FX/CFD Industry Performance Index Q3 2025

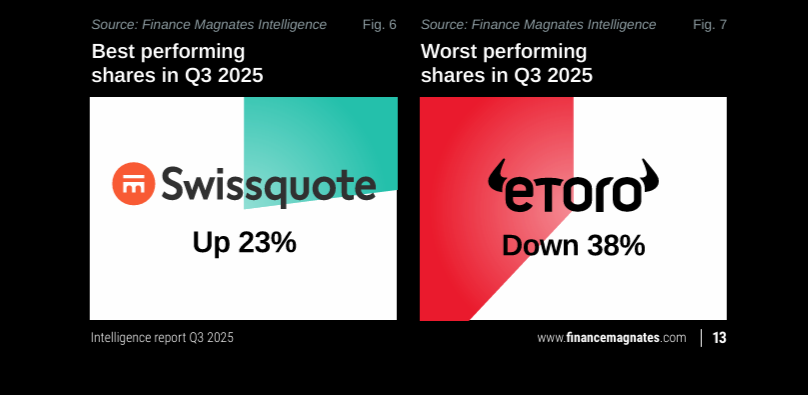

The FX/CFD Industry Performance Index dropped 2.7% in Q3 2025 to 7,386 points, driven by a sharp 38% decline in eToro shares (due to a 50% drop in net income) and an 11.9% fall in XTB shares. Swissquote was the clear market winner, surging 23.6% in the quarter.

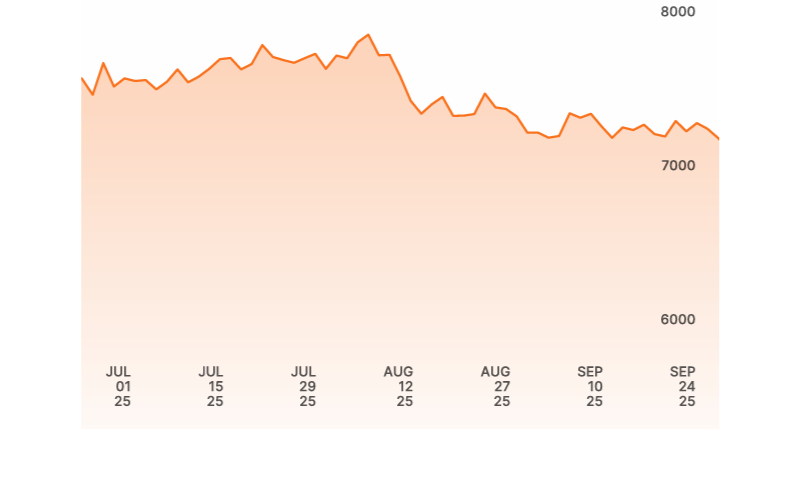

The Finance Magnates FX/CFD Industry Performance Index, which tracks the stock performance of publicly listed brokers (IG Group, CMC Markets, eToro, Plus500, XTB, NAGA Group, and Swissquote), declined by 2.7 percent in the third quarter of 2025, closing at 7,386 points (starting from 1,000 points on July 1, 2019). The overall decline was primarily caused by major losses from eToro, whose shares plummeted 38 percent following financial results showing a near 50 percent drop in net income. XTB also saw an 11.9 percent decline. Conversely, Swissquote stood out as the clear winner, with its shares surging 23.6 percent, marking its second consecutive quarter of strong growth. IG was the only other gainer with a 1.2 percent increase. This index aims to provide investors with a business perspective on the health and future potential of the FX/CFD industry.

FX/CFD Industry Performance Index

Index Overview and Performance

A proprietary index tracking the share performance of publicly listed FX/CFD brokers (IG, XTB, eToro, etc.) to present the industry's health from an investor's perspective.

The FX/CFD Industry Performance Index was created by calculating the performance of individual shares of FX/CFD brokers listed on exchanges. These brokers are IG Group, CMC Markets, eToro, Plus500, XTB, NAGA Group and Swissquote. The initial value of the index was equal to 1,000 points, starting on July 1, 2019.

The aim of this index is to present FX/CFD industry performance as investors see it. It gives all market participants a broader perspective on the industry and its potential future, as seen by the people who judge the industry from a business angle.

The Finance Magnates FX/CFD Industry Performance Index fell 2.7% in the third quarter of 2025, closing at 7,386 points. Most publicly listed brokers saw their shares decline, led by the newest company in the ranking. Still, there was one particularly strong result that stood out.

Broker Performance Breakdown

Finance Magnates FX/CFD Industry Performance Index in Q3 2025

- The bright star of Q2 turned into the biggest loser in Q3. Shares of eToro fell 38% after financial results published in August showed net income had dropped by nearly 50%, down from $60 million in the first three months of 2025.

- The second largest decline came from XTB, whose shares lost 11.9% in Q3. While its quarterly earnings initially looked satisfactory, results for the first half of the year showed an 11% decline.

- Shares of CMC Markets and Plus500 each slipped 5%, while Naga Group saw only a modest 1.5% drop. The company’s revenue, however, managed to rise by 2% in Q2.

- Among only two gainers, IG recorded a 1.2% increase in its share price. The clear winner, however, was Swissquote, whose shares surged 23.6% in Q3. Even more notable, this marked another consecutive quarter of growth, following a 29% gain in Q2.