Top 5 Industry Moves for Q3 2025

The CFD/FX industry saw five major shifts in Q3 2025: 1) The UK CFD trading base shrank to 167K but became more highly engaged; 2) Tokenized stocks and 24-hour trading emerged as a major trend, with Robinhood, Kraken, and CMC Markets adopting the instruments; 3) Polish broker XTB mandated 2FA after a high-profile security breach resulted in client losses, causing its stock to drop over 6%; 4) H1 earnings painted a mixed picture, with Plus500 and Swissquote posting strong results, while Admirals reported a wider loss; and 5) Major retail CFD brokers, including Axi and CFI, rushed into institutional services (B2B) to diversify revenue streams and seek higher-margin, less volatile business.

Q3 2025 saw 5 key trends: UK traders shrank but engaged more; tokenized stocks launched (Robinhood, Kraken); XTB mandated 2FA after a security breach; H1 results varied (Plus500 up, Admirals down); and retail brokers pivoted to B2B institutional services.

Overview

The world of CFD and FX trading moved rapidly throughout Q3 2025. Fewer traders were active in the UK, but engagement and platform innovation continued rising. Tokenized equities and 24-hour trading rewrote market dynamics, while cyberattacks put platform security firmly in the spotlight. H1 results revealed diverging paths: record deposits for some brokers, losses for others. Throughout the period, retail brokers rushed into the institutional space, chasing steadier revenues and tighter margins.

1. UK CFD Trading Base Shrinks to 167K Despite Rising Engagement

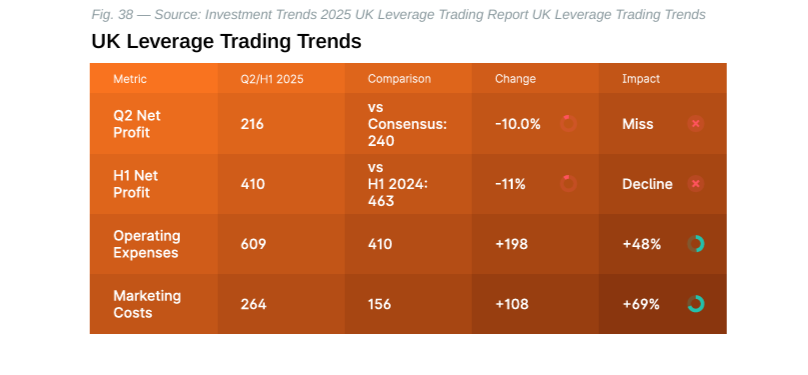

The number of active UK leverage traders declined by 3.5% in 2025, dropping from 173,000 to 167,000, but dormancy rates fell to their lowest level in five years. Investment Trends’ 2025 UK Leverage Trading Report reveals a shift toward a smaller but more engaged trader segment that thrives in volatile market conditions.

The report shows trader satisfaction has reached a seven-year high following platform improvements, including enhanced charting tools, extended trading hours, and tailored client support. While total trader numbers peaked at 275,000 in 2021, the core group of previously active traders who continued trading has remained.

2. Tokenized Stocks and 24h Trading Hits Market

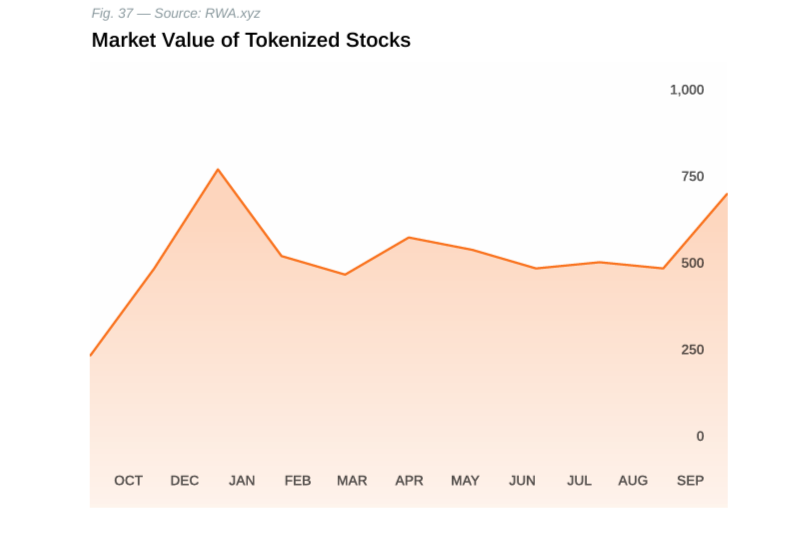

Tokenized stocks emerged as a major trend in Q3 2025, with major crypto exchanges and traditional brokers rushing to offer blockchain-based equity trading. Robinhood announced tokenized stocks for European customers on the Arbitrum blockchain, while Kraken and Bybit launched simultaneously with 60+ U.S. stock tokens on Solana-based xStocks. The CFD broker CMC Markets has also hinted at the upcoming launch of tokenized assets.

The movement promises 24/7 trading access, fractional ownership, and global accessibility. Kraken offers tokenized stocks “24 hours a day, five days a week,” while Robinhood provides “24/5 access” to over 200 U.S. stocks and ETFs, including private companies like OpenAI and SpaceX.

3. XTB Mandates 2FA After 150K Client Security Breach

Polish broker XTB faced major security scrutiny after a client publicly claimed losing 150,000 zloty ($38,000) through sophisticated hacking tactics that targeted account vulnerabilities. The five-year client discovered 75% of his portfolio vanished through thousands of rapid-fire trades on obscure securities, executed while he was unaware of the breach.

XTB’s stock plummeted over 6% in a single day following the viral social media post, marking its sharpest decline of 2025. The incident affected just 0.017% of XTB’s client base, but none of the victims had activated two-factor authentication, a feature only 10% of customers used despite being available since September 2024. Some time after this incident, XTB announced that it would reimburse all clients for losses resulting from the cyberattacks.

Additionally, the company released its first-half results, which fell short of analysts’ expectations and were weaker than those of the previous half-year.

4. H1 Earnings Paint Mixed Picture Amid Market Volatility

Warsaw-based XTB, however, is not alone. Other brokers also delivered contrasting H1 2025 results as market conditions created winners and losers across the trading industry. Plus500 led the pack with record customer deposits hitting $3.1 billion (+107% YoY) and revenue climbing 4% to $415.1 million, while Swissquote posted the strongest growth with 13% revenue increase to CHF 358.2 million ($444.2 million).

The standout performers included Saxo Bank with 18% profit growth to EUR 73 million and a record 1.39 million clients (+13%), while Dukascopy bounced back from losses to post CHF 3.3 million profit compared to just CHF 19.8K in H1 2024.

However, challenges remained evident across several operators. Admirals reported a wider EUR 5.9 million loss despite cutting operating expenses 20%, while NAGA managed only 2% revenue growth to EUR 32.2 million amid increased marketing spend.

| Broker / Key Metric | H1 2025 Result |

|---|---|

| Plus500 Revenue | $415.1 million revenue (+4% YoY); Record customer deposits hit $3.1 billion (+107% YoY). |

| Swissquote Revenue | CHF 358.2 million ($444.2 million) with the strongest growth (+13% YoY). |

| Saxo Bank Growth | Strong profit growth of +18% (EUR 73 million) and a record 1.39 million clients (+13%). |

| Dukascopy Profit | Bounced back from losses to post a CHF 3.3 million profit (up significantly from CHF 19.8K in H1 2024). |

| NAGA Group Revenue | Managed only 2% revenue growth (EUR 32.2 million) amid increased marketing spend. |

| Admirals Profit/Loss | Reported a wider EUR 5.9 million loss (wider EUR 5.9 million loss), despite cutting operating expenses by 20%. |

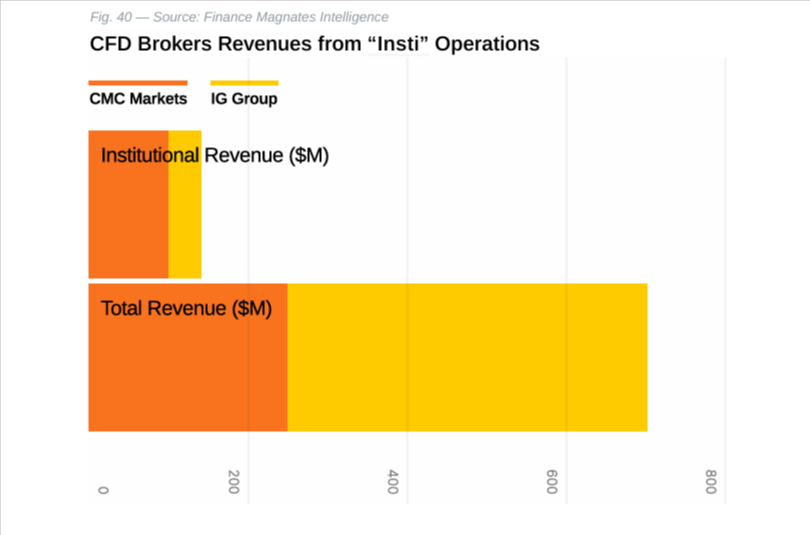

5. CFD Brokers Rush Into Institutional Services

Major retail CFD brokers are pivoting toward institutional offerings in a bid to diversify revenue streams and reduce dependence on volatile retail markets. Axi, CFI, and Taurex joined established players like IG Group, CMC Markets, Exness, and Pepperstone in launching dedicated institutional divisions.

Financial data reveals the appeal: CMC Markets generated £99.8 million from B2B services versus £149.1 million from retail in FY2025, while IG Group earned £41.6 million from institutional and emerging markets. This B2B revenue often comes with higher margins and lower operational risks since institutional clients require less regulatory protection.