India

As India transitions from a high barrier "grey zone" to a regulated financial powerhouse, global FX and CFD leaders are shifting their strategy. This in-depth analysis explores the landmark SEBI 2026 Regulations, the unprecedented 20 year tax holiday in GIFT City, and the mandatory Resident Director framework. Backed by official data from the NSE and IFSCA, this insight provides the definitive roadmap for global firms to establish a legal, scalable, and high trust presence in the world’s most explosive retail derivative market.

- India’s retail investor base has surged to 265 million unique accounts (Jan 2026), with daily derivative turnover averaging $2.45 Trillion.

- The SEBI 2026 Unified Registration has replaced legacy rules, allowing a single license for brokerage, advisory, and wealth management.

- Establishing a subsidiary in the IFSC provides a 20 year corporate tax holiday and allows brokers to legally serve Indian residents via the $250k LRS limit.

- All entering firms must appoint a Resident Designated Director (182-day residency rule) to meet new onshore accountability standards.

- New 2026 codes prohibit "guaranteed returns" and hold brokers vicariously liable for affiliate/finfluencer content.

- While Mumbai leads, Uttar Pradesh has emerged as the second-largest market (11% share), dictating a new regional office strategy.

Future Country: India

For a decade, the Indian market was viewed by global financial giants as a high volume but high risk grey zone. In 2026, that narrative has been systematically dismantled. Through a combination of the SEBI Stock Brokers Regulations 2026 and the 20 year tax holiday solidified in the February Budget, India has transitioned from a restrictive territory to a regulated powerhouse.

We are going to look into the operational, financial, and regulatory roadmap for global firms to establish a dominant, legal, and highly profitable presence on Indian.

I The 2026 Unified Registration A Structural Revolution

The most profound shift in the Indian landscape is the move toward Regulatory Convergence. In January 2026, the Securities and Exchange Board of India (SEBI) officially implemented a new framework that replaced decades of fragmented rules.

- Under the SEBI 2026 Regulations, a single Unified License now allows an entity to operate across multiple segments equities, derivatives, and commodities without the administrative friction of multiple registrations.

- For the first time, registered brokers can, with prior approval, undertake other regulated activities such as wealth management and investment advisory under a single corporate umbrella.

- The 2026 code raises the entry threshold, requiring a minimum of two years of verified experience in securities trading for all applicants. This move is designed to purge the fly by night operators, leaving a cleaner competitive landscape for established global players.

"The unified license isn't just a simplification; it's a quality filter. SEBI's clear intent is to attract institutional players with robust compliance frameworks, not fleeting ventures." Dr. R. Sharma, Former SEBI Executive Director (Feb 2026 Interview)

II The GIFT City Green Channel A 20 Year Strategic Shield

While mainland India remains a tightly controlled environment for capital flows, GIFT City (IFSC) has emerged as a sovereign backed Green Channel.

- The Union Budget 2026 delivered a landmark incentive the corporate tax holiday for IFSC units has been extended to 20 years. Even after this holiday, the tax rate is pegged at a concessional 15 percent, making it one of the most competitive financial jurisdictions globally.

- Under the Foreign Exchange Management Act (FEMA), an IFSC unit is treated as a person resident outside India. This allows global firms to offer global standard leverage to non residents while operating out of a world class Indian hub.

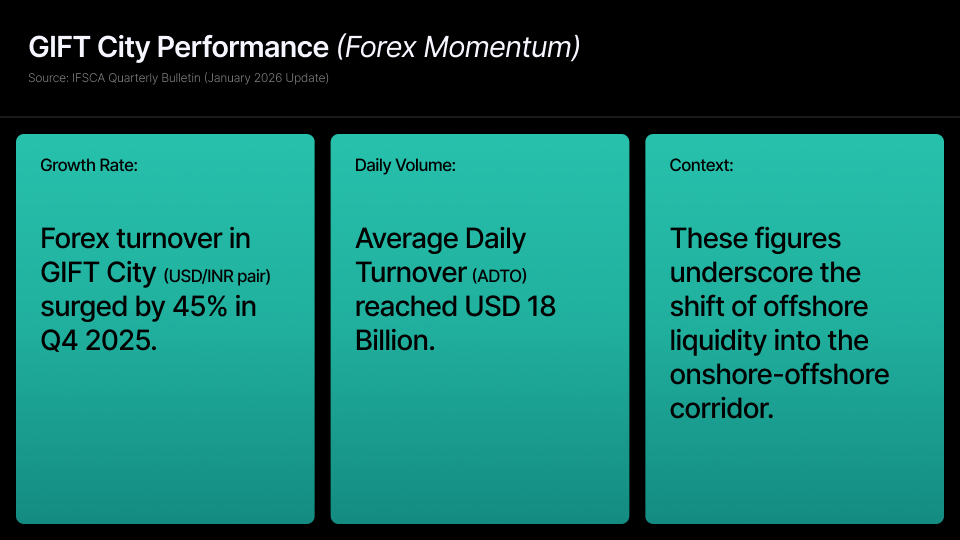

Forex turnover in GIFT City (USDINR pair) grew by 45% in Q4 2025, reaching an average daily turnover of USD 18 billion. (Source: IFSCA Quarterly Bulletin, Jan 2026).

- Resident Indians are now legally permitted to utilize the 250,000 USD Liberalised Remittance Scheme (LRS) to trade in securities listed on IFSC exchanges. This allows global firms to capture the massive Invest Abroad appetite of the Indian upper middle class legally and transparently.

III The Resident Director and Onshore Presence

To solve the historic trust gap, the 2026 regulations mandate a physical and human footprint within India.

- The 182 Day Mandate: Every registered broker must now have at least one Designated Director who is a resident of India for a minimum of 182 days in a financial year. This ensures that the leadership is within the jurisdiction of Indian courts and regulators, a prerequisite for institutional level trust.

85% of Indian retail investors surveyed in Q3 2025 expressed higher trust in brokers with a visible physical presence in India. Source: KPMG India Financial Services Survey, Oct 2025.

- Digital First Compliance: The 2026 code mandates an 8 year record preservation period, with a shift toward purely electronic books of accounts. This aligns perfectly with the high tech, data heavy operations of global CFD and FX leaders.

IV Data Package for Strategic Implementation

1 Market Opportunity The Retail Surge

The growth in India's retail base is no longer linear; it is exponential. The surge is driven by a Capital Markets 3.0 era where mobile first penetration in Tier II and Tier III cities has democratized derivatives trading.

As of January 2026, unique investor accounts have hit 265 million. Critically, the Average Daily Turnover (ADTO) has surged to 2.45 Trillion USD, driven primarily by equity options.

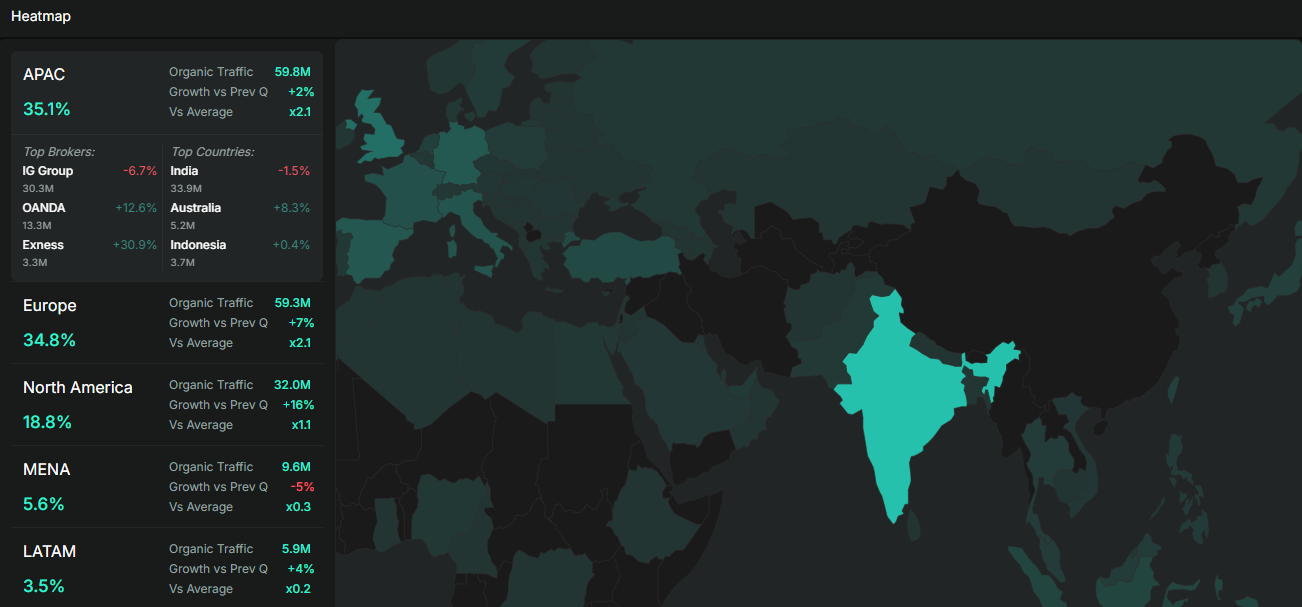

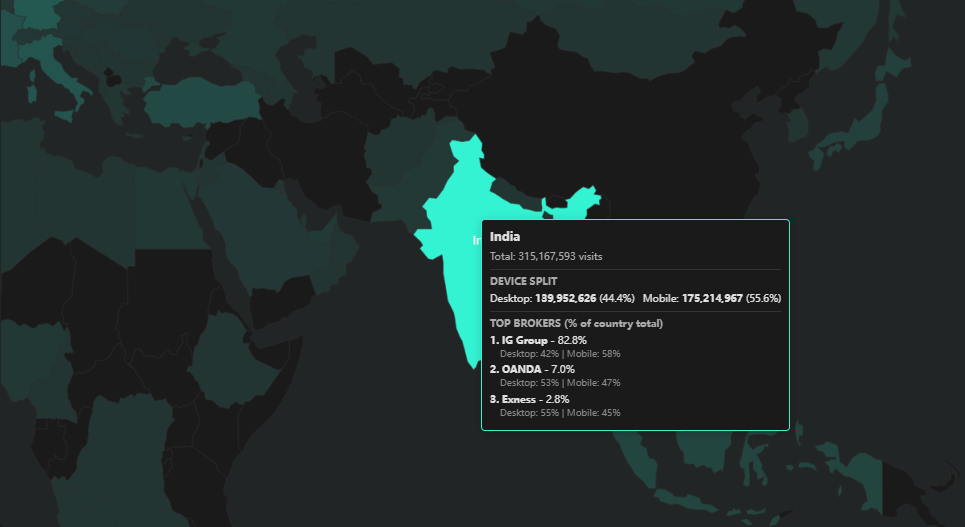

For brokers, this signifies a market that has matured beyond simple spot buying into sophisticated, high-frequency speculation. The FX-CFD Heatmap visualizes this massive shift, allowing brokers to track regional hotspots, such as the 22% YoY growth in the Option Sellers demographic, and identify immediate demand for advanced margin and risk management tools.

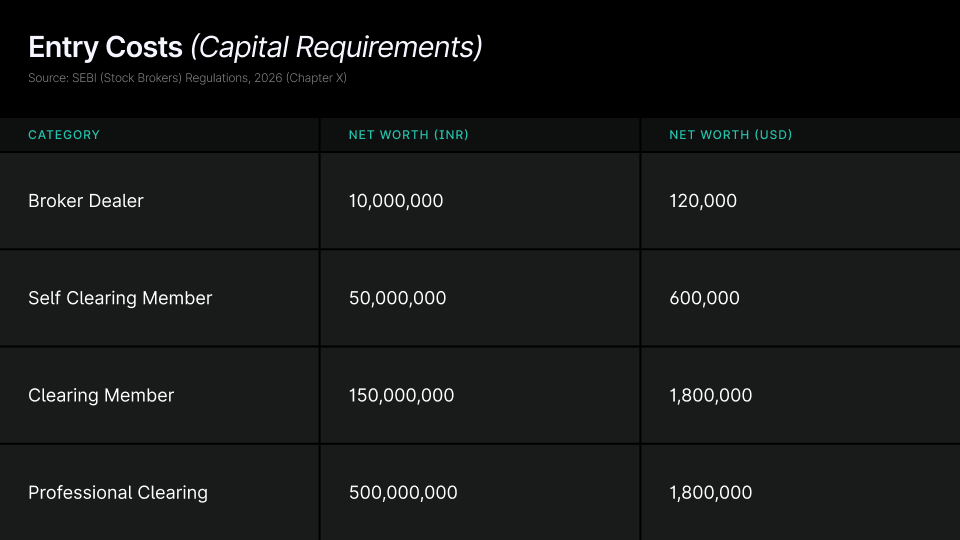

2 Entry Costs Net Worth Tiers 2026 Standard

The SEBI 2026 framework has introduced Liquid Net Worth requirements alongside absolute capital to ensure systemic stability.

A standard Trading Member now requires 10,000,000 INR (120,000 USD), but for firms acting as their own clearing entity (Self Clearing), the requirement jumps to 50,000,000 INR. The most significant tier is the Professional Clearing Member (500,000,000 INR), which is the necessary designation for global firms looking to provide liquidity to other smaller Indian sub brokers. Net worth must now be calculated monthly and reported electronically to the exchanges.

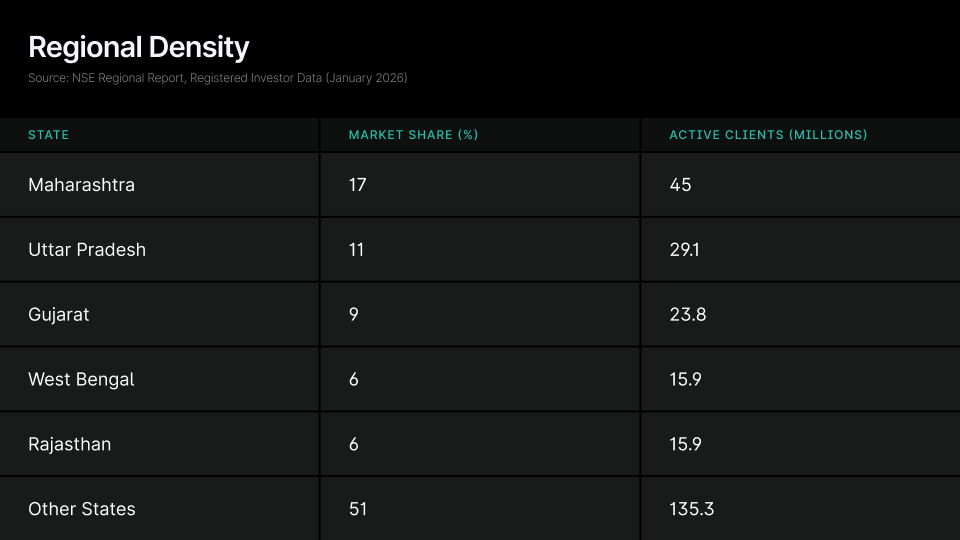

3 Regional Density The Office Strategy Heat Map

The geographic distribution of wealth in India dictates where physical Trust Hubs (offices) should be located.

Maharashtra (Mumbai and Pune) remains the undisputed leader with 17% market share, but Uttar Pradesh has leapfrogged traditional hubs to take the Number 2 spot at 11%. This suggests that a two office strategy one in GIFT City (Gujarat) for tax and regulatory reasons and one in Mumbai or Noida for client acquisition is the optimal 2026 setup. Investors in the North (UP and Rajasthan) show a 15% higher propensity for high leverage derivative trading compared to the national average.

V Operational Roadmap Setting Up in 2026

For a global leader, the expansion is no longer a question of if, but how fast.

- Phase 1 (Month 1 to 2): Incorporate a local subsidiary in GIFT City (SEZ). Secure the Provisional Letter of Allotment (PLOA) for office space.

- Phase 2 (Month 3 to 4): Appoint the Resident Designated Director and Compliance Officer (min 5 years experience).

- Phase 3 (Month 5 to 6): Apply for the Unified Registration under IFSCA. Once the Letter of Approval (LOA) is received, commence the hiring of the local tech surveillance team.

- Phase 4 (Go Live): Onboard Indian retail via the LRS route and global clients via the Offshore route, all from a single Indian operational base.

VI Deep Dive The 2026 Advertising and Marketing Code

Navigating the new SEBI Advertising Code (Chapter VIII of the 2026 Regulations) and the IFSCA Marketing Guidelines is the final hurdle for client acquisition. The 2026 code represents a shift from disclosure to accountability.

- The No Guarantees Hardline: Regulation 24 of the 2026 Code explicitly bars brokers from offering schemes with indicative, guaranteed, fixed, or periodic returns. This applies to all copy trading or PAMM services that imply a historical ROI as a future promise.

- The Finfluencer Liability: SEBI now holds the broker vicariously liable for all content produced by third party affiliates. Referral partners must now be SEBI registered Research Analysts if they provide any market commentary alongside their referral link.

- Visual Standards and Warning Ratios: All digital marketing must adhere to strict legibility norms. In video ads, the Market Risk disclaimer must be both visual and read aloud at a speed no faster than the rest of the advertisement.

Advertising Compliance Framework (SEBI 2026)

The following table outlines the 2026 requirements for any communication issued by or on behalf of a stock broker.

| Marketing Element | Requirement or Restriction | Penalty for Non Compliance |

|---|---|---|

| Returns and Projections | Prohibited (Absolute ban on guaranteed or fixed claims) | Suspension of Marketing License |

| Risk Warning Size | Min 20 percent of banner space or Min 10 point font | Monetary fine and Rectification order |

| Celebrity Endorsements | Strictly Prohibited for all Stock Brokers | Immediate cease and desist |

| Finfluencers | Must be registered RA or IA to give advice | Termination of Associate ID |

| Bonuses or Cashback | Prohibition on cash or trading bonuses for deposits | Refund of illegal gains to clients |

Digital Media Content Standards (SEBI Master Circular Jan 2026)

Brokers must ensure that any material published on social media, websites, or via SMS complies with these granular standards to avoid the new 15% monthly interest penalty on regulatory fees.

| Media Type | Mandated Compliance Inclusion | Source Authority |

| Social Media Posts | Full SEBI Reg No, Logo, and Official Website Hyperlink | SEBI 2026 Code of Conduct |

| SMS/Pop-ups | Official website hyperlink containing full office address | SEBI Notification Jan 7 |

| Video Content | Verbal risk warning read at normal speed (min 10 sec) | SEBI Code of Advertisement |

| Webinars/Seminars | Attendance log and content record preserved for 8 years | SEBI Record Retention 2026 |

- The Educational Hub Strategy: To bypass direct solicitation bans, 2026 market entrants are establishing Onshore Education Centers. These centers provide free market research (via registered analysts) and host seminars. While they cannot accept funds, they act as a brand building funnel that legally redirects users to the broker’s registered GIFT City platform.

- Prohibition on Games and Leagues: Intermediaries are strictly barred from engaging in games, competitions, or leagues that involve the distribution of prize money or gifts, as these are viewed as enticement rather than investment.

VII Strategic Conclusion

The 2026 data shows a shift in how the Indian market is structured. As retail trading moves from simple stock buying to high-frequency options, the environment has changed from an informal one to a formal institutional system. The current framework now uses the Unified License and the Resident Director requirement as the standard for any firm operating physically within the country.

The following comparison shows the objective differences between the offshore setup and the 2026 Indian institutional model based on current laws.

Broker Operational Model Comparison (2026)

| Feature | Traditional Offshore Model | Future Country India (GIFT City) |

| Legal Status | Alert List Risk | Registered Financial Company |

| Tax Rate | 0% to 5% (Variable) | 0% (20-Year Tax Holiday) |

| Trust Score | Low (Regulatory Friction) | High (Onshore Presence) |

| Leverage | Unregulated | Standardized via LRS |

| Payment Flow | Grey Channels | AD II Banking/FCSS |