What Brokerages Pay in Cyprus: 2024–2025 Salary Guide

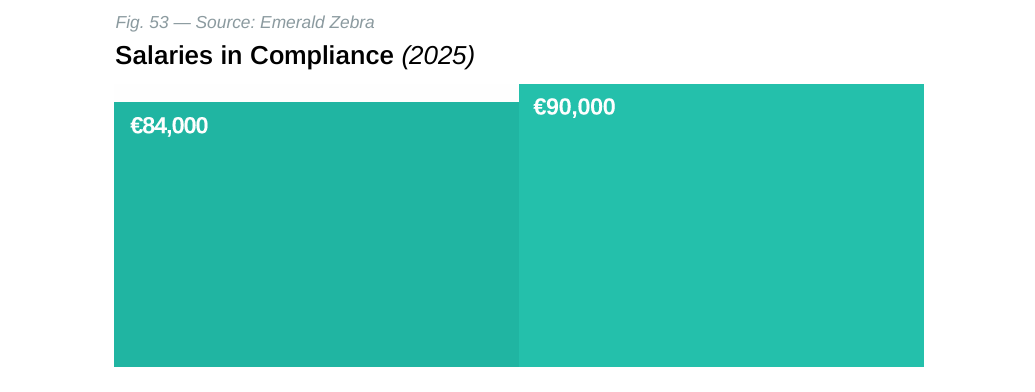

For forex and CFD firms, the primary cost of operating in Cyprus is not the license or office, but talent retention. Executives command the highest salaries, with CEOs averaging approximately €192,500 annually (ranging from €85,000 to €300,000). Notably, pay for Compliance roles has significantly increased; a Head of Compliance now commands a median salary of €90,000 (up from €84,000 in 2024) with highs above €110,000, reflecting the function's shift from a support role to a critical component of brokerage survival under close regulatory scrutiny.

The main operating cost for Cyprus brokerages is talent; CEO salaries average €192.5k, and compliance salaries are surging, with Head of Compliance median pay now reaching €90,000.

Overview

For years, Cyprus has been the main base for many forex and CFD firms in Europe. The draw is obvious: access to EU markets, a pool of skilled staff, and a familiar, friendly regulator. But while salaries here are lower than in London or Frankfurt, they’re not small by any means.

“The license may open the door, but the real cost of running a brokerage in Cyprus is always people. Talent retention is the single biggest line item for brokers—and the one they can least afford to get wrong.” — Donna Stephenson, Founder/CEO of Emerald Zebra

The Cyprus Workforce Insights 2024 report from Emerald Zebra, reviewed by Finance Magnates Intelligence, showed just how much companies are paying. Now, preliminary results from the upcoming 2025 Emerald Zebra Salary & Workforce Insights Report reveal how pay is evolving, especially in risk and compliance functions, where the pressure to retain talent remains high.

Big Chairs, Big Salaries

Executives sit at the top, and the pay reflects it. CEOs average around €192,500 a year, but the spread is wide: anywhere from €85,000 to €300,000. CFOs follow at €165,000. COOs sit near €140,000.

| Role | Low (euro) | Mid (euro) | High (euro) | Average (euro) | Median (euro) |

|---|---|---|---|---|---|

| CEO | 85,000 | 190,000 | 300,000 | 192,500 | 185,000 |

| CFO | 95,000 | 160,000 | 220,000 | 165,000 | 160,000 |

| COO | 80,000 | 95,000 | 180,000 | 140,000 | 135,000 |

| CCO | 75,000 | 135,000 | 150,000 | 125,000 | 130,000 |

| CTO | 70,000 | 125,000 | 165,000 | 135,000 | 120,000 |

| CRO | 80,000 | 120,000 | 95,000 | 78,000 | 78,000 |

Compliance has climbed into the executive club. A Head of Compliance averaged €84,000 in 2024, and the 2025 preliminary data shows a stronger band: median €90,000, average €90,000, with highs above €110,000. Twenty years ago, compliance barely had a seat at the table. Today, it’s standing shoulder to shoulder with finance and tech; the pay packets show it.

And no surprise. Regulators keep a close eye on brokers. Compliance is no longer paperwork. It’s survival.

“Our preliminary 2025 data shows compliance leaders consolidating their position alongside finance and operations executives. A Head of Compliance now commands a median package of €90,000, with highs above €110,000. For many firms, compliance is no longer a support function – it’s survival.” — Donna Stephenson, Founder/CEO of Emerald Zebra

Marketing Roles

Brokers can’t grow without new clients. That puts a price tag on marketing teams. A senior Marketing Manager earns about €60,000. A Head of Marketing makes €84,000. Digital Marketing Specialists and Affiliate Managers are usually in the €45,000–€50,000 range.

These salaries are lower than in London, but still significant in Cyprus. And here’s the reality: if firms try to save too much here, they’ll struggle to attract people who can actually deliver results.

Sales Staff

AI, automation, and social media have changed the game, but sales teams remain vital for most brokers. A Sales Manager in Cyprus earns around €68,000. Account Managers and Business Development Managers usually make between €50,000 and €60,000. Junior staff start closer to €30,000–€40,000.

The bonus picture is where things get interesting. The 2024 report showed 42% of employees didn’t receive any bonus, and only 7% earned more than €25,000. That hasn’t shifted significantly in the early 2025 data. For sales-heavy firms, it’s still a gap. A clear commission structure could make teams hungry and keep them loyal. Without it, they’ll look elsewhere.

Dealers and Risk Managers

Trading may be electronic and automated now, but dealing rooms still matter.

- Senior Traders or Dealers average €55,200.

- Dealing Room Managers earn about €65,500.

- A Chief Dealer Officer makes roughly €120,000.

Risk teams track closely behind. In 2024, a Risk Manager averaged €65,500. Preliminary 2025 data shows a median of €63,500, with highs near €95,000 and an average around €58,000. Stability is being priced carefully but consistently.

Compliance and Regulatory Functions (2025 Spotlight)

Cyprus Compliance Salary Preliminary Dataset 2025

Emerald Zebra’s 2025 preliminary dataset highlights how layered the compliance profession has become in Cyprus:

| Position | Low (euro) | Mid (euro) | High (euro) | Average (euro) | Median (euro) |

|---|---|---|---|---|---|

| Head of Compliance | 65,000 | 87,500 | 110,000 | 90,000 | 85,000 |

| Compliance Manager | 26,000 | 55,500 | 90,000 | 48,800 | 44,000 |

| Senior Compliance Officer | 22,000 | 58,500 | 95,000 | 48,409 | 44,500 |

| Compliance Officer | 15,000 | 32,000 | 67,000 | 28,055 | 22,500 |

| AML Analyst | 24,000 | 49,000 | 110,000 | 48,300 | 36,500 |

| KYC Analyst | 15,000 | 24,000 | 38,000 | 25,500 | 27,000 |

So what does this tell us? There’s a clear pay pyramid. Heads of Compliance have consolidated their position as executive peers, while analysts and officers remain at the lower end of the scale. But the sheer range, from €15,000 entry-level KYC roles to €110,000 compliance leaders, shows how brokerages must navigate a fragmented talent market.

“There’s a very steep pyramid in compliance roles. Entry-level KYC analysts start as low as €15,000, while senior executives exceed €100,000. That disparity shows how fragmented the market is, but also how essential it is for firms to build career pathways if they want to keep staff engaged and loyal.” — Donna Stephenson, Founder/CEO of Emerald Zebra

Look closely and you’ll notice something: in many cases, control staff now out-earn dealers. That says a lot. Stability and compliance are being priced above trading.

Conclusions

- Leadership is costly. Finance, risk, and compliance executives now add real weight to payrolls.

- Marketing and sales remain critical. Underpaying risks slower growth and higher churn.

- Retention is fragile. Many employees still see career development as only “fair,” and bonus structures remain underused.

- Compliance is king. The preliminary 2025 data shows firms are paying up to secure compliance talent, reinforcing its role as a survival function.