Not Bitcoin, but Gold. What Drives CFD Industry More

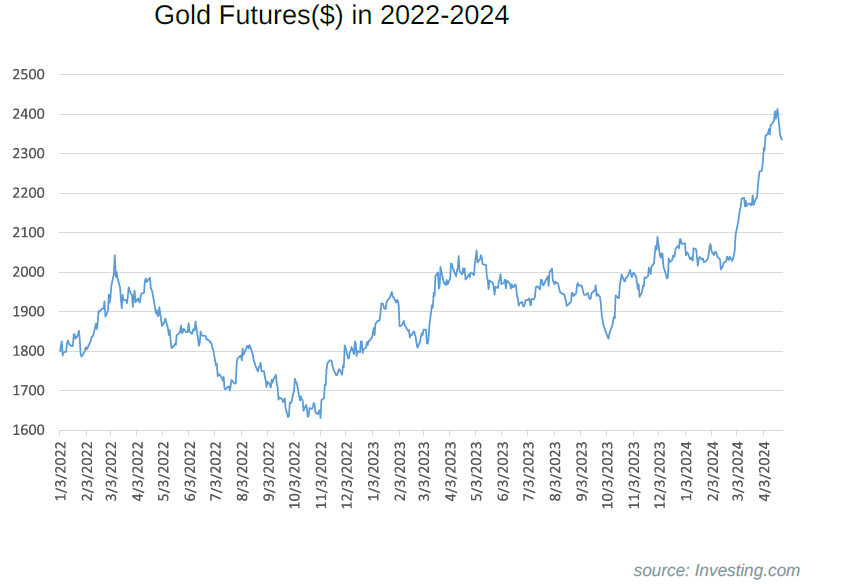

In the first quarter of 2024, rising gold prices, alongside interest in Bitcoin’s halving, became a key driver of retail trading activity in the CFD industry. Demand for gold was supported by geopolitical uncertainty, inflation concerns, and unclear monetary policy.

In the first quarter of 2024, beyond anticipation of Bitcoin’s halving, rising gold prices emerged as a major development influencing the CFD industry by driving increased retail trading activity. Gold’s long-standing role as a store of value, an inflation hedge, and a safe-haven asset is supported by its scarcity, physical properties, and historical importance, and has been strengthened by geopolitical tensions, uncertain monetary policy, and ongoing inflation concerns. In addition, lower interest rates in developed economies have reduced the appeal of traditional fixed-income investments, further increasing investor demand for gold as a reliable alternative.

Introduction

While everyone was waiting for Bitcoin's halving, the first quarter of 2024 brought other developments that impacted the CFD industry even more. One of them was the growing price of gold, which brought both attention and increased retail traders' activity. But can this last forever, bringing permanent profits to the CFD industry?

History of Gold as a Key Precious Metal

In the world of financial markets, few assets command the allure and universal appeal of gold. For centuries, this precious metal has served as a store of value, a hedge against inflation, and a safe haven asset during times of economic uncertainty. Its significance in the global economy cannot be overstated, as gold trading remains a cornerstone of investment strategies for individuals, institutions, and governments.

Gold's intrinsic value lies not only in its scarcity but also in its unique properties. Unlike fiat currencies, which can be printed at will, gold cannot be manufactured or replicated. Its limited supply and enduring demand contribute to its resilience as a wealth-preserving asset. Moreover, gold's tangibility and tangible nature provide investors with a sense of security in an increasingly digitalised financial landscape.

In recent years, the popularity of gold has only grown stronger, fueled by a confluence of macroeconomic factors and shifting investor sentiments. Heightened geopolitical tensions, uncertain monetary policies, and the spectre of inflation have spurred a renewed interest in gold as a safe haven asset. Additionally, the interest rates in many developed economies has [AS1.1]diminished the appeal of traditional fixed-income instruments, prompting investors to seek alternative stores of value.

The COVID-19 pandemic, in particular, has underscored gold's status as a safe haven asset. As financial markets were roiled by unprecedented volatility and economic uncertainty, gold emerged as a bastion of stability, experiencing a surge in demand from investors seeking refuge from market turmoil. The pandemic-induced economic downturn, coupled with massive fiscal and monetary stimulus measures, has heightened concerns about currency debasement and inflation, further bolstering gold's appeal as a hedge against inflationary pressures.

Against this backdrop, gold trading has soared to record highs, reflecting investors' growing appetite for safe-haven assets. The surge in gold prices has not only attracted seasoned investors but also piqued the interest of a new generation of traders drawn to the allure of alternative investments.

Moreover, the growing popularity of digital trading platforms and investment vehicles has democratized access to gold markets, allowing retail investors to participate in gold trading with unprecedented ease and convenience. From exchange-traded funds (ETFs) backed by physical gold to gold futures and options contracts, investors have a myriad of avenues to gain exposure to the precious metal, regardless of their risk appetite or investment horizon.

Why Gold Has Been Recently on the Rise?

In recent years, we have observed rising gold prices, which attracted investors worldwide. The yellow metal, often regarded as a timeless store of value, experienced a remarkable ascent in both 2023 and 2024. Let’s explore the factors driving this surge, exploring the interplay of global economic uncertainty, currency dynamics, and investor sentiment.

Again, we should mention the outbreak of the COVID-19 pandemic in early 2020, which sent shockwaves through financial markets. As uncertainty loomed, investors sought refuge in assets that could weather the storm. Gold, with its historical reputation as a safe-haven asset, emerged as a natural choice. During times of crisis, gold tends to shine even brighter, acting as a hedge against economic instability, geopolitical tensions, and currency devaluation.

Central banks worldwide played a pivotal role in bolstering gold prices. Their aggressive purchasing of bullion signalled confidence in the metal’s enduring value. Moving forward to 2023 and 2024, we can see investors’ concerns over geopolitical conflicts—such as the Israel–Hamas and Russia–Ukraine tensions—fueled demand for gold. Investors sought stability in an unpredictable world, and gold provided that reassurance.

Gold and the U.S. dollar (USD) share an obvious inverse relationship. When the USD weakens, gold becomes more attractive to investors. Basic reasons:

- Currency Depreciation: A weaker USD erodes its purchasing power, making dollar-denominated assets less appealing. Investors seek alternatives, and gold stands out as a reliable store of value.

- Dollar as a Benchmark: The USD serves as a benchmark for global trade and finance. When it falters, investors seek assets that transcend national boundaries—gold being a prime example.

- Interest Rates and Opportunity Cost: Gold doesn’t pay interest or dividends, unlike bonds or stocks. When interest rates decline (as expected in 2024 due to Fed rate cuts), the opportunity cost of holding gold diminishes. Investors allocate more funds to gold, driving up its price.

Gold’s ascent in 2023 and 2024 reflects a dynamics between global uncertainties, central bank actions, and currency dynamics. Whether geopolitical tensions or monetary policy shifts, gold continues to glitter as a beacon of stability in an ever-changing financial landscape.

The Impact of Gold on the CFD Industry

How does this all relate to the CFD industry? Contrary to what media coverage may suggest, events such as Bitcoin's halving are not that important for CFD brokers. According to different data, the share of cryptocurrency trading in total CFD volume is not bigger than a few percent.

In 2022, Finance Magnates wrote an article about ”Crypto Winter,” where many brokers confirmed that CFD Cryptocurrency trading plays a small role in their portfolios. "The trading volumes on particular instruments are strictly linked with the volatility of that class of assets. The same applies to cryptocurrencies. The popularity of Crypto-based CFDs was highest in times of significant growth and lower over the last period," said Filip Kaczmarzyk, a Management Board Member responsible for Trading at XTB.

Which Instruments Are Popular?

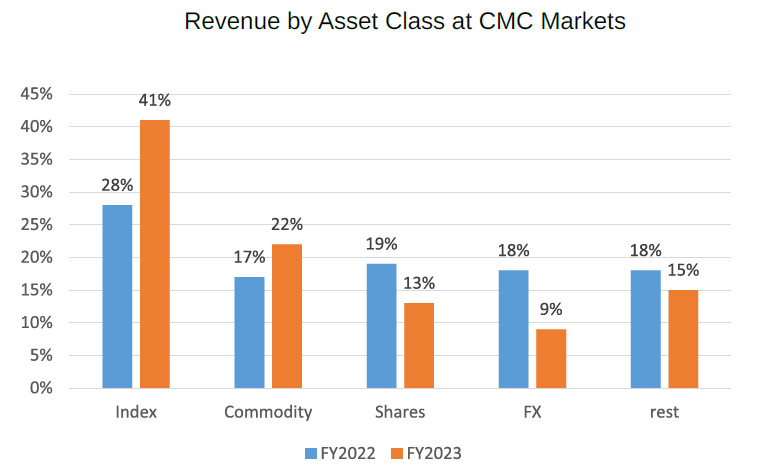

Despite the large media hype around cryptocurrencies, CFD industry traders prefer other, more traditional instruments. For example, if we look into the report of CMC Markets for 2023, we will see that the most popular instrument class (according to the revenue) in 2023 was “index trading”. However, the second most popular asset class was “commodities”. It accounted for 22% of revenue versus 41% of the index trading. While the revenue share is not exactly the same as the volume share, it gives a pretty good picture of what clients of UK brokers choose to trade. Also, Gold and Silver are not the only traded instruments in the “commodity” class, so the mentioned 22% should be split between Gold, Silver, and Oil at least.

Another European broker, XTB, had similar results, but the revenue from commodities was even higher. In its report for 2023, we can see that while index trading was the most popular among XTB clients (47.8% of revenue), the second most popular category ”commodities,” brought in 39.9% of the revenue share, which wasmuch bigger than in case of CMC Markets. In both cases, CMC Markets and XTB, we can see improvement in commodities revenue over 2022, which may result from more Gold trading in 2023.

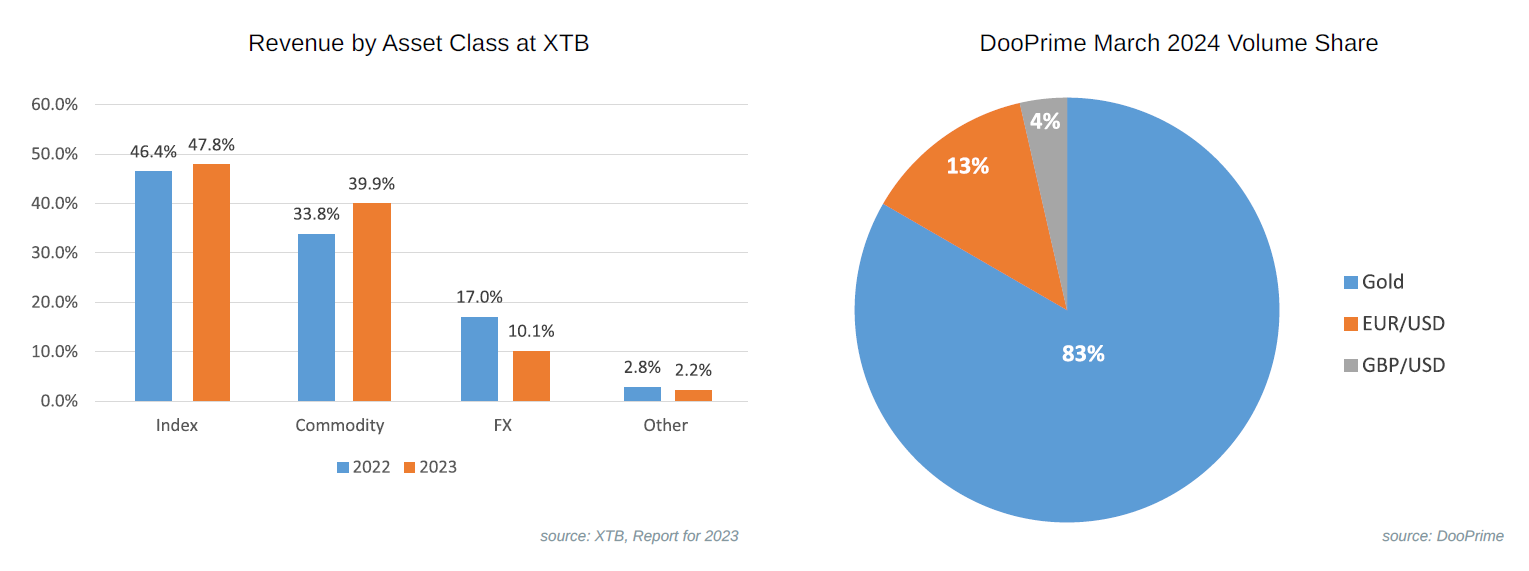

Even more interesting results were published recently by Doo Prime. The global CFD broker, whose roots trace back to Hong Kong, had a volume of $95 billion in March of 2024. According to the same data, more than 70% of that volume was attributed to Gold trading (XAU/USD), while only 11% of the volume was related to EUR/USD. Assadour Khabayan, an analyst at Doo Prime, confirmed to Finance Magnates: “Gold is the most popular asset for Doo Prime clients in March. It had the highest trading volume at USD 67.11 billion and saw the biggest growth of USD 22.6 billion or 50.70% compared to February.”

Similar results were achieved by ATFX, which happens to be another CFD broker with Asian roots. Siju Daniel, Chief Commercial Officer at ATFX, revealed to Finance Magnates: ”Metals trading holds a significant position within our ATFX platform, reflecting the trust and interest our clients in this segment. In the first quarter of 2024, an impressive 70% of our total trading volume was attributed to metals trading.”

Asia…and MENA

Why is there such a big difference between DooPrime and ATFX when compared to CMC and XTB? It is not a secret that in different parts of the world, retail traders prefer different trading instruments. Gold holds significant cultural, social, and economic importance throughout Asia and is being respected for centuries as a symbol of wealth, success, and luck. Its decorative value reflects social status and is frequently seen at celebrations and events as a symbol of prosperity. Additionally, it acts as a reliable store of value in regions where economic conditions are uncertain due to inflation or political unrest, providing stability and assurance for future generations. Seen as a safe investment option, it remains steady in value even during market fluctuations. Furthermore, gold is often given as gifts during special occasions, embodying tradition and bestowing blessings in various Asian cultures, underscoring its enduring significance.

Finance Magnates asked Filip Kaczmarzyk, a member of the Management Board of XTB, if there are any patterns related to the popularity of metal trading in different areas of the world. He told us:” We have observed significant differences in the popularity of instruments that are based on precious metals in various markets. For instance, the MENA region has a high demand for gold and silver, and comparatively less interest in stock indices. A similar trend is visible in Asia, where gold is more popular than in Europe. In the European market, currency, indices, and other commodities like oil and natural gas, are the dominant investment choices”

A similar observation was shared with us by Siju Daniel from ATFX, who said: ”We have observed several patterns in ATFX regarding the popularity of metal trading in different areas of the world. One key pattern is that regions with growing industrial sectors, such as Asia and the Middle East, tend to have a higher demand for metals, particularly for infrastructure development and manufacturing purposes.”

He also mentioned other regions than Asia and MENA:”Additionally, areas with a strong focus on exporting commodities, like South America and Africa, often exhibit a significant interest in metal trading, as metals play a crucial role in their economies. Moreover, geopolitical factors and global economic trends also impact the popularity of metal trading in different regions.”

Are There Other Factors?

The popularity of gold trading and metal trading is influenced by several other factors, encompassing both intrinsic and extrinsic elements. Gold, as it was already stated, attracts investors seeking refuge during times of economic volatility and uncertainty. Its intrinsic value as a safe haven asset endows it with the ability to stabilize investment portfolios, providing a shield against inflationary pressures. Unlike some assets prone to erratic fluctuations, gold exhibits relatively low volatility, making it an appealing choice for risk-averse investors seeking long-term stability. However, while gold's reliability is indisputable, its performance against other assets may not always yield exceptional returns over extended periods.

Furthermore, the popularity of metal trading is linked to global economic trends and geopolitical developments. It is worth repeating again that in times of heightened uncertainty, spurred geopolitical tensions or economic downturns, the allure of precious metals intensifies as investors gravitate towards assets perceived as safe harbours. This surge in demand underscores the role geopolitical factors play in shaping market sentiments and driving metal trading activity. Moreover, the regional dynamics of economic growth and industrial development also exert a significant influence on the popularity of metal trading across different parts of the world. As emerging economies burgeon and industrialization accelerates, the demand for metals surges, amplifying their attractiveness within the trading sphere.

A very detailed and interesting opinion on this subject was given to Finance Magnates by Assadour Khabayan, from Doo Prime. He revealed: „The patterns related to the popularity of CFD metal trading in different areas of the world are quite diverse, reflecting the unique economic, technological, regulatory and geopolitical factors at play in each region.” Assadour Khabayan further explained: „For instance, developed markets with established financial sectors might see more speculative trading on metal price movements using CFDs. Conversely, emerging economies might use CFDs on precious metals more for hedging against inflation or currency devaluation.” He continued: „CFD trading allows speculation on price movements without physically owning the metal. This can be attractive in regions where access to physical metals might be limited due to infrastructure or regulations."

Better Than Bitcoin But Not Enough?

For sure, we can agree that more CFD retail investors trade metals than cryptos. Except for the few CFD brokers pushing with the cryptocurrency subject, the majority popularity of CFD Crypto trading will be in the range of a few percent of the total share of the volume.

We can also agree that metals trading is popular. However, this will vary from broker to broker, depending on the region where they operate. Asia-focused brokers will benefit more from offering CFD Metals trading, while in other regions, such as Europe, it will be less popular.

Finally, we need to remember that the current popularity of gold trading is a consequence of a bull run, which results in breaking previous record levels for gold prices. This attracts the attention of retail traders. But such a situation will not last forever. Gold itself is not a volatile market and, as such, naturally does not attract a lot of turnover.

The Bright Future of Metals Trading..with Doubts

Filip Kaczmarzyk from XTB did not have an easy answer for us.”Gold is a popular choice among investors and is considered a safe haven asset that can stabilize investment portfolios and protect against inflation.” – he said. At the same time, he noticed: „Due to its low volatility, it is unlikely that CFDs based on gold will outperform other assets in the long run.” He further added: „metals may find it challenging to compete for investors' interest. CFDs based on these assets are unlikely to gain popularity immediately and would require significant volatility to attract investors. However, unless specific market events occur, it is doubtful that other metals will capture investors' attention in the long term.”

A totally different and more optimistic opinion was shared by Siju Daniel from ATFX: „In the CFD industry, metals trading holds great potential compared to other assets. Metals such as gold and silver have been widely regarded as safe-haven assets, providing stability and diversification to investment portfolios. As the global economy continues to evolve, metals trading is expected to remain relevant and even grow in importance. That’s why at ATFX our traders focus on bullion markets in recent years.”

The COO of ATFX pointed to an interesting argument that is often overlooked. He said: „Furthermore, metals trading aligns with the increasing focus on sustainable and responsible investing. As environmental concerns and social responsibility become key considerations for investors, metals such as silver and platinum, which are crucial in renewable energy technologies and emission reduction processes, are likely to witness an upward demand trajectory.” He finally concluded: „In summary, the future of metals trading in the CFD industry looks promising. Their role as safe-haven assets, potential for hedging against uncertainties, liquidity through CFDs, and alignment with sustainability trends make metals stand out among other assets.”

Conclusion

Considering these perspectives, CFD brokers should expect gold trading to remain a stable choice for investors seeking stability and diversification, with the potential for occasional growth driven by both traditional safe-haven perceptions and emerging sustainability trends. However, capturing investor interest in other metals may require significant volatility or alignment with sustainability narratives. Thus, brokers should strategize to capitalize on the enduring appeal of metals trading while remaining attuned to evolving market dynamics and investor preferences. Gold can be and should be a solid base in the portfolio of any CFD broker. Yet, relying on it as the vehicle for the growth of revenue should not be the best idea.