Evolution of Global CFD Interest in 2024

Identifying where to attract new clients is a major challenge for CFD brokers. Using Finance Magnates’ annual “Heat Map,” this piece highlights global shifts in retail interest in FX/CFD products and points to regions that may offer the best expansion opportunities in 2025.

Understanding where to find and attract new clients is a key challenge for any CFD broker. Using Finance Magnates’ annual “Heat Map,” this piece analyzes how global retail investor interest in FX/CFD products has shifted over the past year, highlighting regional traffic trends to leading broker websites and identifying potential markets that may offer the strongest opportunities for expansion in 2025.

Introduction

Introduction

One of the most important questions any CFD broker can ask themselves is, “Where should I search for customers?” In our Quarterly Intelligence Reports, we try to answer this question by presenting a “Heat Map” that helps brokers monitor the activity of retail investors around the world. This time, we have made an annual review, showing how things have evolved throughout the year. Most importantly, we show trends that may indicate directions of expansion for 2025. Where should CFD brokers invest their attention?

The Finance Magnates “Heat Map” is a tool designed to track which regions of the world most traffic to FX/CFD websites comes from. We follow the statistics of the top 15 brokers from our volume rank, and based on this, we create a model and the map. Our map and data show in which regions of the globe people are interested in viewing these top websites. Of course, this does not automatically imply that the number of viewers corresponds 1:1 with the number of actual traders. However, it gives a very good indication of interest in FX/CFD products.

Analysis of the Regions

Analysis of the Regions

The year 2024 revealed interesting trends in the geographical distribution of traffic to FX/CFD websites, with Asia steadily underlying its dominance. In Q1, Asia accounted for 48.5% of all views, up from 43.6% in Q4 2023, driven primarily by India, which contributed an impressive 38.3%. Europe followed with 31.1%, reflecting a slight decline, while North America claimed 12.5%, showing moderate growth. Africa, Oceania, and the Middle East contributed smaller shares, each below 3%, and South America accounted for 2.6%. Key countries during this period were India, the United States, and the United Kingdom, reflecting both emerging and established markets.

By Q2, Asia’s share surged to 62.1%, an impressive increase largely driven by India’s significant rise to 52.8% of global views. Thailand also emerged as a notable contributor during this period. Meanwhile, Europe’s share declined sharply to 18.4%, and North America’s fell to 5.4%. Africa experienced substantial growth, reaching 10.3%, but other regions, including Oceania, South America, and the Middle East, remained relatively stable with minimal contributions. The dominance of Asia during this quarter highlighted the growing interest in trading within emerging markets, particularly in regions with evolving regulatory frameworks.

In the third quarter, Asia’s dominance strengthened further, with its share climbing to 70.3%, driven by India’s continued growth to 55.5% of global views. Thailand and Japan also contributed notably during this period. Europe’s share declined further to 17.1%, while North America’s dropped to 4.0%. Africa, which had shown growth in Q2, saw its share fall to 5.6%, signaling a reversal of earlier gains. Oceania, South America, and the Middle East remained relatively stable, each contributing less than 2%. Overall, this quarter emphasized Asia’s growing influence as other regions struggled to maintain their share of global traffic.

By Q4, Asia stabilized its lead, accounting for 69.5% of all views. Europe’s share continued to decline, reaching 16.1%, while North America’s slightly recovered, climbing to 5.2%. Africa’s share decreased further to 4.2%, while the Middle East saw a marginal increase to 2.4%. Oceania and South America remained relatively unchanged at 1.6% and 1% of views, respectively. Throughout the year, India consistently led the global markets, contributing over half of all traffic, with additional notable contributions from Southeast Asian countries like Thailand and Japan.

Finance Magnates asked several brokers for their opinion on Asia as a place to do CFD business. Eloise Croker, Head of Marketing at TMGM, said: “Asia has always been a very important market for TMGM, and the region’s continued development and increased interest in trading has greatly contributed to our growth as a business. Asia’s traders are very sophisticated, and the need for quality products has always pushed us to innovate and enhance our offerings. Although there are still huge opportunities for growth in Asia, it’s very important for CFD brokers to properly understand the nuances of each market if they are to be successful.”

This opinion on Asia is being echoed by Siju Daniel, Chief Commercial Officer at ATFX, who told Finance Magnates: “Asia has definitely been a key driver in the growth of CFD trading in 2024. It generated the highest traffic to CFD websites, which really shows the increasing interest in trading across the region.” He continued: “For ATFX, we’ve really leaned into this trend. In 2024, we saw strong engagement from Asia, and we’ve prioritized offering solutions that are tailored to local needs. As more traders get involved in CFDs for the flexibility and access to global markets, we’re excited about the continued growth we’re seeing in the region. We’ve focused on building trust by ensuring we meet local regulatory standards and offering a smooth, reliable trading experience. Asia is a market we’re really optimistic about as we move forward.”

Marios Chailis, CMO at Libertex Group, seems to go even further in his praise for the region and its future: “It is well accepted now that Asia is well on its way to becoming a global economic powerhouse, perhaps overtaking Europe and North America. However, this phenomenon will not be limited to the industrial sector alone. Everyday people in these countries have been experiencing improved economic conditions, and a new middle class has emerged and continues to grow. As people begin to have real disposable income, it's only natural that they will look to invest it.” Marios further shares interesting insights on local preferences: “Of course, CFDs are a convenient method for retail traders and investors to gain access to the markets without having to physically own assets, so it's logical that new entrants to the space will be primarily attracted to these kinds of instruments. Notably, our top performers in Asia include BTCUSD, Gold (XAUUSD), and EURUSD, reflecting strong investor interest in both traditional and digital assets. It is my opinion that the Asian CFD market thus has huge potential, which is why we are actively working to expand our presence in this region.”

The Most Popular Countries

The Most Popular Countries

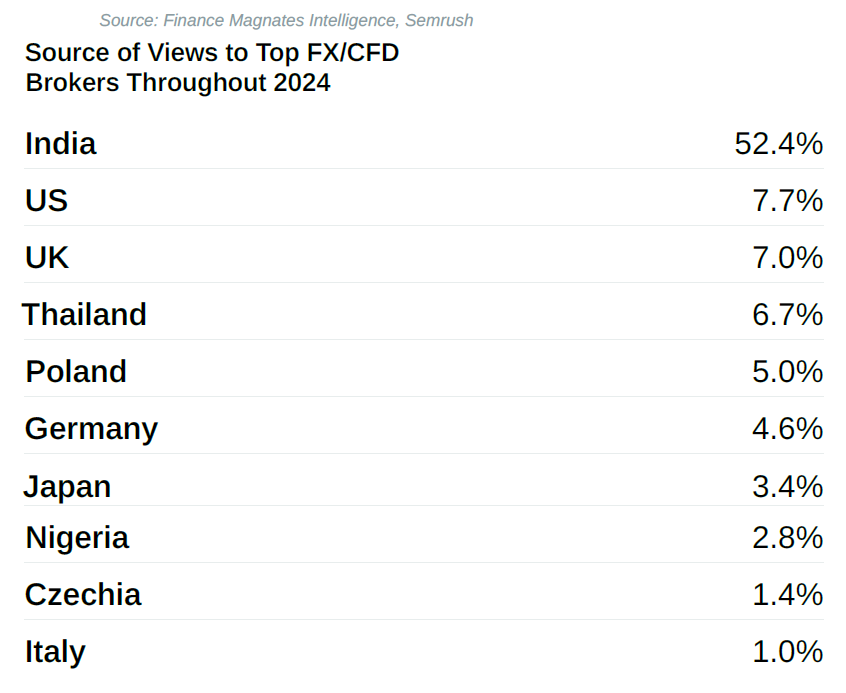

The data on average global traffic to FX/CFD websites in 2024 reveals a strong dominance by India, contributing an impressive 52.4% of the total traffic. This reflects India’s central role in the FX/CFD market, likely driven by its rapidly growing online trading community and expanding digital infrastructure. In recent years, options trading has surged in popularity in India, largely due to the speculative opportunities it offers in a fast-moving market environment. Many retail investors are drawn to the potential for quick gains, often holding their positions for very short periods—sometimes less than 30 minutes. Many of these investors look at CFD trading as it also gives quick but risky opportunities for trading.

The next significant contributors were the United States (7.7%) and the United Kingdom (7.0%), indicating sustained interest from established markets, albeit at much smaller scales compared to India. Other notable countries included Thailand (6.7%), Poland (5.0%), and Germany (4.6%), showing increasing engagement from diverse regions. Japan (3.4%) and Nigeria (2.8%) also made notable contributions, with the latter emphasizing Africa’s growing potential. Smaller shares from Czechia (1.4%) and Italy (1.0%) highlight the broader, albeit less significant, global reach of FX/CFD trading platforms.

Speaking of Germany, the CMO of Libertex commented: “Germany is a very important market for us, that's for sure. As Europe's largest economy, it's unsurprising that many traders and investors want to maximize returns on their disposable income and savings— and we’re proud that so many choose Libertex. However, this success is no accident; our extensive marketing efforts, including our multi-year partnership with German superclub FC Bayern, have significantly boosted brand recognition and helped introduce a new audience to trading.”

Views

Analysis of the Number of Views

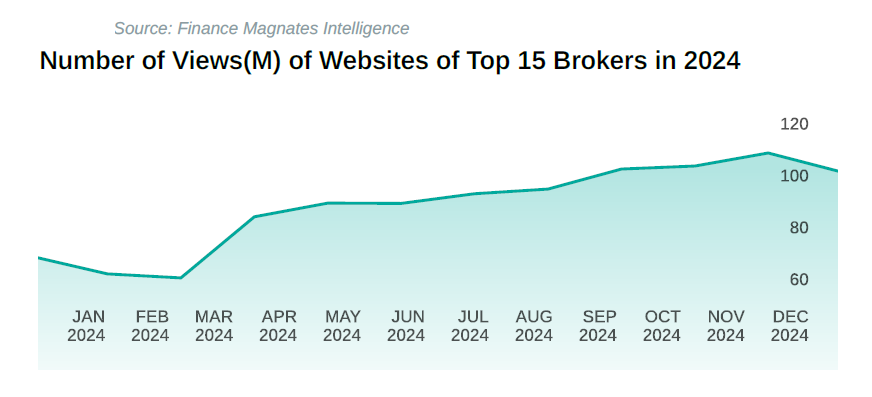

The number of views for the top 15 brokers in 2024 demonstrated consistent growth throughout the year, with noticeable fluctuations and key periods of improvement. The year began with 70.43 million views in January, followed by a slight decline in February (63.82 million) and March (62.26 million). This slow start was reversed in April, which saw a sharp increase to 85.99 million views, marking the beginning of sustained growth. May and June maintained this upward momentum, with 91.32 million and 91.28 million views, respectively, indicating a stable rise in engagement during the second quarter.

In the second half of the year, growth became more pronounced. July recorded 95.07 million views, and August followed with 96.78 million, continuing the steady increase. September brought a significant spike, reaching 104.59 million views, which was further exceeded in October at 105.75 million. The upward trend peaked in November, which achieved the highest monthly views of the year at 110.86 million, before slightly declining in December to 103.47 million, still a strong close to the year.

The quarterly growth reflects a clear trend of rising interest, with total views climbing progressively each quarter. The most dramatic surges occurred in Q2, when views rebounded strongly after a slow start, and in Q4, which recorded the highest overall activity. 2024 was a year of consistent engagement increases, driven by increased interest in CFD trading in the latter half of the year.

Top Brokers

Popularity of the Top Brokers

The data on website views for the top FX/CFD brokers in 2024 provides an interesting snapshot of traffic distribution but may not fully reflect the dynamics of the entire market. It’s worth considering that website views alone may not account for all trading activity or customer engagement, as these metrics can vary due to differences in regional presence, marketing strategies, and market positioning of each broker. Nevertheless, the numbers offer valuable insights into how user interest evolved over the year.

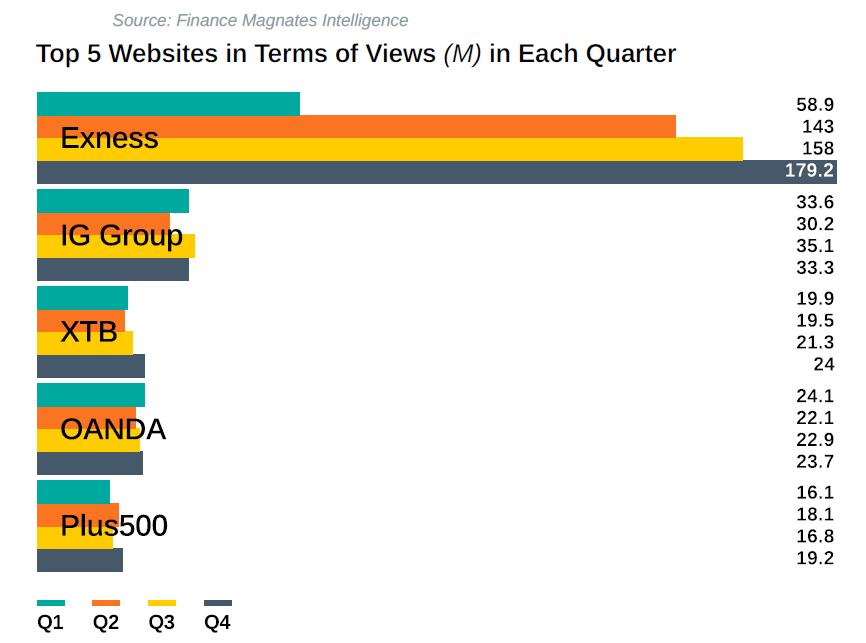

Looking at the data, IG Group, XTB, OANDA, and Plus500 showed relatively stable trends throughout 2024. IG Group began the year with 33.6 million views in Q1, experiencing minor fluctuations but ending Q4 at 33.3 million views, indicating a consistent level of interest. XTB, similarly, maintained a steady trend, starting at 19.9 million views and gradually increasing to 24 million views by the year’s end. OANDA followed a similar pattern, beginning at 24.1 million views in Q1 and closing the year at 23.7 million views. Plus500 saw modest growth, rising from 16.1 million views in Q1 to 19.2 million in Q4. These figures suggest a relatively stable market presence for these brokers without dramatic shifts in user engagement. (FIG5)

However, the standout performer was undeniably Exness, whose growth far outpaced its competitors’. Starting with 58.9 million views in Q1, Exness experienced an extraordinary surge to 143 million views in Q2. This growth continued into Q3, with 158 million views, culminating in a remarkable 179.2 million views in Q4.

Such a significant increase highlights Exness as the primary driver of the overall rise in traffic across the FX/CFD sector in 2024. This performance suggests that Exness not only captured a larger share of the market but also likely attracted significant new interest from regions experiencing a surge in trading activity, such as Asia. While the broader market appears relatively steady, the exceptional performance of Exness demonstrates its unique ability to reach new traders, sparking their interest in CFD products.

Future Directons

Possible Future Directions

Based on the 2024 trends, brokers may further focus on expanding their presence in Asia. Countries like India and Thailand have shown significant growth in trading activity. These markets offer vast potential due to their growing economies, increasing digital adoption, and large populations. However, the whole region, together with neighboring Oceania, may be interesting.

In the recent quarter, TMGM and Chelsea Football Club announced a multi-year partnership extension. TMGM became the official regional online forex and trading partner in the Asia-Pacific region. When asked about the rationale behind this decision, apparently one that is already successful, Eloise Croker from TMGM said: “The primary markets TMGM wants to approach with this sponsorship are in the Asia-Pacific region, where it has a strong presence. By utilizing Chelsea’s influence and TMGM’s localized platforms in various Asian languages, the partnership aims to foster deeper connections across the region and expand TMGM’s reach in key financial markets.”

This is not the only broker looking into the Pacific region. Siju Daniel from ATFX revealed: “Sydney and Hong Kong, on the other hand, are key for their strong regulatory standards and access to institutional traders. Australia’s strict regulatory environment helps us attract high-quality clients, both retail and institutional, solidifying our presence in the Asia-Pacific region. Securing the Hong Kong SFC license marked a significant milestone, allowing us to serve professional clients in one of Asia’s top financial hubs.”

However, this is not the only direction brokers explore. Eloise from TMGM also revealed: “In 2025, we look to open new offices in Kenya and Mauritius, which will help us encroach on emerging markets.” Even more details of expansion plans were shared with Finance Magnates by ATFX: “For 2025, we’re focusing on expanding further in Latin America, Southeast Asia, and South Africa while also tapping into the broader African market. These regions show strong potential, driven by increasing demand for reliable trading platforms and greater access to financial markets. In Latin America, the growing interest in forex and CFDs is tied to evolving economic conditions and the search for alternative investment opportunities. Southeast Asia stands out due to its rapid digital adoption and rising financial literacy. Similarly, South Africa presents a promising landscape with its emerging market dynamics and increasing interest in trading, making it a crucial area for growth,” said the CCO of ATFX.

Speaking of Africa, it clearly presents opportunities, with countries like Nigeria and previously mentioned Kenya showing growing interest in trading, supported by expanding digital infrastructure. Additionally, Eastern Europe, including markets like Poland and Czechia, offers potential for steady growth. While traditional hubs in the US and Europe remain important, the focus is likely to shift toward emerging markets that promise rapid expansion and large customer bases.

For this reason, another direction might be South America. The Chief Marketing Officer of Libertex shared interesting observations: “In 2025, our focus remains on Southeast Asia and Latin America, where rising living standards are driving record investment demand. LATAM, in particular, has seen impressive growth, with a 65% increase in revenue and a 40% rise in deposits from Q4 2023 to Q4 2024. The surge in crypto trading and strong performance of energy instruments, especially Henry Hub Natural Gas, present key opportunities. However, rising CPA costs and a dip in new and active users highlight the need for further marketing and engagement optimizations.”

Conclusion

Conclusion

Our analysis and interviews suggest that Asia will remain the dominant region for FX/CFD brokers in 2025, driven by growing digital adoption, expanding economies, and rising interest in trading across the region. Southeast Asia and Oceania, in particular, present significant opportunities. At the same time, emerging markets in Africa and Latin America are becoming increasingly important. While established markets in Europe and the US remain important, the future growth for brokers lies in these dynamic, rapidly evolving new regions.