Revolutionizing Financial Compliance: The Impact of AI on KYC and AML

Rapid advances in artificial intelligence are reshaping KYC and AML processes in financial services, delivering significant gains in speed and efficiency for CFD brokers. New AI models claim to reduce compliance check times dramatically, highlighting the growing potential of automation.

Artificial intelligence has advanced rapidly over the past three years, significantly improving its learning and adaptability and transforming financial services, particularly KYC and AML processes. For CFD brokers, AI offers faster, more efficient, and more accurate compliance operations, as highlighted by Coinbase’s development of a large language model expected to cut basic AML check times by up to 99%. While these claims suggest dramatic productivity gains, the article explores whether current AI technologies are truly capable of such performance by examining both foundational AI models and their latest applications in financial markets.

Introduction

In the past three years, artificial intelligence (AI) has rapidly evolved, making significant improvements in learning and adaptability. This technological revolution has impacted various industries, including financial services, particularly in the segments of Know Your Customer (KYC) and Anti-Money Laundering (AML). For CFD brokers, AI’s integration promises enhanced speed, efficiency and accuracy. Finance Magnates explores the journey of AI in financial compliance, its current applications, and the future landscape of KYC and AML services.

A major cryptocurrency exchange, Coinbase, has developed a large language model (LLM) anticipated to reduce the time needed for basic anti-money laundering (AML) checks by as much as 99%, according to its risk management team. Ian Rooney, the Head of Enterprise Compliance at Coinbase, announced during a recent webinar that the LLM tool is set to be implemented for enhanced due diligence (EDD) checks within the next months. He highlighted that the tool could dramatically cut down on tasks “that we estimate, on average, would take an analyst about an hour.”

This seems difficult to believe at first. That would be an enormous saving of time. Are modern AI solutions already that advanced? To better answer this question, we need to dive deeper into both basic AI models and the latest developments in this area, especially their application in financial markets.

Evolution from Chat GPT

Evolution from Chat GPT-1 to Chat GPT-4

First, let’s understand what a large language model (LLM) is. A large language model (LLM) is an AI program designed to understand and generate text. It operates using a transformer model, a specific type of neural network and is trained on extensive datasets, often sourced from the internet. This training allows the LLM to interpret and produce human language and other complex data. The effectiveness of an LLM depends on the quality of its training data, which is sometimes curated to enhance learning and performance. ChatGPT is a large language model but not every LLM is ChatGPT.

The first model in the Generative Pre-trained Transformer series, GPT-1, marked a breakthrough in AI-driven natural language processing. It could produce coherent and contextually relevant text from a given prompt, leveraging unsupervised learning. However, it was limited by a smaller dataset and less advanced handling of complex language structures, often resulting in repetitive or irrelevant outputs.

GPT-2 significantly advanced the capabilities of natural language processing. Trained on a much larger dataset, it could generate nuanced and diverse text that was more human-like. It demonstrated improved contextual understanding and could create varied content such as stories, poems, and articles. Despite its enhanced abilities, concerns over potential misuse for generating fake news led to an initially limited release.

GPT-3 represented a substantial leap in AI language models. With a larger dataset and more sophisticated algorithms, it showcased a remarkable ability to understand context, generate human-like text, and even perform coding tasks. Its versatility allowed it to be used in chatbots, creative writing, content creation, programming assistance, and language translation. Its conversational capabilities were particularly noteworthy, making human-computer interactions more natural and efficient.

GPT-4 is the latest and most advanced model, building on its predecessors with even more sophisticated algorithms and a deeper understanding of context. It excels in generating nuanced text and handling complex queries. Notable improvements include better multilingual capabilities, reduced biases, and more reliable content generation. GPT-4’s applications span advanced programming assistance, accurate content creation, and enhanced conversational AI, setting new standards in the field.

Other AI Models

What Are Other AI Models?

GPT models are renowned for their advanced language generation capabilities, but there are various other AI models with unique strengths and applications. BERT, or Bidirectional Encoder Representations from Transformers, focuses on understanding word context within sentences using a bidirectional approach, making it ideal for tasks like sentiment analysis and question-answering. LSTM, or Long Short-Term Memory networks, are a type of Recurrent Neural Network (RNN) that processes data sequentially and are excellent for handling time-series data.

T5, the Text-To-Text Transfer Transformer, converts all NLP tasks into a text-to-text format, providing greater versatility for a broad range of activities. NNLMs, or Neural Network Language Models, are less complex and smaller in scale compared to GPT models, which can handle a wider range of data types and generate more contextually accurate text. Rule-based AI models follow predefined rules and lack the adaptability of machine learning models like GPT, making them more suitable for straightforward, consistent tasks.

Technology and New Problems

Technology is a Double-Edge Sword. New Problems

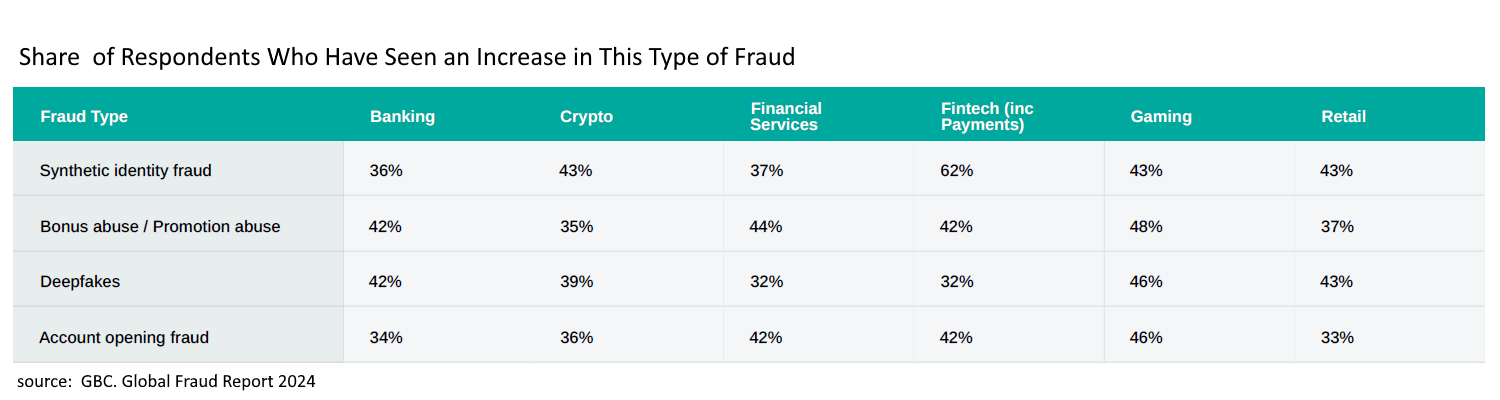

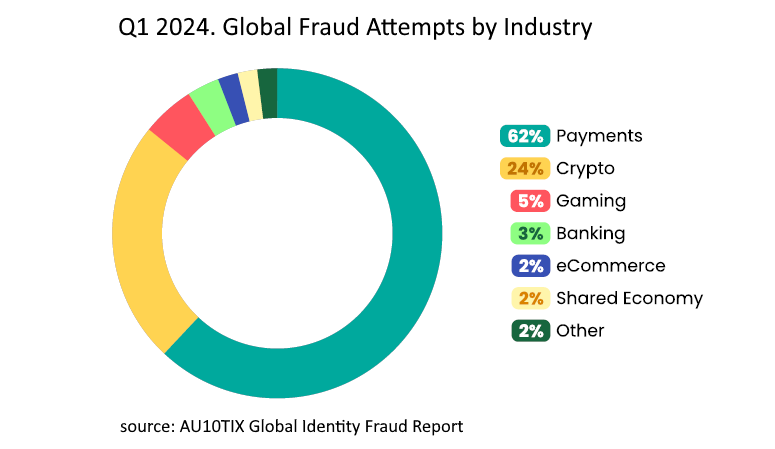

While technological evolution makes our lives better and easier, it also brings new challenges. It is a double-edged sword. The use of AI in KYC and AML has provided brokers with new tools and faster results, cutting down the time necessary to perform standard procedures. However, at the same time, it has given fraudsters new power. As we can see, fraud, which has always existed, now becomes “fraud on steroids.”

Gus Tomlinson, Chief Product Officer at GBG, shared with Finance Magnates her knowledge: “Fraudsters themselves are now employing AI to break the defences organisations have in place, using this technology to create increasingly sophisticated synthetic identities. Our latest Global Fraud Report revealed this is a huge concern globally.” She further continued: “Looking at Europe specifically, nearly a third (27%) of fraud prevention professionals believe generative artificial intelligence (GenAI) and machine learning (27%) will be the biggest trends in identity verification and fraud over the next three to five years. Those who believe GenAI will be a major trend are most likely to say they see the increased accuracy of fake ID documents generated by AI (30%), GenAI’s influence on phishing and smishing and the use of GenAI to create deepfakes (24%) as being the most threatening fraud vectors.”

As evident, the problem of sophisticated new fraud is serious. Fraudsters are using advanced technology to create fake photos, IDs, and even deepfake videos. However, leading providers of KYC/AML solutions are actively developing their products for brokers to stay one step ahead of the fraudsters. Rebecca Aspler, Director and Product Management at AU10TIX, told us: “AU10TIX remains committed to advancing the detection of deepfaked images and identity documents through ongoing investment initiatives. Our multi-layered approach leverages continuous enhancement of machine learning models, comprehensive dataset collection, sophisticated feature engineering, rigorous adversarial training, seamless user feedback integration, and real-time processing optimization. This ensures the utmost integrity and security in identity verification processes.” She further clarified in detail what AU10TIX is working on: “Three-Step Deep Fake Handling. We are moving to a three-step deep fake handling approach. This innovative method will be the first combined tool for detecting deep fakes in an injection-based setting, allowing us to identify AI-manipulated images that no other vendor can.”

Other industry participants are preparing their own solutions as the war with fraudsters continues. Andrew Novoselsky, CPO at Sumsub, told Finance Magnates about their efforts to combat modern fraud techniques: “Another critical innovation is our liveness detection combined with deepfake detection. Depending on business processes and specific use cases, users may be required to undergo a liveness check. This process uses advanced AI algorithms to detect any attempts at fraud, such as deepfake videos or altered images, ensuring that the person presenting the ID is indeed who they claim to be.”

Compliance and Regulation

Compliance and Regulation

Another important issue for CFD brokers is compliance and regulation in KYC/AML. It is crucial for brokers who operate globally across various regulatory environments. These measures ensure that brokers adhere to diverse legal requirements, preventing fraud, money laundering, and other financial crimes according to local regulations. By implementing KYC and AML protocols, CFD brokers can maintain comprehensive records, meeting each jurisdiction’s compliance standards. This not only protects the broker from legal and financial penalties but also enhances its reputation and trustworthiness among international clients and regulators. Effective compliance fosters a secure and transparent trading environment, which is essential for sustaining long-term client relationships and success in the global financial markets.

Gus Tomlinson from GBG admitted: “We continue to track advancements and leverage AI in all that we do within GBG, recognising it’s not a one-size-fits-all model and must be balanced against the needs to be responsible, ethical, safe, and secure in its application. This differs not just in use case, but sector and geography where regulations all vary.”

Andrew Novoselsky, CPO at Sumsub, also emphasized that compliance with local regulators is very important: “Our system enables users to generate detailed reports for regulators, including Suspicious Activity Reports (SARs) and Suspicious Transaction Reports (STRs), ensuring that our clients fully comply with regulatory requirements. Additionally, our internal reporting has become more robust, providing valuable insights for ongoing risk management and decision-making processes.”

Improvements in KYC/AML

Ongoing Improvements in KYC/AML

The starting point for our article was the improvements made by Coinbase. One of the biggest crypto exchanges demonstrated significant benefits through the integration of AI technologies in its KYC/AML processes. By employing generative AI solutions, Coinbase has dramatically reduced the time required for data gathering and synthesis, enhancing efficiency and accuracy. This decrease in handle time from hours to minutes allows compliance teams to focus on more complex tasks, improving overall operational effectiveness and enabling faster, more reliable decision-making.

“We are still early on our journey in the integration of AI technologies, but our preliminary efforts show great potential. For example, during our development of a generative AI solution to support our consumer-enhanced due diligence program, we were able to reduce the handle time for data gathering and synthesis of information from our internal Coinbase systems from approximately 1.5 hours to less than a minute. Equally important, we were able to achieve this outcome in a consistent, easy-to-understand format and with a high degree of accuracy (>95%),” Ian Rooney, Head of Enterprise Compliance at Coinbase told us. However, he wanted to clarify one thing: “The 99% time savings referenced during the ACAMS Live event was to a specific part of our Enhanced Due Diligence process, where our pre-production LLM demonstrated the potential to reduce the handle time of a labor-intensive part of that process by 99% (i.e. from up to 1.5 hours to less than 1 minute). We are still in the process of conducting a production implementation and can provide the final metrics on the overall average handle time reduction at a later date.”

GBG has also seen transformative benefits from AI integration. By leveraging AI, the company processes billions of transactions annually with high accuracy, ensuring robust fraud detection and identity verification. AI-driven innovations, such as document and biometric verification solutions, have significantly enhanced GBG’s ability to combat sophisticated fraud techniques, including deepfakes and synthetic identities. This continuous use of AI has enabled GBG to maintain a high standard of security and trust for its customers. “While we use AI in many ways, ultimately it allows us to shift the scale of what we do. At GBG, we manage over 5.2 billion transactions per year—that’s 165 every second. We deploy AI where it makes the most difference to our results, ensuring our customers are always at the forefront of identity and fraud,” revealed Gus Tomlinson, CPO at GBG.

Similarly, AU10TIX has harnessed AI to enhance the efficiency and speed of their KYC and AML solutions. Their AI-driven systems, like the IDV Suite, automate identity verification with up to 98% accuracy, reducing the verification time from days to seconds. Advanced AI techniques have improved threat detection, such as recognizing deepfakes and synthetic identities, ensuring compliance and security. AU10TIX’s real-time processing capabilities and proprietary decision-making mechanisms have minimized false positives, providing a more reliable and efficient verification process. Rebecca Aspler, Director and Product Management at AU10TIX, described to Finance Magnates one of the improvements AI made possible: “AI-driven systems, like our IDV Suite, automate identity verification processes with up to 98% accuracy for document verification. This reduces the verification time from days to seconds, significantly boosting operational efficiency.”

It looks like seconds have become the new standard for the KYC/AML industry. Sumsub has also benefited from AI by combining it with quality assurance to improve its KYC and AML processes. Their approach has led to faster and more accurate verifications, reducing the time for automated KYC processes to seconds. “Talking about speed, our automated KYC process now completes in just 30 seconds, a stark contrast to the hours or even days required for manual verification. This rapid turnaround not only improves customer experience but also accelerates our overall operational efficiency,” revealed the CPO at Sumsub, Andrew Novoselsky.

Across the industry, the integration of AI in KYC and AML processes has brought numerous benefits, including increased accuracy, speed, and cost efficiency. AI’s ability to handle large volumes of data in real time, detect sophisticated fraud techniques, and continuously improve through machine learning has revolutionized compliance and fraud prevention.

The Future of AI-Powered KYC/AML

The Future of AI-Powered KYC/AML

The future of KYC/AML processes is poised for significant advancements, driven by cutting-edge technologies. One of the most anticipated developments is the refinement of advanced machine learning algorithms. These sophisticated algorithms will enhance fraud detection and risk management by recognizing complex patterns and anomalies in data more accurately than ever before. By continually learning from vast datasets, machine learning will help institutions stay ahead of increasingly sophisticated fraud techniques, reducing false positives and ensuring more reliable identification of illicit activities. Rebecca Aspler from AU10TIX predicts: “Advanced Machine Learning Algorithms. Continued improvements in machine learning will enable more sophisticated pattern recognition and anomaly detection, further reducing fraud and enhancing compliance.”

Obviously, all activities and processes undertaken by KYC/AML departments will be much faster and smoother. Andrew Novoselsky from Sumsub anticipates this improvement: “Additionally, verification processes, including non-document-based methods, will become faster and more reliable. Enhanced algorithms and machine learning models will enable near-instant verification, ensuring that legitimate users experience minimal friction while fraudulent activities are swiftly identified and mitigated. This will be particularly beneficial in high-volume transaction environments, where speed and accuracy are paramount.”

He also expects that the work itself will be much easier for the companies and much more convenient for the customers. The implementation of AI as a co-pilot for compliance officers is expected to revolutionize rule generation and fraud detection. These AI co-pilot systems will assist in optimizing compliance strategies by analyzing vast amounts of data, suggesting alternative rules, and generating new ones based on identified patterns. “Another transformative development will be the introduction of AI as a ‘co-pilot’ for compliance officers in AML transaction monitoring and fraud prevention. This AI co-pilot may assist in several key areas. Rule Optimization: AI will analyze existing rules and events to suggest alternative rules, enhancing detection coverage and accuracy. […] Rule Generation. AI will generate new rules based on patterns identified in labeled data. This automated process will ensure that rules are both comprehensive and adaptive to new AML and fraud tactics, significantly improving the overall detection capability of the system,” Andrew Novoselsky concluded.

Another transformative development is the integration of digital identities and blockchain technology. Leveraging these technologies will enable secure and tamper-proof verification processes, making it more difficult for fraudsters to manipulate identity information. Digital identities will simplify KYC procedures by providing verifiable and reusable credentials, while blockchain’s decentralized nature will ensure the integrity and security of the data. This will not only streamline the verification process but also enhance overall trust and security, particularly in global operations where regulatory compliance varies significantly across regions. “Adopting digital identities and blockchain technology will provide more secure and tamper-proof verification processes, simplifying KYC and AML procedures,” says Rebecca Aspler.

Ian Rooney from Coinbase seconds her on the blockchain future: “We are leaning into machine learning capabilities to improve risk detection and reduce false positive output, allowing us to quickly identify and report on activity that may be of interest to law enforcement. For a company like Coinbase, this will mean drawing on techniques and information available to traditional financial institutions and using the properties of the blockchain to improve our understanding of risk.”

Conclusion

Conclusion

The rapid evolution of AI over the past few years has brought big changes to the financial services industry, particularly in KYC /AML areas. Major advancements in AI, such as the development of large language models (LLMs), have significantly enhanced the efficiency, accuracy, and speed of these processes. Some companies have leveraged an LLM to reduce the time required for AML checks from hours to minutes, highlighting AI’s potential to streamline compliance tasks and improve operational effectiveness.

AI’s integration has also strengthened fraud detection capabilities for CFD brokers. By deploying advanced machine learning algorithms, companies like GBG, AU10TIX, and Sumsub have developed sophisticated tools to combat increasingly complex fraud techniques, such as deepfakes and synthetic identities. These AI-driven innovations not only enhance security but also ensure compliance with diverse regulatory standards across global markets.

Looking ahead, the future of KYC and AML processes is set to be further revolutionized by advancements in AI. Some expected developments include the refinement of machine learning algorithms for better fraud detection, the integration of digital identities and blockchain for secure verification, and the implementation of AI co-pilot systems to optimize compliance strategies. Enhanced biometric technologies and the use of predictive analytics and natural language processing (NLP) will also play key roles in proactively managing risks and improving the overall efficiency of KYC and AML operations.

These advancements should benefit CFD brokers by providing faster, more reliable client onboarding and ensuring compliance with regulatory requirements in various jurisdictions. The continuous improvement in AI capabilities will help brokers stay ahead of fraudsters, offering a secure and transparent trading environment that fosters long-term client trust and success in the global financial markets.