The Cayman Islands

The Cayman Islands, regulated by CIMA, strengthened its reputable offshore status by launching Phase Two of its VASP (Virtual Asset Service Providers) framework in April 2025. This move integrates digital asset regulation with its traditional SIBL licensing for FX/CFD brokers. The jurisdiction, though pricier than others, offers recognized credibility and access to institutional banking, positioning itself as a hub for both traditional leveraged and emerging digital products.

The Cayman Islands, overseen by the Cayman Islands Monetary Authority (CIMA), remains a recognized offshore regulatory center for the FX and CFD industry, issuing Securities Investment Business Licences (SIBL). On April 1, 2025, CIMA initiated Phase Two of its Virtual Asset Service Providers (VASP) legislative framework, requiring licensing for virtual asset custodians and trading platforms. This development solidifies the Cayman Islands’ appeal for firms offering both traditional derivative products and digital instruments. Although the jurisdiction has slightly higher operating costs compared to non regulated offshore centers, the CIMA license provides significant competitive advantages, including institutional credibility and adherence to strong AML and governance standards. The cost for a SIBL licence varies by category, with major licences such as Broker Dealer, Securities Manager, and Market Maker having an annual renewal fee of CI$10,000 (approximately $12,195 USD).

Overview

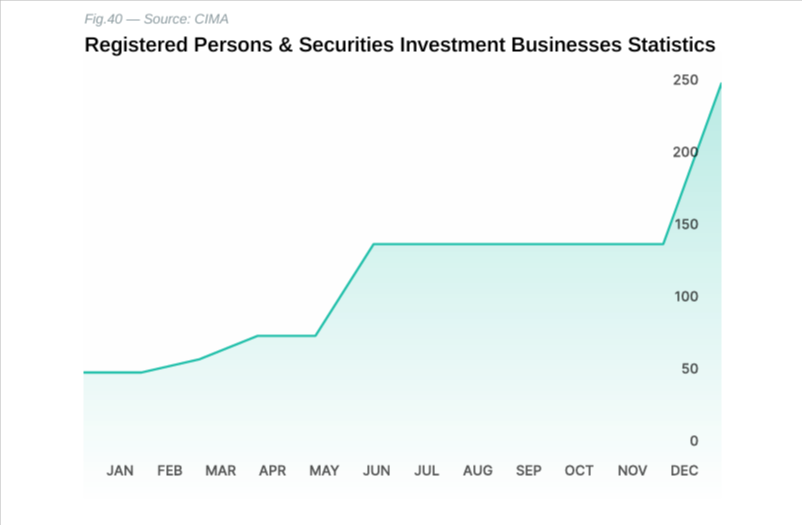

Effective 1 April 2025, the Cayman Islands Monetary Authority (CIMA) launched Phase Two of its Virtual Asset Service Providers (VASP) legislative framework. This is an opportune time to take a closer look at this jurisdiction. The Cayman Islands Monetary Authority (CIMA), one of the more reputable offshore regulators, governs the sector. It issues Securities Investment Business Licences (SIBL) for firms trading in securities and derivatives, including CFDs and Forex. CIMA enforces strong standards in AML, compliance, and governance to uphold market integrity. However, recent years have seen a slight drop in licensees, possibly due to higher setup and operating costs compared to other offshore jurisdictions.

innovation. This positions the Cayman Islands as a potential hub for firms offering both traditional leveraged products like CFDs and emerging digital instruments. The number of registered VASP entities in 2024 was 18

For FX and CFD brokers, the Cayman model offers distinct advantages: a globally recognized offshore license, access to professional banking and payment solutions, and the ability to target a broad international client base. While more stringent than unregulated jurisdictions like SVG, Cayman regulation provides a competitive edge by ensuring credibility with institutional partners and global affiliates

Fees — Securities Investment Business (SIB) Licence

Cayman Islands Monetary Authority (CIMA) License Fee Structure

| Category | Application Fee (CI$) | Grant of Licence (CI$) | Annual Renewal Fee (CI$) | USD Equivalent (Approx.) |

|---|---|---|---|---|

| Broker Dealer | 1,000 | 10,000 | 10,000 | ~$12,195 |

| Broker Member | 500 | 3,000 | 3,000 | ~$3,659 |

| Securities Arranger | 1,000 | 10,000 | 10,000 | ~$12,195 |

| Securities Advisor | 1,000 | 10,000 | 10,000 | ~$12,195 |

| Securities (Restricted) | 1,000 | 5,000 | 5,000 | ~$6,098 |

| Market Maker | 1,000 | 10,000 | 10,000 | ~$12,195 |

Fig 42 — Source: CIMA

Fees — Securities Investment Business (SIB) Licence

| Fee Type | Estimated Amount (based on CIMA practice) |

|---|---|

| Application Fee | CI$ 1,000 – 3,000 |

| Grant of Licence | CI$ 10,000 – 15,000 |

| Annual Fee | CI$ 10,000 – 15,000 |

Fig 43 — Source: CIMA