What Brokerages Pay in Cyprus: 2024–2025 Salary Guide

Running a brokerage in Cyprus is less about licensing costs and more about staffing expenses. While salaries are lower than in major EU hubs, they remain a significant cost for forex and CFD firms in 2024–2025.

What is the real cost of running a brokerage in Cyprus? It’s not the license or the office space, it’s the people. As the long-time European hub for forex and CFD firms, Cyprus offers access to EU markets, experienced talent, and a well-known regulator. But while compensation levels remain below those of London or Frankfurt, salaries are far from modest. Finance Magnates examines brokerage pay trends in Cyprus for 2024–2025 and what they reveal about the true cost of doing business.

Introduction

What’s the real cost of running a brokerage in Cyprus? It isn’t the license. It isn’t the office. It’s people. Finance Magnates takes a closer look at the salaries in 2024–2025.

For years, Cyprus has been the main base for many forex and CFD firms in Europe. The draw is obvious: access to EU markets, a pool of skilled staff, and a familiar, friendly regulator. But while salaries here are lower than in London or Frankfurt, they’re not small by any means.

“The license may open the door, but the real cost of running a brokerage in Cyprus is always people. Talent retention is the single biggest line item for brokers—and the one they can least afford to get wrong.” — Donna Stephenson, Founder/CEO of Emerald Zebra

The Cyprus Workforce Insights 2024 report from Emerald Zebra, reviewed by Finance Magnates Intelligence, showed just how much companies are paying. Now, preliminary results from the upcoming 2025 Emerald Zebra Salary & Workforce Insights Report reveal how pay is evolving, especially in risk and compliance functions, where the pressure to retain talent remains high.

Big Chairs, Big Salaries

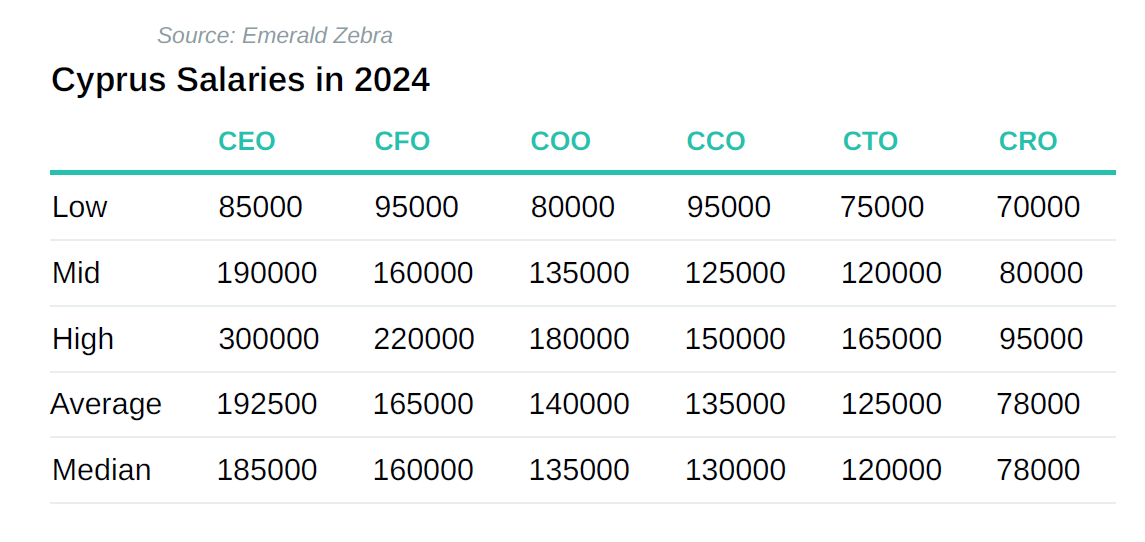

Executives sit at the top, and the pay reflects it. CEOs average around €192,500 a year, but the spread is wide: anywhere from €85,000 to €300,000. CFOs follow at €165,000. COOs sit near €140,000.

Compliance has climbed into the executive club. A Head of Compliance averaged €84,000 in 2024, and the 2025 preliminary data shows a stronger band: median €90,000, average €90,000, with highs above €110,000. Twenty years ago, compliance barely had a seat at the table. Today, it’s standing shoulder to shoulder with finance and tech; the pay packets show it.

And no surprise. Regulators keep a close eye on brokers. Compliance is no longer paperwork. It’s survival.

“Our preliminary 2025 data shows compliance leaders consolidating their position alongside finance and operations executives. A Head of Compliance now commands a median package of €90,000, with highs above €110,000. For many firms, compliance is no longer a support function – it’s survival.” — Donna Stephenson, Founder/CEO of Emerald Zebra.

Popular Positions

Marketing Roles

Brokers can’t grow without new clients. That puts a price tag on marketing teams. A senior Marketing Manager earns about €60,000. A Head of Marketing makes €84,000. Digital Marketing Specialists and Affiliate Managers are usually in the €45,000–€50,000 range.

These salaries are lower than in London, but still significant in Cyprus. And here’s the reality: if firms try to save too much here, they’ll struggle to attract people who can actually deliver results.

Sales Staff

AI, automation, and social media have changed the game, but sales teams remain vital for most brokers. A Sales Manager in Cyprus earns around €68,000. Account Managers and Business Development Managers usually make between €50,000 and €60,000. Junior staff start closer to €30,000–€40,000.

The bonus picture is where things get interesting. The 2024 report showed 42% of employees didn’t receive any bonus, and only 7% earned more than €25,000. That hasn’t shifted significantly in the early 2025 data. For sales-heavy firms, it’s still a gap. A clear commission structure could make teams hungry and keep them loyal. Without it, they’ll look elsewhere.

Dealers and Risk Managers

Trading may be electronic and automated now, but dealing rooms still matter.

- Senior Traders or Dealers average €55,200.

- Dealing Room Managers earn about €65,500.

- A Chief Dealer Officer makes roughly €120,000.

Risk teams track closely behind. In 2024, a Risk Manager averaged €65,500. Preliminary 2025 data shows a median of €63,500, with highs near €95,000 and an average around €58,000. Stability is being priced carefully but consistently.

Compliance and Regulatory Functions (2025 Spotlight)

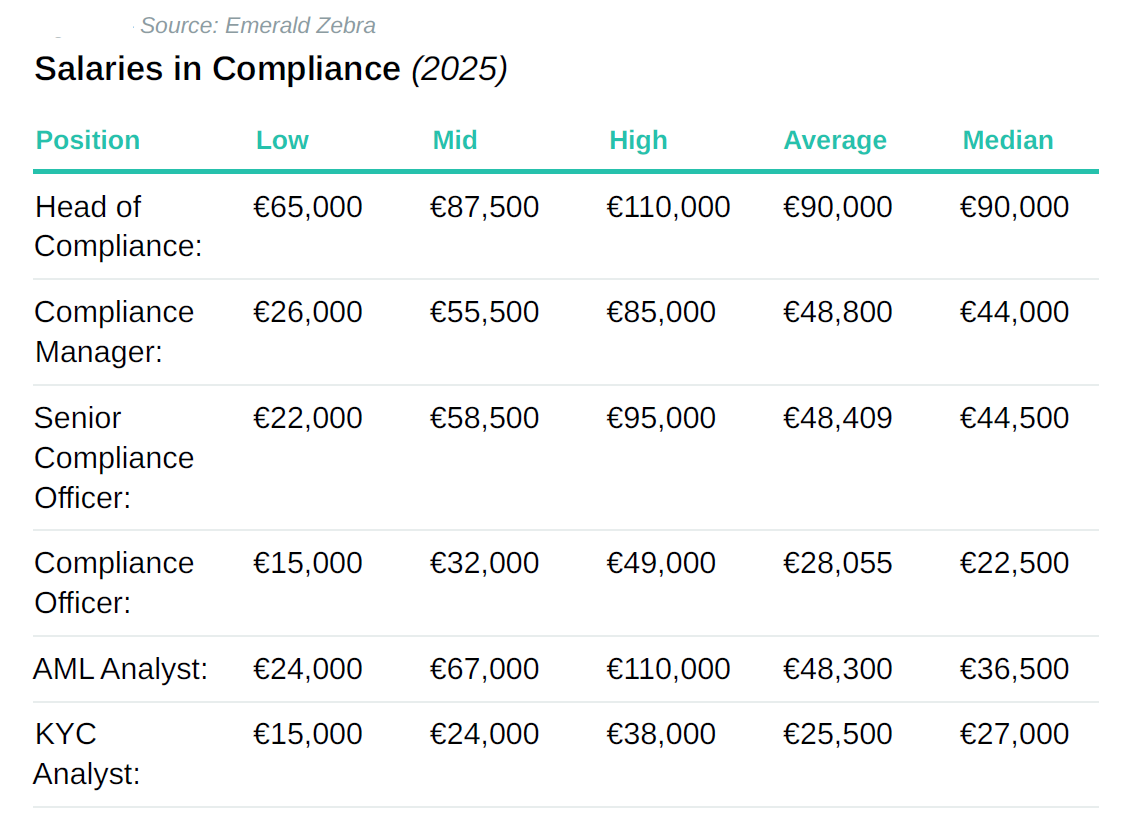

Emerald Zebra’s 2025 preliminary dataset highlights how layered the compliance profession has become in Cyprus:

So what does this tell us? There’s a clear pay pyramid. Heads of Compliance have consolidated their position as executive peers, while analysts and officers remain at the lower end of the scale. But the sheer range, from €15,000 entry-level KYC roles to €110,000 compliance leaders, shows how brokerages must navigate a fragmented talent market.

“There’s a very steep pyramid in compliance roles. Entry-level KYC analysts start as low as €15,000, while senior executives exceed €100,000. That disparity shows how fragmented the market is, but also how essential it is for firms to build career pathways if they want to keep staff engaged and loyal.” — Donna Stephenson, Founder/CEO of Emerald Zebra

Conclusion

Finance, risk, and compliance executives now add real weight to payrolls.

- Leadership is costly. Finance, risk, and compliance executives now add real weight to payrolls.

- Marketing and sales remain critical. Underpaying risks slower growth and higher churn.

- Retention is fragile. Many employees still see career development as only “fair,” and bonus structures remain underused.

- Compliance is king. The preliminary 2025 data shows firms are paying up to secure compliance talent, reinforcing its role as a survival function.