TOP 5 Industry Moves Q1 2025

Q1 2025 saw major consolidation as FTMO acquired broker OANDA. The CFD market hit a milestone of 5M active accounts globally, led by XTB. However, market volatility due to US trade policies caused eToro to pause its IPO, and prompted a divergence in European markets, with Germany growing while France declined.

The first quarter of 2025 was marked by strategic industry moves and market turbulence driven by US trade policies. The most significant consolidation saw Czech prop firm FTMO Group acquire the global broker OANDA from CVC Asia Fund IV, signaling major structural changes in the trading space. Despite volatility, the CFD industry reached a significant milestone, surpassing 5 million active accounts worldwide, an almost 30% increase in two years. XTB leads the market, serving 555,000 active monthly clients. In contrast, eToro temporarily halted its IPO roadshow due to market instability caused by President Trump's new tariffs. Leading established brokers like XTB, IG Group, and CMC Markets reported strong financial results, indicating sustained client growth. Finally, European markets showed divergence, with Germany's FX market growing by 3% to 63,000 active traders for the first time since the pandemic, while France continued to see a decline.

1. FTMO Acquires OANDA from CVC

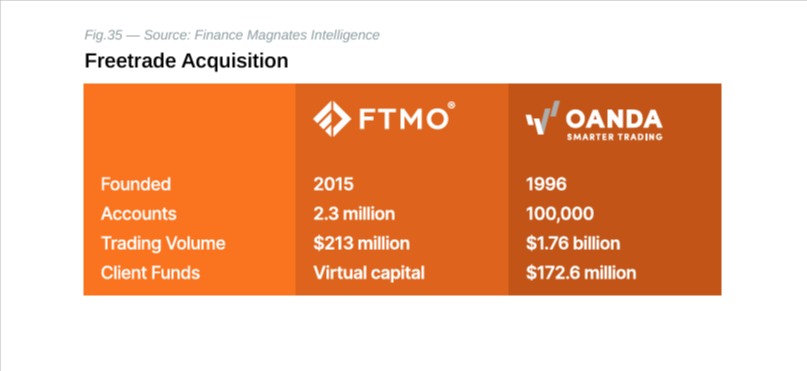

Czech Republic-based FTMO Group has agreed to acquire OANDA Global Corporation from CVC Asia Fund IV. While financial terms remain undisclosed, the deal represents a significant consolidation in the trading space, particularly as prop trading firms navigate an increasingly complex regulatory landscape.

In 2018, CVC Partners Asia Fund acquired a 98.5% stake in OANDA for $160 million, valuing the broker at $175 million based on the previous year’s $35 million EBITA. Since then, OANDA has expanded under CVC's ownership, introducing new products, establishing a back-end office in Poland, and developing a mobile trading platform. The remaining 1.5% equity was classified as management profit interest.

2. CFD Market Surpasses 5 Million Active Accounts

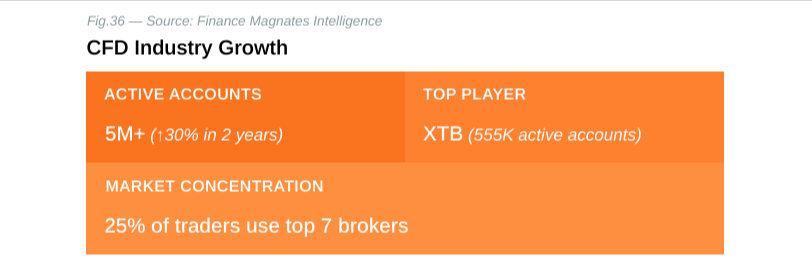

The CFD industry has reached a significant milestone in Q1 2025, with the total number of active accounts surpassing 5 million globally. This represents remarkable growth of nearly 30% over the past two years, up from 3.9 million accounts.

According to Finance Magnates Intelligence, just seven brokers now serve approximately 1.4 million active traders monthly—meaning one in four global CFD traders uses one of these platforms. XTB dominates this elite group with 555,000 active monthly clients in Q4 2024, more than triple its nearest competitor IC Markets (168,000).

3. eToro Pauses IPO Roadshow

Social trading platform eToro has temporarily paused its IPO preparations following market turbulence triggered by President Trump's new tariffs. The company, which recently filed its F-1 prospectus with the SEC, has reportedly delayed roadshows that were scheduled to begin in early April.

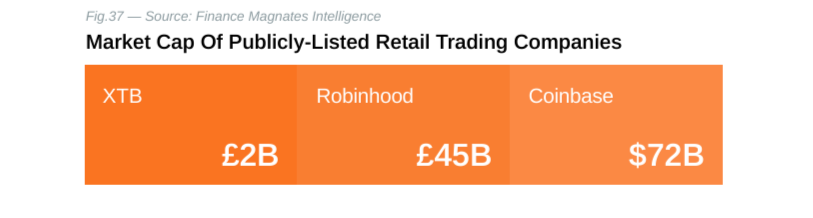

eToro still plans to go public in Q2 2025 but is "evaluating market conditions" after tariff announcements wiped out $6.6 trillion in market value over just two trading sessions. The S&P 500 fell nearly 10.5% from its February high, while Robinhood—considered a close competitor to eToro—lost approximately 23% of its value in a matter of days.

4. XTB, IG and CMC Markets Numbers

The industry's leading players posted remarkable results, with XTB adding 500,000 new clients - a 59.8% increase - and achieving PLN 1.87 billion in revenue. IG Group's revenue jumped 11% to £522.5 million, while CMC Markets reported a striking 45% increase in net operating income to £180 million.

5. Germany's FX Market Grows for First Time Since Pandemic

Germany's leveraged trading market has reversed course after three consecutive years of decline, growing 3% to reach 63,000 active CFD and forex traders in the 12 months to February 2025, according to research firm Investment Trends. Despite this positive turn, the market remains 25% below its COVID-era peak of 84,000 traders recorded in March 2021.

In comparison to other markets, Germany's 63,000 active traders exceeds Singapore's 38,000 but falls short of Hong Kong's approximately 100,000 CFD traders. France has also seen declining participation, with active traders falling from a pandemic peak of 38,000 to 29,000 currently.

Conclusions

As we move into Q2, the industry's response to tariff-induced market turbulence and evolving trader preferences will likely determine which companies emerge stronger from this period of adjustment.