Is Cyprus Losing CFD Brokers to Dubai's Rising Appeal?

Did Cyprus's financial regulator just hand the CFD industry another reason to the dissatisfaction that is reportedly being heard more loudly on the streets of Limassol?

In January 2026, CySEC proposed raising CIF licensing costs, while the market watchdog Chairman announced plans to "strengthen supervisory controls and focus on the conduct of investment firms toward their clients". The message is unmistakable: higher costs, tighter scrutiny, and zero acknowledgment that brokers are already voting with their feet.

Over the past 18 months, more than 20 major brokers have established Dubai operations while prominent firms like FXTM, SquaredFinancial, and Fibo Markets have voluntarily surrendered their CySEC licenses entirely. MultiBank Group didn't just open a Dubai office. It moved its entire headquarters to the UAE.

The contrast with Dubai couldn't be sharper. While Cyprus tightens the noose, the Dubai Financial Services Authority launched DFSA Connect in October 2025, cutting licensing processing times by 33%.

Is the regulatory gap between Limassol and Dubai poised to widen? Did CySEC's latest proposal just hand brokers the shovel to dig deeper?

The Breaking Point

CySEC's latest consultation paper, published in January 2026, proposes raising CIF license application fees from 7,000 euro to 8,000 euro per investment service, with dealing on own account jumping to 15,000 euro. For multilateral trading facilities, the fee would climb to 30,000 euro from 25,000 euro.

These increases come alongside higher annual subscription fees and new charges for material change notifications, creating a cumulative cost burden that many brokers view as the final straw.

The timing couldn't be worse. FXTM, SquaredFinancial, and Fibo Markets have already renounced their CySEC licenses in 2024-2025, signaling a strategic retreat from EU-centric business models.

Todor Georgiev, who worked in Cyprus for companies including Exness, tixee, FXGlobe, and Traders Trust and is now the CEO of the prop trading firm Funded7, puts it bluntly:

"CySEC and ESMA have been suffocating the CFD industry for years now, but in the past few years what really changed is the level of sophistication and complexities added such as DORA, GDPRs, tighter controls and more importantly overreach of CySEC demanding data from EU brokers on their offshore brands and their clients."

George Pavel, General Manager at Naga.com Middle East, observes that "European rules have evolved to put client protection front and center, and rightly so, but the cumulative effect of leverage limits has narrowed product margins." The economics are stark: Cyprus caps retail leverage at 30:1 under ESMA rules, while Dubai permits 50:1 on major pairs through DFSA regulation.

Dubai's Accelerating Advantage

While Cyprus tightens the screws, Dubai has systematically dismantled barriers to entry. The Dubai Financial Services Authority launched DFSA Connect in October 2025, an automated platform that cuts licensing processing times by 33%. What previously took 8-12 months now targets 6 months for many applications.

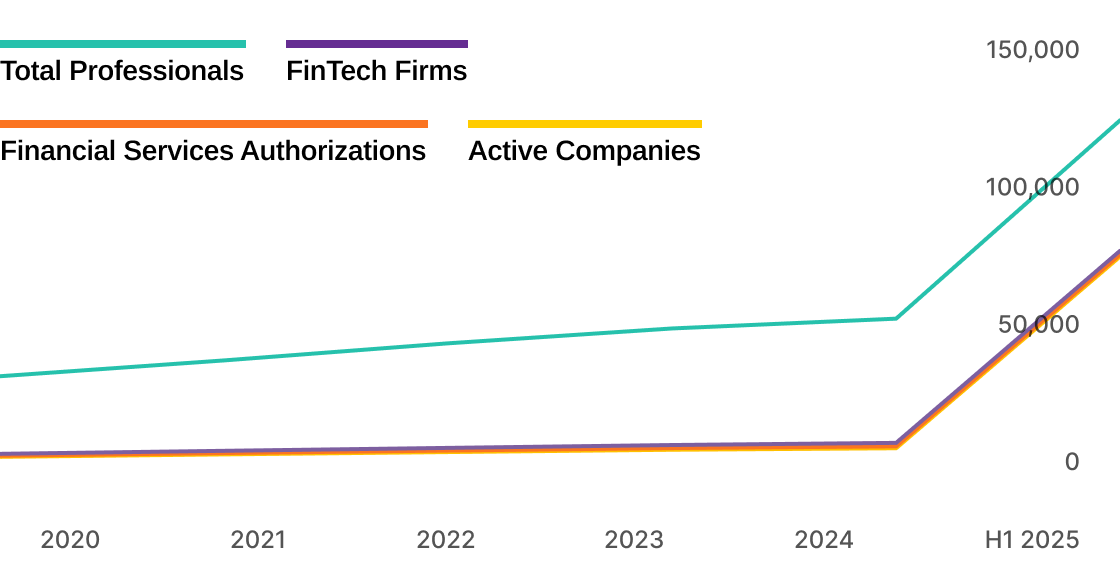

The numbers tell the migration story. DIFC registered 1,081 new companies in H1 2025 alone, bringing total active entities to 7,700 - a 28% year-on-year increase in financial services authorizations (78 new licenses vs 61 in H1 2024). More than 70 brokerage firms now operate from DIFC, including five of the world's top ten interdealer brokers.

Charlotte Day, Director at Contentworks Agency, adds the broader context: "The Dubai International Financial Centre has grown to more than 7,700 active companies. Dubai now hosts a number of high profile Forex and fintech events, therefore facilitating networking between HNW individuals in the space."

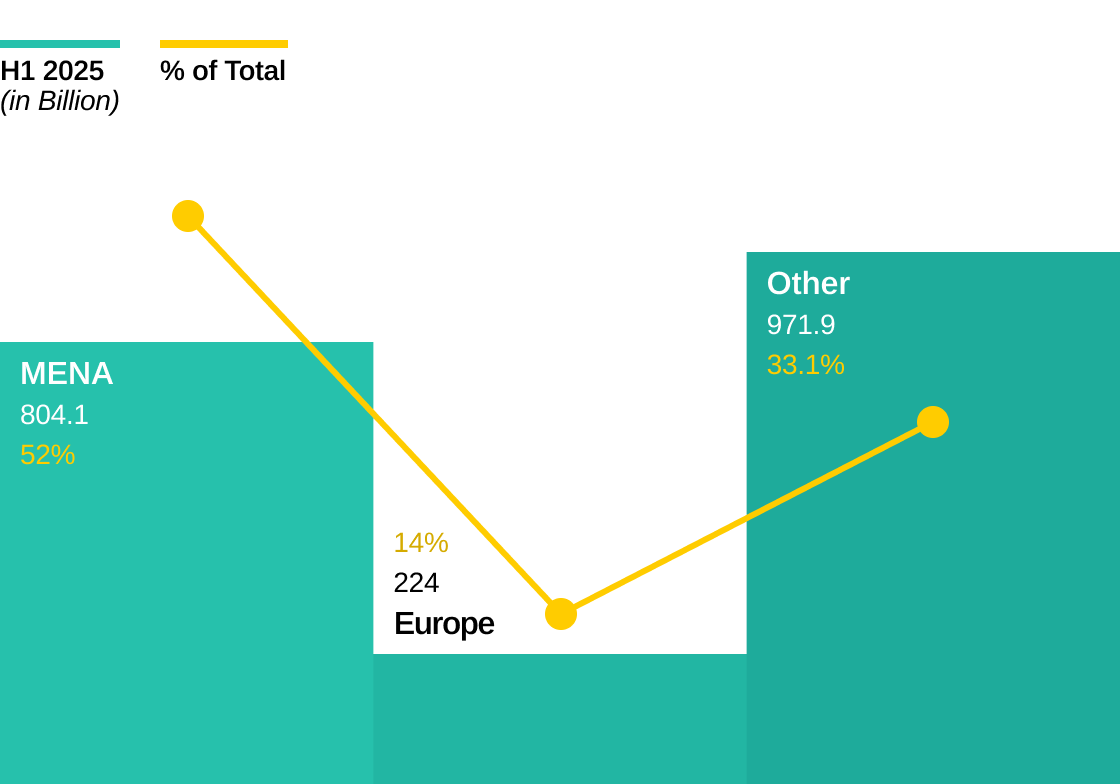

Capital.com's data provides the clearest evidence of this shift. In H1 2025, 52% of the broker's trading volume - $804.1 billion - came from MENA, with UAE traders accounting for 71.7% of regional activity. By contrast, Europe contributed just $224 billion, or 14.9% of global volume. The region now generates trading volumes 3.5 times larger than Europe despite having fewer active traders (35,000 in MENA vs 61,400 in Europe).

"Regulatory transparency and pragmatism are why so many brokers are setting up in the UAE," explains Hani Abuagla, Senior Market Analyst at XTB MENA. "The regulatory environment combines rigorous oversight with a capacity to engage industry stakeholders".

His assessment captures what many in the industry now recognize: Dubai isn't just offering lower costs. It's providing a fundamentally different regulatory philosophy.

The License Migration Wave

Let’s be honest. So far, only a handful of brokers have relocated, and it is still very far from being an exodus. However, many companies are instead choosing to expand their options and are also looking to establish a presence in Dubai. Not only because of low taxes and business-friendly regulation, but also due to access to a large base of new clients.

Major 2025 Expansions to Dubai:

- XM - Secured SCA Category 5 license (December 2025),

- Exinity (FXTM) - Obtained SCA Category 5 after surrendering CySEC license (July 2025)

- RoboMarkets - Full Category 1 SCA license (September 2025),

- Deriv - Category 1 trading broker license allowing local client fund holding (October 2025),

- Forex.com (Gain Capital) - Category 5 license from Dubai's SCA (October 2025),

- VT Markets, Eightcap, EC Markets, Taurex - All secured Category 5 licenses (July-September 2025).

Moreover, CME Group – the biggest derivatives exchange – has launched a Dubai hub in October 2025 signalling institutional validation, with the derivatives giant citing a 16% climb in regional trading volumes.

| Fee Category | Cyprus (Current) | Cyprus (Proposed 2026) | Dubai DFSA | Dubai SCA Cat 5 |

|---|---|---|---|---|

| Application Fee (Standard CIF) | 7,000 euro | 8,000 euro per service | $20-30K | $15K |

| Dealing on Own Account | Included | 15,000 euro | Included in category | N/A |

| Annual Supervision Fee | 5,000 euro base + volume levy | Higher base + steeper increments (2% on 500K-1M) | 20k+ | Lower (varies) |

| Material Change Notification | Free | New charge (amount TBD) | Included | Included |

The Operational Economics

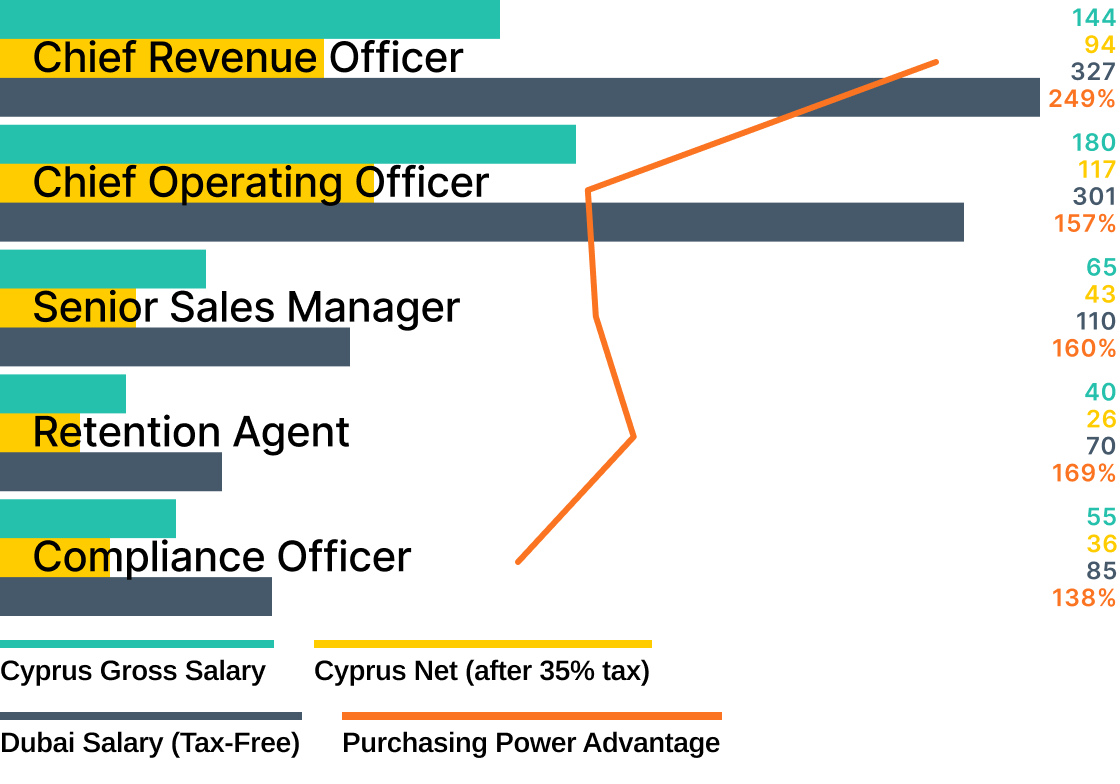

Beyond regulation, the tax and talent arbitrage drives C-suite relocations. Dubai offers zero personal income tax and 0% corporate tax for DIFC entities on qualifying income, compared to Cyprus's 12.5% corporate rate (rising to 15% under global minimum tax) and tiered personal income tax up to 35%.

"Salary expectations and hiring costs can be meaningful inputs into location decisions, but broader country attractiveness factors can materially affect hiring success, such as infrastructure, connectivity, safety, and overall living standards,” Abuagla adds emphasizing the talent dimension.

Comparative salary data from 2025 shows Dubai Chief Revenue Officers commanding 327,000 euro annually versus 144,000 euro in Limassol - a 127% premium. Even mid-level retention agents see 80% higher take-home pay in Dubai (50,000-90,000 euro tax-free vs 30,000-50,000 euro taxable in Cyprus).

"The UAE's zero income tax and competitive executive packages make it easier to attract experienced people, even though the cost of living is higher. Cyprus remains a strong hub with a deep pool of EU-licensed specialists, but wage expectations there are generally more modest,” adds Pavel.

What CySEC Gets Wrong?

The regulator's 2026 priorities reveal a fundamental misreading of industry dynamics. In its recent statement, CySEC Chairman, George Theocharides, said:"In 2026, we will strengthen our supervisory controls and focus on the conduct of investment firms toward their clients" - signaling closer scrutiny of CFD marketing, appropriateness tests, and cost disclosures.

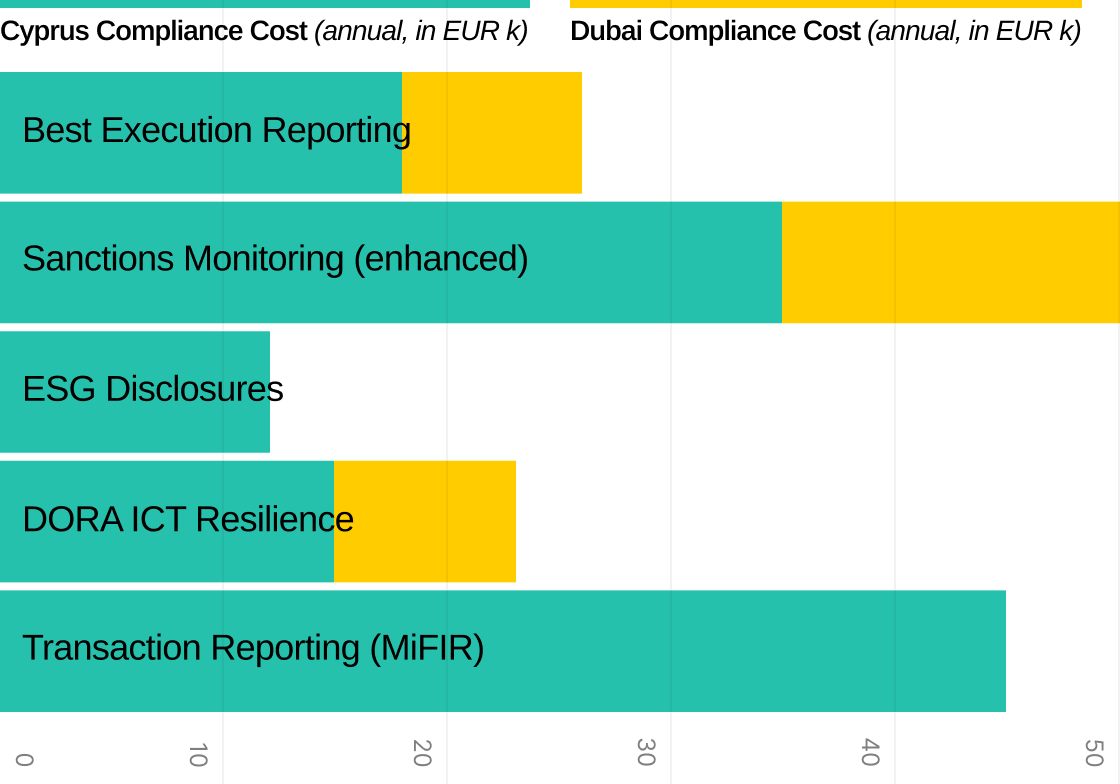

This enforcement-first approach comes as brokers are already drowning in compliance obligations. The Digital Operational Resilience Act (DORA) alone adds 2,000-20,000 euro annual fees depending on firm size. ESG reporting, MiCA crypto requirements, and sanctions monitoring through Cyprus's new National Sanctions Implementation Unit have created "a regulatory layer cake.”

The proposed fee structure particularly penalizes diversified firms. Under the new model, firms would pay 8,000 euro per investment service rather than a flat 7,000 euro. A broker offering reception and transmission of orders, execution, portfolio management, and investment advice would face 32,000 euro in application fees - before annual costs and capital requirements.

However, we need to remember than as an EU member state, Cyprus offers passporting rights across 27 countries, “something Dubai cannot provide, alongside a competitive 15% corporate tax rate and alignment with OECD and EU regulatory standards,” Day added. “Cyprus also has an opportunity to attract firms seeking long term certainty, family relocation and access to European clients."

And while the EU Passport doesn't look like fool's gold just yet (and won't for a long time) something is slowly starting to crack. With ESMA leverage caps, bonus prohibitions, and product restrictions, the "European client" has become a lower-margin, higher-compliance liability.

Georgiev notes that brokers now view CySEC's overreach, "demanding data from EU brokers on their offshore brands and their clients,” as crossing a red line that makes Dubai's siloed regulatory approach more appealing.

The Dubai Advantage Deepens

While Cyprus adds costs, Dubai is streamlining. The SCA Category 5 license, designed for introduction and advisory services, has become the industry's preferred vehicle. It allows firms to maintain sales, marketing, and client introduction operations in UAE while booking trades through offshore or other jurisdictional entities.

Processing times tell the efficiency story. Category 5 approvals for established foreign firms now take 3-6 months for initial approval, compared to Cyprus's 9-12+ month CIF timeline. The DFSA's risk-based approach means firms with existing regulatory approval elsewhere receive expedited treatment.

"Being on the ground in the UAE exposes brokers to a vibrant and fast-growing trading community,” Pavel summarizes the strategic calculus. “The Gulf's younger population and large expat community are increasingly active in online trading and looking for sophisticated products. Proximity to emerging markets makes it an excellent launch pad for brokers who want to diversify beyond European markets."

The Golden Visa program provides the final piece. High-earning executives and their families can secure 10-year UAE residency with minimal physical presence requirements, compared to Cyprus's non-dom scheme that demands 60 days annual residence and increasingly faces EU scrutiny.

DIFC now employs 47,901 professionals and hosts over 1,000 regulated entities supervised by DFSA as of October 2025. FinTech companies in DIFC grew 28% to 1,388 firms in H1 2025, creating a technology ecosystem.

Is Dubai Becoming the New Cyprus?

Cyprus retains structural advantages that shouldn't be dismissed. The EU passport remains valuable for genuine European client acquisition, and Cyprus's fund administration infrastructure (9.3 billion euro in AUM as of 2024) provides diversification opportunities. The island's 120% R&D tax deduction and 50% income tax exemption for high earners (over 55,000 euro annually for 17 years) could retain technical talent.

The Island, once considered an offshore location, became a regulatory hub for brokers and financial firms looking to operate across the entire European continent. Dependence on EU regulations, however, forces defensive plays in a game where Dubai holds offensive momentum.

"Dubai appeals to those who value scale, speed and a highly structured, cosmopolitan environment, with premium infrastructure, luxury living and a fast-paced, global city feel,” Day's lifestyle observation cuts to the heart of the choice. “Cyprus, by contrast, attracts individuals who prioritize balance, community, a Mediterranean climate, easier access to nature and a more relaxed way of living."

For C-suite executives, sales teams, and UBOs, Dubai's proposition is increasingly irresistible. For compliance officers, developers, and back-office functions, Cyprus offers EU expertise at lower cost than Western Europe. The result might be the dual-hub model. Regulatory headquarters in Limassol, commercial headquarters in Dubai?

Georgiev's final assessment deserves the last word: "All of this is making a number of companies much more sensitive to CySEC, so a lot of them waived their licenses. They go to UAE regulators and get licenses where the regulator is much less experienced and knowledgeable. Of course, now more than ever offshore jurisdictions are flourishing."

Does Cyprus risk becoming what one broker privately called “a compliance museum”? It's still far too early for such bold statements. However, small cracks are starting to appear in the monolith.