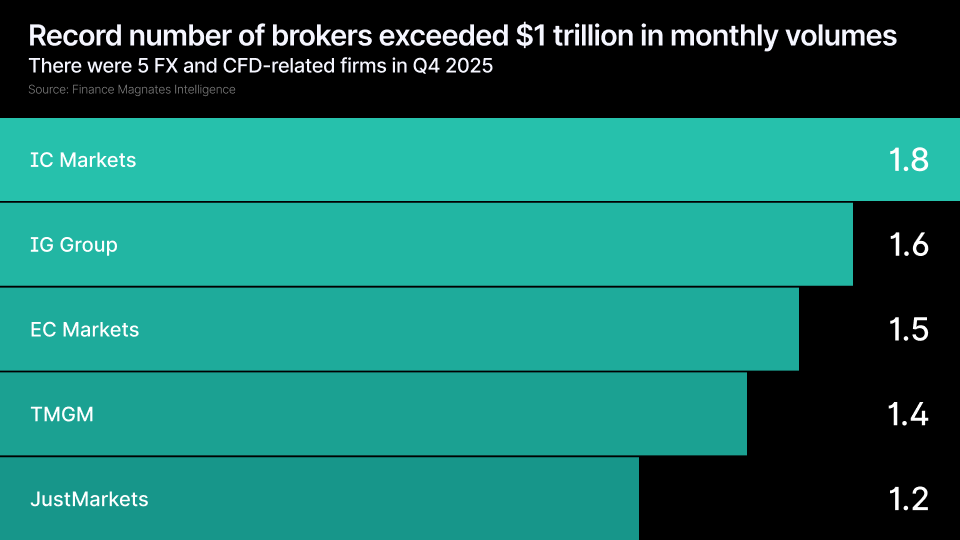

Five Brokers Join the Trillion-Dollar Club

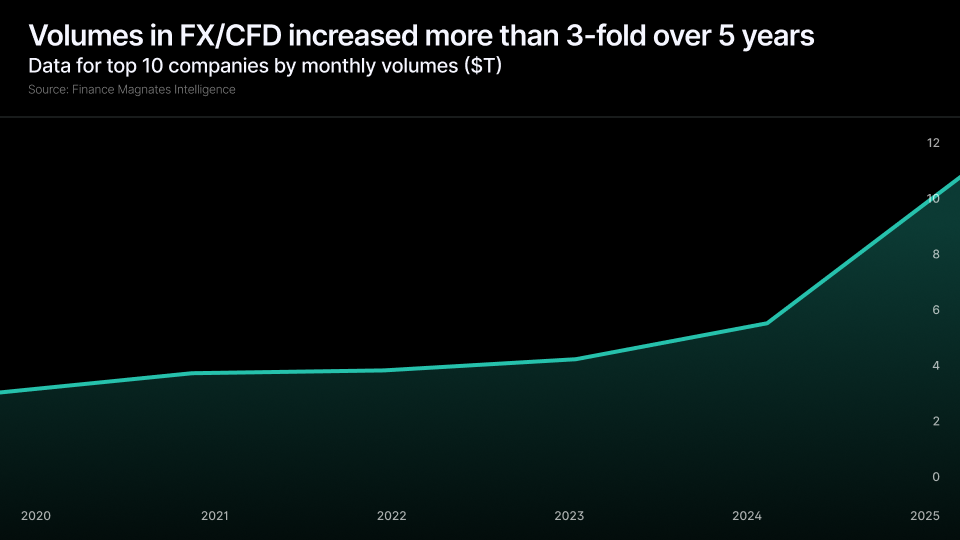

The magnitude of this expansion becomes clear when examining the pace of growth. The industry added $6.5 trillion in aggregate monthly volumes between 2023 and 2025 alone. That’s more than the entire market size just five years earlier, Finance Magnates Intelligence data shows.

This acceleration reflects fundamental changes in how retail traders access markets, what they trade, and where the most active participants are located.

IC Markets led the sector with $1.76 trillion in monthly volumes, followed by IG Group at $1.56 trillion and EC Markets at $1.49 trillion. TMGM and JustMarkets rounded out the trillion-dollar club at $1.39 trillion and $1.24 trillion, respectively.

The remaining top 10 brokers - Saxo Bank, Plus500, XM, CFI, and eToro - each reported volumes between $550 billion and $810 billion monthly.

Top Five Capture Two-Thirds of Market

The top five brokers collectively handled $7.44 trillion in monthly volumes during 2025, up from $2.26 trillion in 2020, a 229% increase. However, their share of the top 10 market actually declined slightly from 72% to 69% over the period. This suggests that while the largest platforms continued growing rapidly in absolute terms, mid-sized competitors gained ground in relative market share.

The final year of the period saw particularly strong growth across all platforms. The top five brokers grew an average of 109% between 2024 and 2025. Even the two largest brokers by volumes in Q4 2025 - IC Markets and IG Group - posted 45-46% annual growth despite their trillion-dollar-plus volume bases.

This acceleration coincided with several market dynamics. Gold trading emerged as the dominant force in Q4 2025, with XAU contracts accounting for the majority of activity at several platforms. The precious metal's rally toward $5,600 per ounce more than doubled trader interest compared to previous quarters, driving substantial volume increases across the industry.

MENA Surpasses Europe in Trading Volume

Regional dynamics also shifted as Middle Eastern traders began generating more volume than European clients. UAE traders alone represent around 70% of MENA regional activity, establishing the Emirates as a major hub for retail trading.

The MENA region now produces trading volumes 3.5 times larger than Europe despite maintaining fewer active accounts. In a separate analysis, Finance Magnates Intelligence examined the differences between Dubai's and Cyprus's approaches to regulating the CFD and retail trading market, asking whether the emirate is becoming the new destination for brokers. You can read more about it here.