Strong Finish to 2025: What Q4 Tells Us About the CFD Industry

The CFD industry finished 2025 strongly, with rising retail activity and active accounts driven by higher trading volumes, growing interest in metals, and shifting participation trends, pointing to continued momentum into 2026.

The CFD industry ended 2025 on a strong note, with retail trading activity and the number of active accounts rising sharply despite the usual slowdown seen in the final quarter of the year. Growth was supported by increased interest in metals trading, shifting patterns in retail participation, and higher overall trading volumes. These developments suggest that market engagement remained strong into year-end and may continue to influence industry growth in 2026.

Introduction

In the last quarter of 2025, the CFD industry recorded strong results, particularly in retail trading activity. What makes this outcome notable is that the final quarter of the year typically brings a slowdown due to the holiday period. Instead, Q4 delivered clear improvement. This raises important questions. What factors drove this growth? And what does it tell us about the industry and the likely pace of expansion going forward?

Impressive Results and the Reasons Behind Them

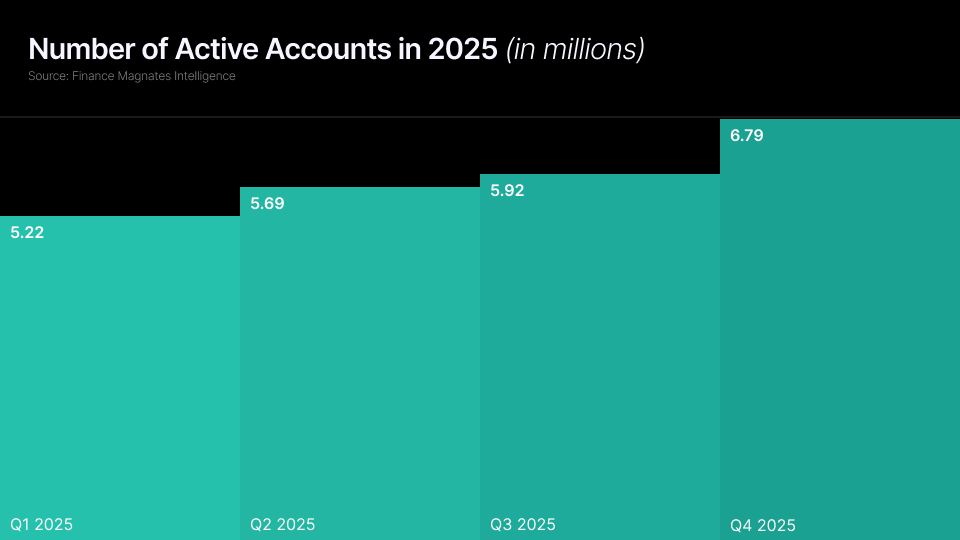

The situation becomes even more striking when we consider that the final months of the year are usually marked by reduced activity, as many firms and traders shift their focus to holidays and year-end preparations. When growth does occur, it is often modest. This was the case in 2024, when the number of active accounts rose from 4.919 million in Q3 to just 5.067 million in Q4.

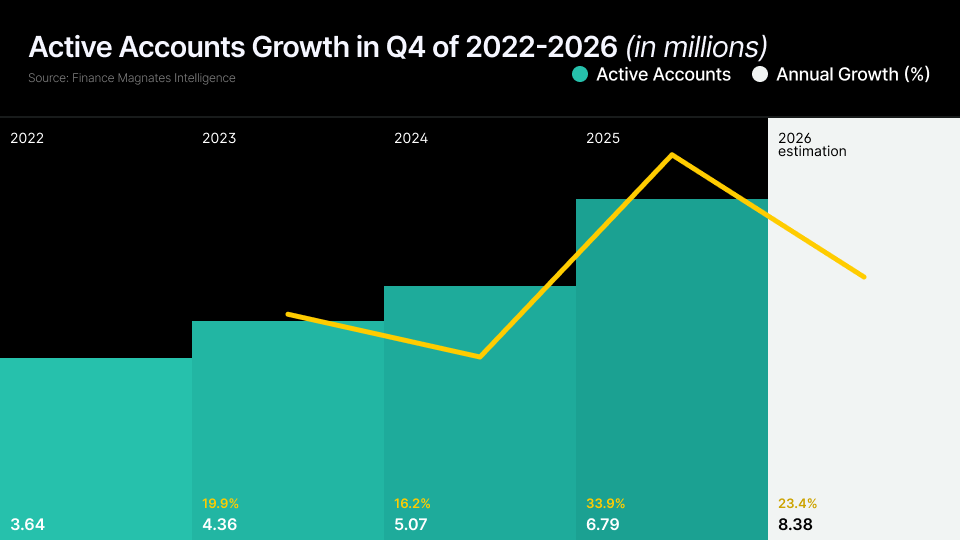

In 2025, the picture was very different. Growth in active accounts between Q3 and Q4 reached 14%, which is twice the average increase seen over the past four years, where the typical rate was around 7%. This represents a meaningful shift. The smallest quarterly increase during this period was recorded in 2024 at just 3%, while the strongest result prior to 2025 was seen in 2022, at 5%.

Alongside account growth, trading volumes also improved in Q4 2025. The average monthly volume across the CFD industry reached $29.83 trillion, representing a 20% increase compared with Q3, when the average stood at $24.7 trillion. It is even less common for the final quarter of the year to outperform the third quarter in volume terms, which makes this result particularly notable.

Several factors may explain this growth. One of them appears to be a partial withdrawal of retail interest from the crypto market. At the same time, 2025 saw a strong rise in the popularity of gold and silver trading. Metals trading remains especially popular in Asia, which is clearly reflected in our data. The key question, however, is whether this pace of growth can be maintained.

Google Confirms the Trend

The Finance Magnates Intelligence data tracks more than 50 of the largest brokers, though it does not cover the entire market. As with any data model, there may be gaps. That said, the overall direction shown by our data is clear and consistent.

To support these findings, we can also look at external indicators. Google Trends provides a useful reference point by showing how public interest develops over time. For this purpose, we reviewed the popularity of the search term “CFD trading” during 2025.

The data shows that interest in this term increased steadily throughout the year. The highest levels were reached in September and then repeated in December. Overall, the second half of the year shows stronger interest, with slightly higher search activity in Q4.

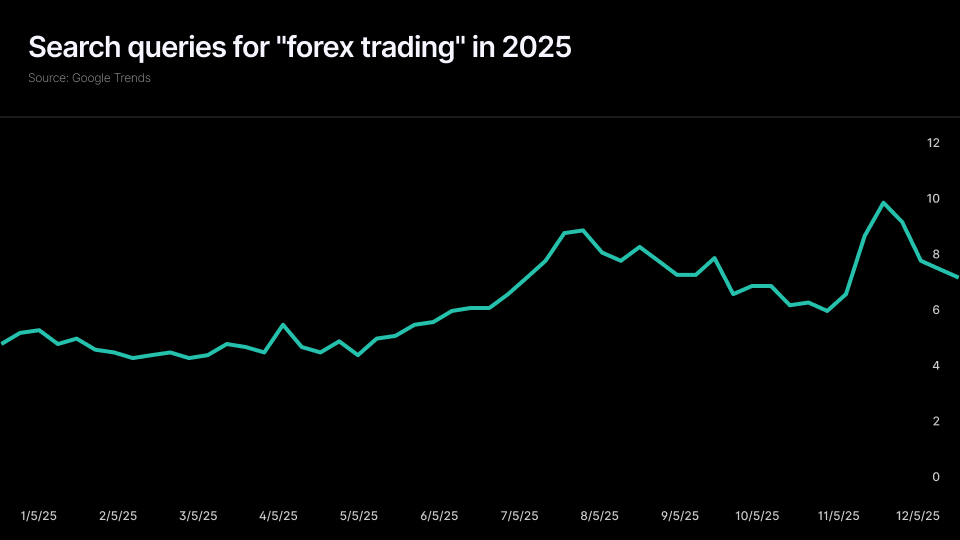

A similar pattern can be seen when looking at the term “forex trading”. Search interest followed a clear upward path, peaking in early September. After a pullback, interest rose sharply again in December 2025.

Milestone Reached. What to Expect in 2026?

The year 2025 was a record-breaking period for the industry on several fronts. Early in the year, Finance Magnates reported that the MT5 platform had overtaken MT4 in retail trading volume. Around the same time, the industry passed the 5 million active accounts mark, first reached in 2024.

By the end of 2025, the industry had moved beyond 6 million active accounts. With 6.78 million accounts recorded, it also came very close to reaching the 7 million level. Is this next milestone achievable in 2026? The answer appears to be yes.

A review of results from 2022 to 2025 shows that average growth in the fourth quarter across these years was 23.4%. Applying this rate to Q4 2026 would suggest a potential total of around 8.37 million active accounts. Even if this estimate proves optimistic, passing the 7 million mark and moving closer to 8 million seems highly likely. It is also worth noting that the average growth rate of 23.4% is lower than the pace recorded in 2025, when the industry expanded by 33.9%.

Conclusion

Further growth in the CFD industry, measured by the number of active accounts, appears likely. Continued strong trading in gold and silver remains one of the main drivers. Metals trading is one of the most popular categories among CFD brokers, particularly in Asia. Even if interest in these markets cools, the trading activity sparked by them is likely to remain among retail clients for some time.

Other factors, including regulatory and macroeconomic conditions, will also play a role. Overall, the outlook for CFD brokers remains positive at this stage, with growth momentum carrying into the new year.

Key Takeaways

| Q4 is no longer a quiet period |

|---|

| Year-end trading activity can remain strong, so planning should reflect this shift. |

| Metals are driving retail interest |

| Gold and silver played a key role in activity growth and should remain a focus. |

| Retail interest is rotating, not fading |

| Lower crypto activity was offset by stronger demand in other markets. |

| Account growth remains strong |

| Crossing 6 million accounts and nearing 7 million points to continued expansion. |

| Engagement matters beyond market hype |

| Sustained activity depends on platform quality, product range, and communication. |