Top 5 Industry Moves for Q2 2025

eToro successfully debuted on Nasdaq, surging 37%, valuing the firm at $4.2B. Meanwhile, Crypto.com expanded into CFDs in Europe via the acquisition of LegacyFX's MiFID license, and Spain's CFD market continued its decline. A key trend saw proprietary trading firms transitioning into offshore CFD brokers using licenses in jurisdictions like Comoros and Saint Lucia.

The financial industry saw several major developments, led by eToro's highly successful IPO on Nasdaq, which raised 310 million dollars and resulted in a 4.2 billion dollar valuation. Concurrently, major crypto exchange Crypto.com expanded its offerings to include traditional financial products like CFDs in Europe after acquiring a MiFID regulated entity (LegacyFX operator). Data from 2024 showed strong trading volume growth, reaching 18.4 trillion dollars, a 135 percent year over year increase. However, the Spanish CFD and forex market contracted for the fourth year, with active traders dropping to 35,000. iFOREX postponed its London IPO to complete a compliance inspection. A notable industry trend is the shift of proprietary trading firms, such as FundedNext and City Traders Imperium, into fully fledged offshore CFD brokers via licensing in jurisdictions like Comoros and Saint Lucia to offer MetaTrader services.

Key Market Events and Regulatory Trends

1. eToro’s Triumphant Nasdaq Debut

eToro’s long-awaited IPO finally materialized in spectacular fashion, with shares surging nearly 40% on their Nasdaq debut under the ticker “ETOR.” The Israeli fintech giant priced its shares at $52, exceeding the expected range of $46–$50, and raised nearly $310 million through the sale of almost 6 million new shares.

The company’s market capitalization reached approximately $4.2 billion at the IPO price, with shares opening at $69.69 and climbing to $71.50. This represented a remarkable 37% premium over the initial offering price, making it one of the most notable trading debuts of the year.

2. Crypto.com Expands Into CFDs

Crypto.com secured a significant regulatory milestone by acquiring Cyprus-based A.N. Allnew Investments Ltd., the operator of LegacyFX, gaining a MiFID license for European expansion. The acquisition allows the cryptocurrency exchange to offer traditional financial products including securities, derivatives, and contracts for difference (CFDs) across the European Economic Area. It is part of the digital exchange’s aggressive expansion strategy into more traditional products, including Coinbase and Kraken.

| Metric | Value |

|---|---|

| Average Monthly Trading Volume (2024) | $1.5 trillion |

| Year-over-Year Increase | +135% |

| Total 2024 Trading Volume | $18.4 trillion |

3. Spain’s CFD Market Continues Decline

Spain’s leveraged trading market experienced its fourth consecutive annual decline, with active CFD and forex traders dropping to 35,000 in 2025. This represents a 10% decrease from 2024 and highlights the sustained contraction facing the Spanish market.

New trader sign-ups have reached their lowest levels on record, driven partly by ongoing restrictions on digital marketing and increasingly challenging acquisition conditions. Despite the overall decline, the report indicates that a growing cohort of new traders is entering directly through crypto and leveraged products, bypassing conventional learning curves with shares or ETFs.

4. iFOREX IPO Hits Temporary Pause

iFOREX Financial Trading Holdings delayed its planned London Stock Exchange listing, citing the need to complete a compliance inspection in the British Virgin Islands. The company, which had aimed to go public in late June, expects only a “brief delay” as it wraps up what it describes as a routine thematic review. The delay mirrors eToro’s earlier postponement, which ultimately worked in that company’s favor when it eventually went public. A successful IPO would certainly benefit iFOREX, especially since its KPIs have declined in recent years.

5. Prop Firms Transform Into (Offshore) CFD Brokers

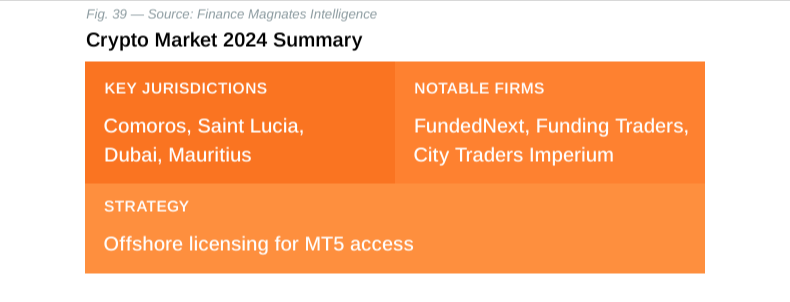

The most significant trend of Q2 has been the transformation of proprietary trading firms into traditional CFD brokers through offshore licensing strategies. Multiple prop firms have established operations in jurisdictions like Comoros, Saint Lucia, Dubai, and Mauritius to offer regulated brokerage services.

FundedNext launched FNmarkets as a separate brokerage entity, currently authorized in Comoros with applications pending for licenses in Mauritius and from the Dubai Financial Services Authority. City Traders Imperium established operations in the Comoros to launch its own in-house MetaTrader 5 platform, while Funding Traders Group restored MT5 access after incorporating in Saint Lucia.