India: The Most Tempting Spot on the Global CFD Map

India has emerged as the biggest global source of FX/CFD online interest, driving over half of broker website visits and signaling booming retail curiosity despite lacking CFD regulation and not yet matching this interest in actual market size

India has unexpectedly become the largest source of global online interest in FX/CFD trading, accounting for over half of worldwide visits to leading brokers’ websites in Q3. Despite having no formal CFD regulations and not translating directly into trading volume or accounts, the surge highlights rapidly growing retail curiosity in CFD trading. India’s massive population helps explain the scale of interest, but structural and regulatory factors mean this does not automatically equate to a proportionally large CFD market.

Introduction

Recently, we have observed Asia's growing popularity on the global CFD trading map. To our surprise, the most popular country on the map now seems to be India, the least-known market with no CFD regulations. How is that possible? Finance Magnates takes a closer look at the phenomenon of India.

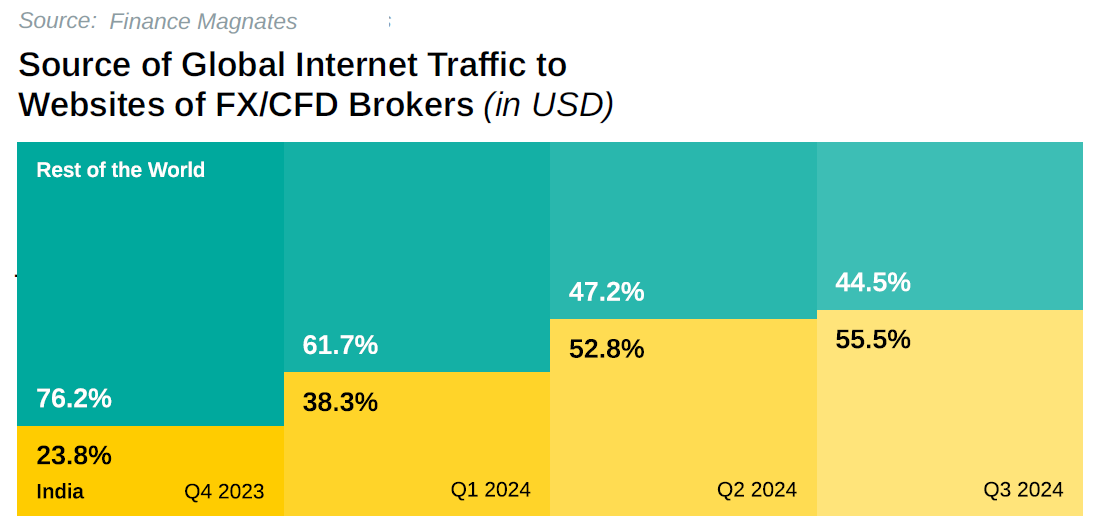

In recent editions of our Intelligence Report, India has been identified as the leading source of 70%internet traffic to FX/CFD-related websites of leading brokers. This time, in the third quarter, the share of activity from India skyrocketed to 55% of global visits. Of course, this is not a perfect indicator, and certainly, that does not mean that half of the global FX/CFD volume or accounts come from India. However, it surely indicates a growing interest in CFD trading among retail traders in India.

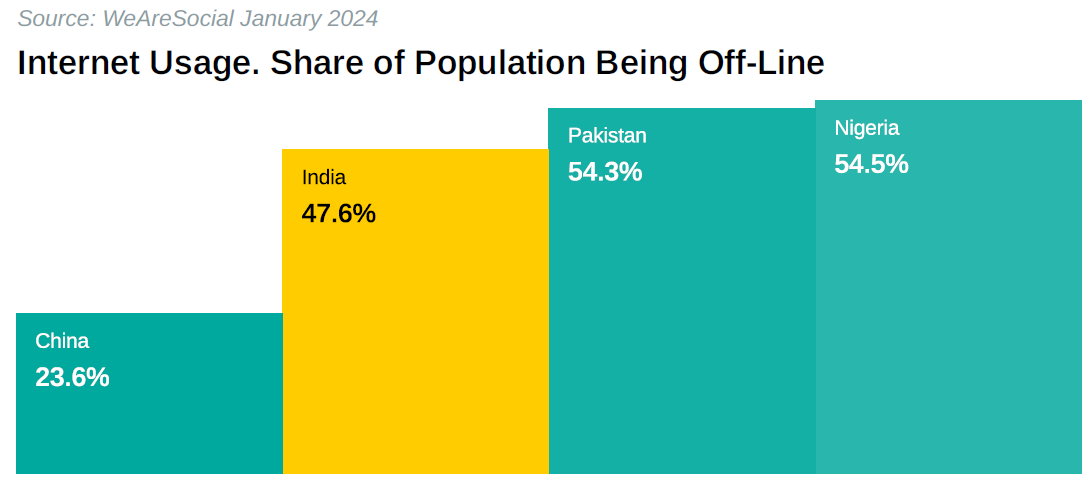

One could think that considering the size of the Indian population, such results could be true and normal. After all, according to the World Bank, there were 1.428 billion people in India in 2023, which gave it the first place in the global population rank. That is double the number of people in Europe (750 million). However, there is no such easy translation between the number of inhabitants and the size of the CFD market (or any other). There are several reasons why the CFD industry in India could not be as large, and we will dive into details now.

India and its Growing Potential

India’s landscape is marked by huge potential, driven mainly by its large population and growing economy. With approximately 1.43 billion people in 2023, India has recently surpassed China, positioning itself as the most populous country in the world. This massive number of inhabitants serves as both a source of economic strength and a potential challenge. It provides a large consumer base, a young workforce, and a growing pool of investors, which can drive demand in sectors such as retail, finance, and technology. However, this also implies that India must address challenges in terms of employment, infrastructure, and income inequality to fully leverage its demographic advantage. With such a large population, even a small percentage can make an enormous difference for a CFD broker. A small piece of a large pie may be bigger than half of a very small pie. And that is the main driving force behind the decisions of offshore brokers to approach India, even though it is not the most friendly regulatory environment.

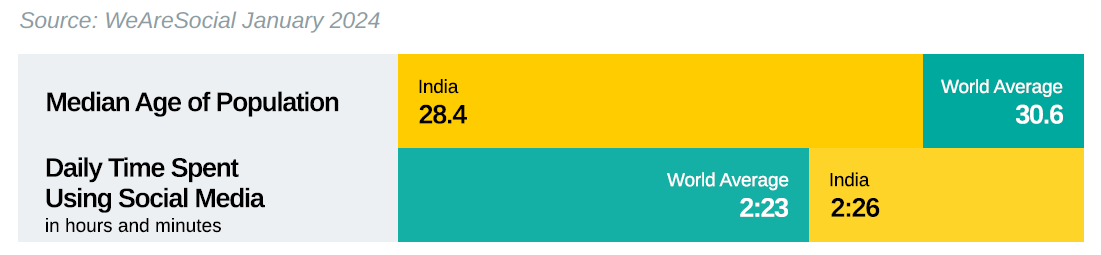

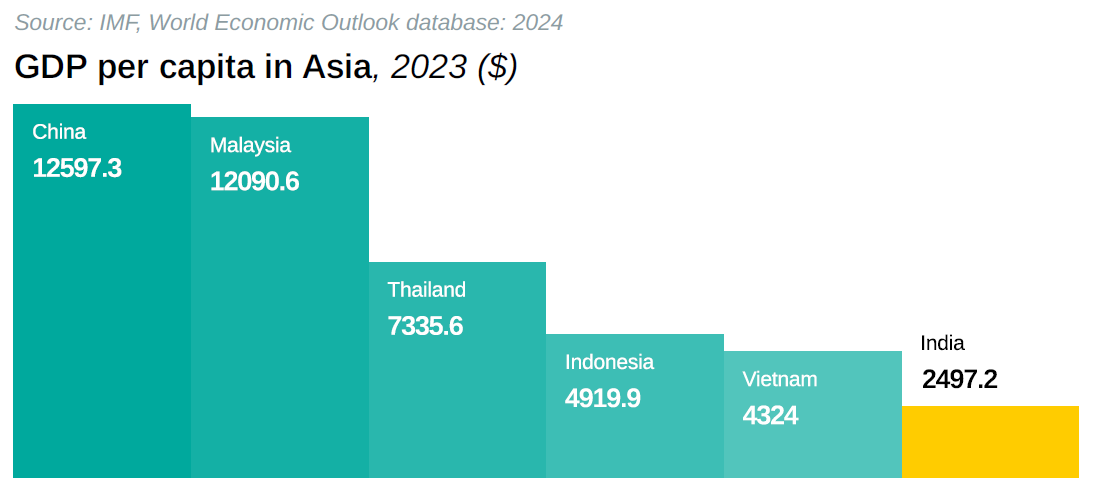

Despite its large number of residents, India’s GDP per capita remains relatively low, at $2,497 in 2023, which is significantly lower than other Asian economies like China ($12,597), Malaysia ($12,090), and Thailand ($7,335). This low GDP per capita reflects vast income disparity within the population and indicates limited individual purchasing power compared to these nations. Yet, it also highlights significant growth potential as economic reforms, investments in education, and technology adoption could gradually elevate income levels. As income rises, India’s vast number of inhabitants could unlock a substantial domestic market for retail products and financial services, fostering opportunities for investors and businesses alike.

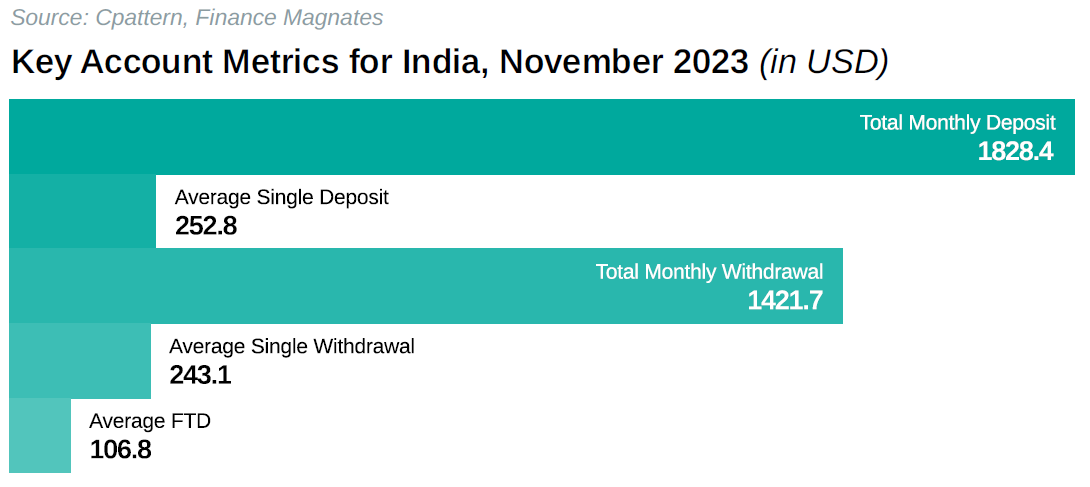

The relatively low economic metrics are reflected in some of the metrics from the local CFD market. The average first-time deposit in India’s CFD industry was $106.9 as of November 2023, and the average single deposit was $252.9. These numbers underscore the limited disposable income available to a large portion of the population, as individuals may only be able to commit relatively small amounts to speculative investments. This indicates both a high level of interest in trading among new investors and a cautious approach to risk, likely due to affordability constraints. For brokers and financial service providers, these figures highlight a need for accessible trading options.

Finally, there is also the already mentioned regulatory environment which happens to be the biggest and probably the only serious risk for the CFD business in India. Local law does not regulate or explicitly ban retail over-the-counter (OTC) markets, which enables numerous forex and CFD brokers to target Indian customers. However, when clients make deposits on platforms lacking local authorization, they are technically breaching local forex regulations under the Foreign Exchange Management Act (FEMA). At the same time, the local central bank is very eager to put foreign FX/CFD brokers on the warning list. As per Q3 2024, there were already over 80 brokers on that list.

Just recently in August, local authorities took action against the broker OctaFX. The Indian Enforcement Directorate (ED) searched various OctaFX office locations in the country and seized INR 804.3 million (more than US$9.6 million), according to a report by the local news outlet India Today. The broker's offices in the country were also raided earlier this year. OctaFX denied allegations by authorities and called them “Unsubstantiated.” More details on that case can be found on the Finance Magnates website. We do not judge here who is to blame but it is worth having that case in mind when evaluating risks of doing CFD-related business in India.

Impressive Capital Market of India

According to SEBI (The Securities and Exchange Board of India), several exchanges are registered in India. These are BSE Ltd, Calcutta Stock Exchange Ltd, Metropolitan Stock Exchange of India Ltd, Multi Commodity Exchange of India Ltd, National Commodity & Derivatives Exchange Ltd, Indian Commodity Exchange Ltd, and National Stock Exchange of India Ltd.

The biggest two of them are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Established in 1875, the BSE is Asia’s oldest stock exchange. Known for its iconic index, the Sensex, which tracks the top 30 companies across various sectors, BSE has been a pillar of India’s capital markets for well over a century. As of today, BSE stands among the world’s top exchanges in terms of market capitalization, offering a broad range of financial products, including equities, derivatives, debt instruments, and commodities.

On the other hand, the National Stock Exchange (NSE), founded in 1992, revolutionized trading in India by introducing electronic trading systems that replaced traditional paper-based settlements. This modernization brought greater transparency, efficiency, and accessibility to Indian markets, attracting a vast number of investors. NSE’s benchmark index, the Nifty 50, is one of the most widely followed indicators of Indian market performance, representing the top 50 companies by market value. NSE now surpasses BSE in terms of trading volume and has grown to be the preferred platform for derivatives and high-frequency trading.

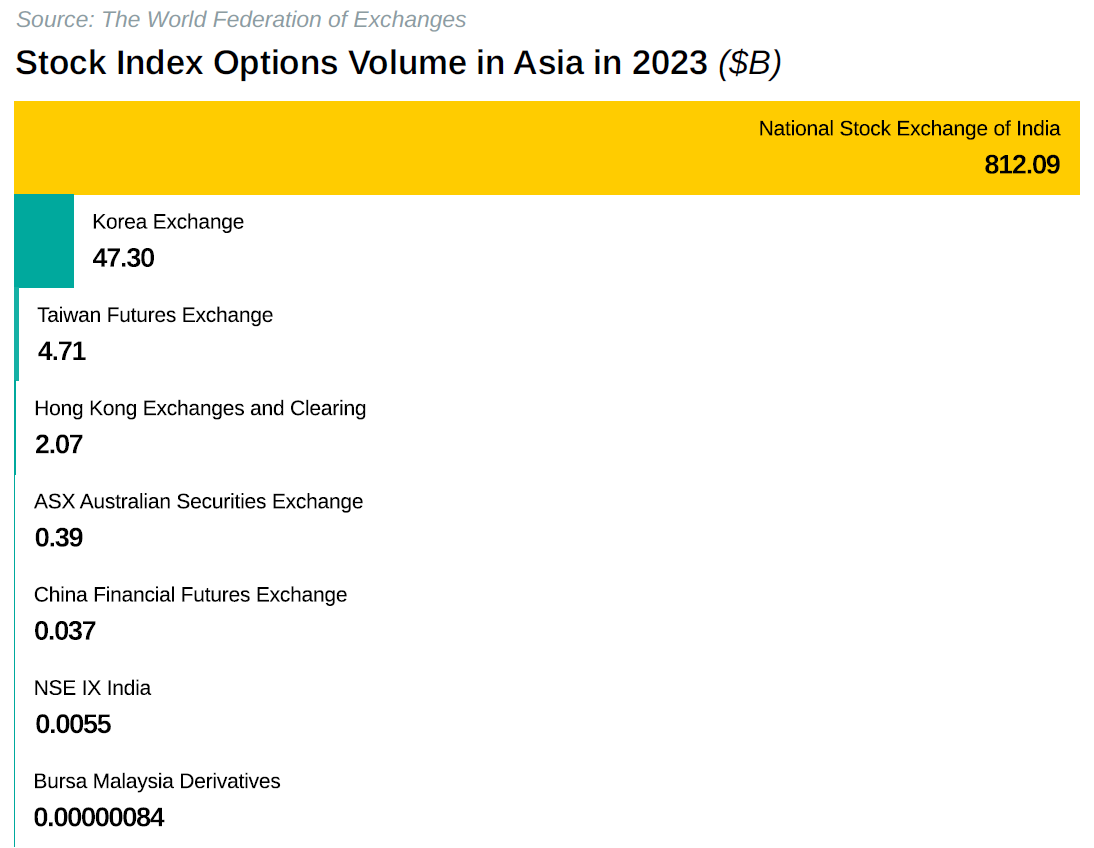

In 2023, the National Stock Exchange of India (NSE) dominated the stock index options market in the Asia-Pacific region, achieving an astonishing trading volume of $812 billion in notional value. This figure placed NSE leagues ahead of other exchanges in the region, underscoring India's booming derivatives market. To put this in perspective, the second-highest volume was recorded by the Korea Exchange, which managed $47.3 billion, barely a fraction of NSE’s volume.

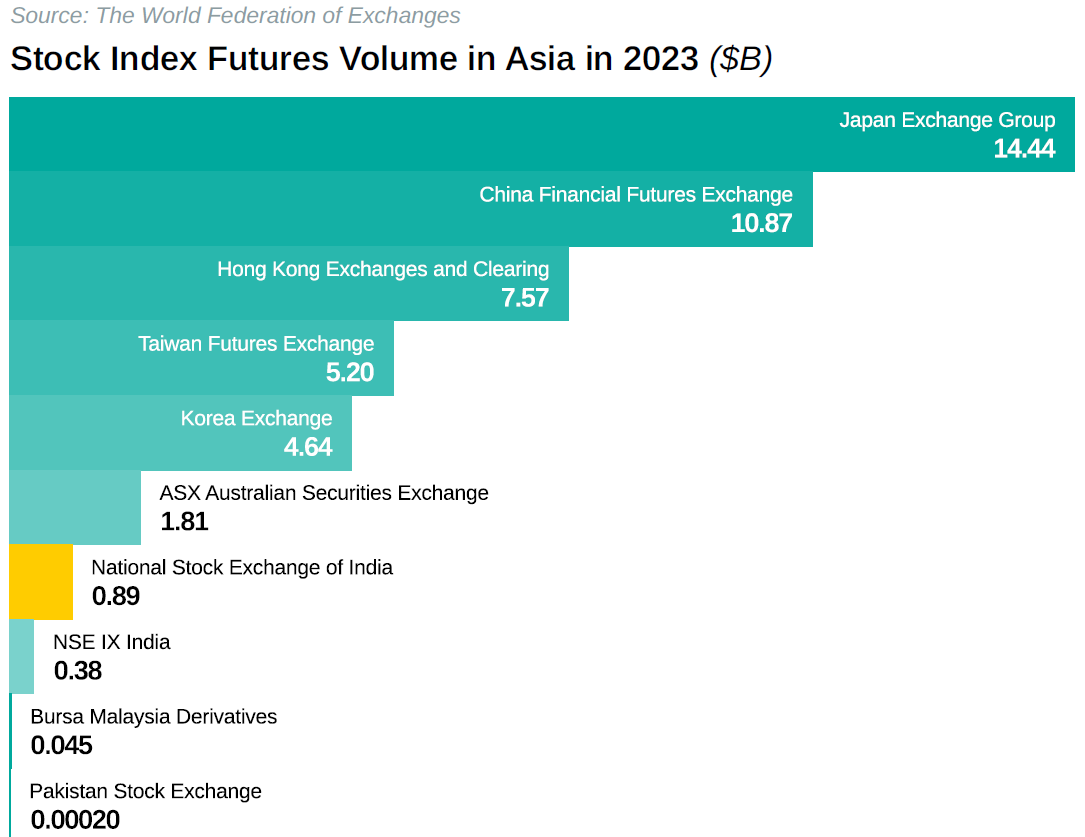

In contrast to its dominance in options trading, the National Stock Exchange of India (NSE) reported significantly lower volumes in stock index futures, with a notional value of only $0.89 billion in 2023. This figure is relatively modest compared to other major exchanges in the Asia-Pacific region. Japan Exchange Group led the futures market with $14.4 billion, followed by China Financial Futures Exchange with $10.9 billion, and Hong Kong Exchanges and Clearing at $7.6 billion.

CFD Market in India

How does this relate to CFDs? Options trading has surged in popularity in India, largely due to the speculative opportunities it offers in a fast-moving market environment. Many retail investors are drawn to the potential for quick gains, often holding their positions for very short periods—sometimes less than 30 minutes. This high-speed trading appeals to those looking for immediate profits, even if it comes with high risks. In an environment where short-term gains can be substantial, the thrill of options trading attracts a significant number of retail traders, especially in India’s rapidly growing and increasingly accessible stock market.

Despite the appeal, options trading in India carries substantial risks, with regulatory data indicating that a large portion of retail traders end up incurring losses. For instance, in the fiscal year that ended in 2022, retail investors collectively lost $5.4 billion on options and other derivatives. This amount averaged $1,468 per trader, which is significant in a country with a relatively low GDP per capita. This financial risk highlights that options trading often serves as a high-stakes endeavor, where many traders enter the market without fully appreciating the potential for loss. Nonetheless, the prospect of outsized returns continues to entice retail investors to try their hand at this form of trading.

One reason for the popularity of options trading in India is the relatively low initial investment required to participate in these contracts. Traders can wager on stock index movements with small amounts of capital, as options allow them to control large positions with a minimal upfront cost. A minor fluctuation in the index, such as a 0.7% rise, can lead to substantial percentage gains on these small investments. For instance, Nifty 50 options can generate returns of 280% in a single day, provided the trade goes in the desired direction. However, if the market moves unfavorably, options can expire worthless, leading to a total loss. This high-reward, high-risk structure is attractive to Indian investors looking for opportunities to capitalize on market volatility, even if it entails considerable financial risk.

Elias Aaraj, Head of Sales & Partnership at Tickmill also mentions a wide offer of CFD brokers as a reason for the growing popularity of CFDs: “Its popularity is increasing as there is a growing interest in flexible, online financial products that offer access to various global markets. Indian traders, seeking alternatives to the local stock exchange, are drawn to CFDs due to the ability to trade commodities, indices, and international stocks without owning them. This provides greater diversification and trading opportunities.”

This and the already mentioned popularity of options trading looks like an ideal environment for CFD trading, which can easily complement or even partially replace options trading. It would, if not the tricky regulatory situation in India. To put it simply, there are no regulations that would cover CFD trading. Yet, from existing regulations, we can deduce that only regulated products can be offered. And the central bank is really harsh on foreign brokers who break this law. Yet, some of the changes may benefit CFD brokers. “In addition, recent regulatory changes by SEBI and the NSE’s plan to discontinue weekly index derivatives for the Bank Nifty, Nifty Midcap Select, and Nifty Financial Services indices have likely contributed to the rise in CFD trading. CFDs allow traders to speculate on price movements without needing to trade directly on Indian exchanges, offering a more accessible avenue for both beginners and advanced traders,” adds Elias Aaraj from Tickmill.

Is it worth the risk? Data collected by Finance Magnates on internet traffic in India is really promising. Our “Heat Map” from several previous editions of our Intelligence Reports has shown India as the top source of CFD-interested traders visiting leading brokers’ websites. In Q4 of 2023, roughly 23.8% of total traffic to CFD brokers’ websites came from India. However, in Q3 2024, it was already a staggering 55.5% of global internet traffic to these websites.

Siju Daniel, Chief Commercial Officer of ATFX, shares his view on the growing interest in CFD trading in India: “The recent increase in CFD-oriented web traffic in India can be attributed to several factors, notably the record-high gold prices, which have heightened interest in precious metal investments. Additionally, there is a growing demographic of traders actively seeking diverse investment opportunities, driven by a desire for portfolio diversification and the potential for higher returns.”

Of course, traffic does not equal a high number of CFD traders active in a country. Not every viewer of a CFD website is necessarily a client. However, the enormous traffic share indicates a huge interest in CFD offerings, and surely, at least a portion of these large numbers must indicate an existing CFD market. How big? In the most optimistic scenario, that could indicate even a few million traders in India, since we have over 5 million globally. Realistically, the number of active CFD traders in India could be in the range of 200,000–400,000 active accounts. If it wasn’t for the complicated regulatory situation, this could be closer to a million.

Customer Behavior: What Works in India?

Many Indian retail traders are drawn into the world of trading through social media and online influencers. These influencers often share success stories, strategies, and market insights that captivate individuals looking for alternative income streams or quick financial gains. Although Indian regulations restrict financial recommendations to registered analysts, influencers often operate in a legal gray area, framing their advice as “education” rather than direct recommendations. This allows them to share market tips and strategies in private messaging groups on platforms like Telegram and WhatsApp, where regulatory oversight is limited. Through these channels, influencers can build trust and a sense of exclusivity, which appeals to new traders eager to learn from perceived experts.

For many Indians, opening a trading account is a decision driven by the allure of fast profits and the ease of access provided by online platforms. The process of account opening has become increasingly simple, with brokers offering seamless digital onboarding, making it easy for individuals to start trading within minutes. New traders are often prompted to open accounts during market booms or after seeing the success of others, frequently amplified by influencers or media coverage of high-profile gains. Additionally, many brokers and platforms offer incentives like zero-fee accounts, bonus deposits, and demo trading options, making the initial step into the market more enticing.

Indian traders are also attracted by educational content such as webinars, seminars, and paid courses, often marketed as essential tools for trading success. Influencers and promoters leverage these educational offerings to build credibility, positioning themselves as mentors who can guide novice traders through the complexities of the market. This “education-first” approach not only brings traders into the ecosystem but also keeps them engaged, as they feel they are continuously learning and improving their skills. However, this model can sometimes blur the line between genuine education and persuasive marketing, as the focus on high returns can overshadow the risks involved, leading many traders into speculative behavior.

Tickmill’s Elias Aaraj gives his broad ideas on how customers in India can be approached: “Brokers should focus on the advantages that CFDs provide. One key aspect is leverage, which allows traders to gain exposure to larger positions in the market without having to come up with 100% of the trade value. This amplifies both potential profits and risks, making a well-planned risk management strategy essential. Competitive trading fees and tighter spreads are also crucial, as they lower the overall cost of trading and make it more attractive for traders to explore different strategies, such as scalping or day trading. What’s more, promotional offers play a significant role in attracting traders. These may include bonuses for account sign-ups, zero-commission trading for a limited period, or demo accounts that allow traders to practice in a risk-free environment.” He further adds: “Offering a diverse product range of CFDs is another powerful way to appeal to traders with varied interests and strategies. By providing CFDs on multiple assets, such as commodities, indices, and cryptocurrencies, brokers give traders the flexibility to diversify their portfolios and explore different market opportunities. Lastly, educating traders through a comprehensive range of educational resources, including webinars, video tutorials, and articles, helps traders understand the complexities of CFDs, their benefits and their risks.”

Behavior patterns among Indian traders reveal a strong influence of social validation and community-based trading. Active participation in private groups and forums fosters a sense of belonging and shared purpose, reinforcing their trading decisions. Many traders adopt high-risk strategies based on tips shared in these groups or mimic the tactics suggested by their influencers, often without fully understanding the underlying risks. This community-driven approach can lead to herd behavior, where traders make impulsive decisions based on peer influence rather than thorough analysis—a pattern reflecting both the accessibility and the volatility of India's retail trading landscape.

ATFX’s Siju Daniel shares another recommendation on approaching local customers: “It is key to have global regulations across multiple well-known jurisdictions to ensure that professional and global standards are maintained. This ensures greater client protection and the safety of their funds, which is of paramount importance in a burgeoning market such as this.”

Payments Are on the Rise Too

India’s digital payment landscape is one of the fastest-growing in the world, driven by a tech-savvy population and widespread adoption of platforms like UPI (Unified Payments Interface). With nearly half of global digital transactions occurring in India, consumers are showing a strong preference for digital methods, using them for both everyday purchases and larger transactions. This shift is evident even in smaller towns and rural areas, where digital payment infrastructure is expanding rapidly. Many consumers now use digital payments daily, indicating a significant behavioral shift toward cashless transactions across diverse demographics. The ease and speed of digital payments have empowered consumers to make more frequent purchases and engage with a wider array of services and products.

In addition to digital payments, India’s credit card market is experiencing rapid growth, with the number of active cards projected to double by 2028–29. Credit cards are becoming a preferred option for high-value purchases, offering benefits like cashback, loyalty rewards, and installment plans that appeal to Indian consumers. This trend is changing spending habits, as credit cards allow consumers to make larger purchases without immediate financial strain. Despite the challenges of app usability, security concerns, and hidden fees, credit cards and digital payments are reshaping consumers’ spending by giving them new ways to manage finances and budget for bigger purchases, from electronics to travel.

However, challenges persist, as many users express concerns about transaction security, hidden fees, and technical glitches, especially in rural areas where connectivity issues are more common. These obstacles underscore the importance of refining digital payment systems to ensure security, accessibility, and transparency. Despite these hurdles, the overall trend shows that Indian consumers are embracing digital spending. The digital and credit-based payment market is primed to further transform retail and eCommerce experiences, expanding the range of products and services available and changing consumer habits nationwide.

The Future of India

The Securities and Exchange Board of India (SEBI) has introduced new regulations aimed at tightening controls on equity derivatives trading. Taking effect on November 20, these rules significantly raise the minimum trade size for derivatives, now set between 1.5 million and 2 million rupees—an increase nearly threefold from the previous threshold. Additionally, SEBI has limited the weekly options contracts available on each exchange to a single option, a move aimed at curbing speculative trading by retail investors. These changes, though contentious among investors, demonstrate SEBI’s intent to create a more cautious approach within the derivatives market, especially targeting new or less experienced participants.The Future of India

The Securities and Exchange Board of India (SEBI) has introduced new regulations aimed at tightening controls on equity derivatives trading. Taking effect on November 20, these rules significantly raise the minimum trade size for derivatives, now set between 1.5 million and 2 million rupees—an increase nearly threefold from the previous threshold. Additionally, SEBI has limited the weekly options contracts available on each exchange to a single option, a move aimed at curbing speculative trading by retail investors. These changes, though contentious among investors, demonstrate SEBI’s intent to create a more cautious approach within the derivatives market, especially targeting new or less experienced participants.

SEBI’s concerns stem from the rapid surge in retail activity within derivatives trading and the potential risks it poses to market stability and individual financial health. Recent data showed that derivatives trading in India reached a monthly notional volume of 10,923 trillion rupees in August, marking the highest level globally. According to SEBI’s findings, only a small percentage of individual traders in derivatives have seen consistent profits, while the majority have incurred significant losses over recent years. Institutional and foreign traders, however, recorded considerable profits, underscoring an imbalance that SEBI aims to address through these tighter regulations.

While these rules focus on risk reduction, they may have an unexpected impact on CFDs trading in India. With the increased barriers to entry in traditional derivatives, some retail investors might pivot toward CFDs, which can offer similar market exposure with typically lower capital requirements. However, SEBI may also consider future CFD regulations or, together with the central bank, may act even more harshly on any CFD offerings in India. For now, these new derivatives regulations may channel some investor interest toward CFDs, especially among those still seeking leveraged trading opportunities in a more accessible format.

In other words, the future could be bright for India. Elias Aaraj from Tickmill is optimistic: “The future of retail FX and CFD trading in India over the next five years looks promising. The rise of digital platforms will likely make trading more accessible to a larger audience, while client interest in CFDs is expected to grow, driven by the flexibility and variety they offer. As India's economy continues to expand, with projections to become one of the largest in the world by 2030, the demand for alternative trading avenues like CFDs is expected to rise. The growth of fintech solutions in India will likely facilitate smoother transactions, encouraging both retail and institutional participation. With potential regulatory reforms, CFD trading could become a mainstream investment option in the coming years.”

Siju Daniel from ATFX seems to share this optimism: “The future of the retail FX and CFD market in India looks promising. We anticipate continued growth over the next five years, particularly with the country's GDP projected to expand at an annual rate of 5–7%. As financial literacy improves and more investors seek diverse investment avenues, we expect the demand to rise, positioning India as a key player in the global trading landscape.”

Conclusions

India’s retail trading landscape is in a potentially crucial moment, shaped by both regulatory changes and rapid economic growth. The Securities and Exchange Board of India (SEBI) has introduced stricter controls on equity derivatives trading. While these regulations aim to protect individual investors and stabilize the market, they may channel interest toward CFDs, an increasingly popular form of trading due to their lower capital requirements and flexible trading options. As India’s economy continues on a growth path, buoyed by digital platforms and rising financial literacy, the demand for accessible investment options like CFDs is anticipated to rise. With the potential for regulatory adaptations and an expanding fintech ecosystem, India stands poised to become one of the key players in the global trading arena. For sure, it will be, and in many cases already is, on the radars of CFD brokers.