South Africa

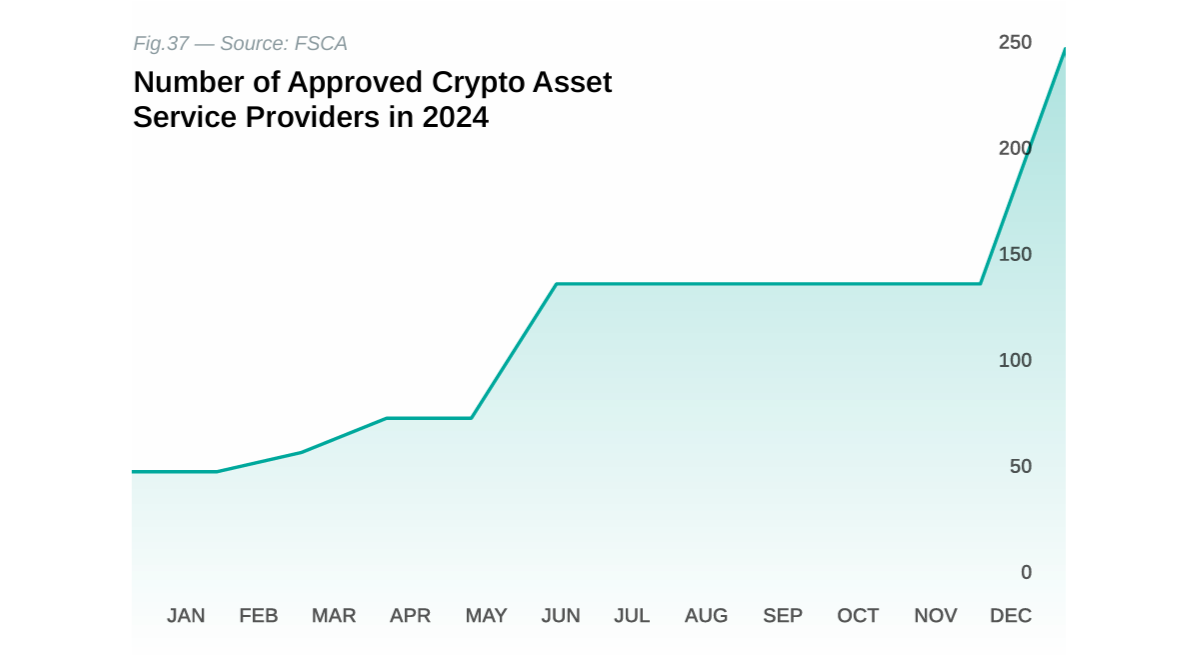

South Africa is a premier FX/CFD hub in Africa, supported by strong FSCA regulation, a $418B forecasted GDP, and 63M people. The country is leading crypto regulation, having licensed 248 Crypto Asset Service Providers (CASPs) since mid 2023, making it a dual market gateway to the continent.

South Africa stands as a major hub for FX/CFD brokers in Africa, leveraging its well developed financial infrastructure and a large, relatively affluent population of 63 million. The market is strictly governed by the Financial Sector Conduct Authority (FSCA), which enforces high standards for market conduct and stability, making it a reliable base for global brokers. In a significant move, the FSCA expanded its focus to the crypto market, having already approved 248 Crypto Asset Service Provider (CASP) licenses since mid 2023, with more under review. This dual regulatory strength in both traditional and digital financial products reinforces South Africa's role as a primary gateway for firms seeking secure and compliant growth across the African continent.

Overview

| Metric | Value |

|---|---|

| Population | 63 Million |

| Forecasted GDP in 2025 | $418 Billion |

| Cost of FSP license for sale | $100,000 |

| Min. operating monthly expenses | $7,500 |

South Africa has long been recognized as a hub for FX/CFD brokers in Africa, offering a unique combination of market potential and regulatory strength. With its well-developed financial infrastructure, a relatively affluent population of 63 million, and strategic location, it has attracted numerous European and global brokers seeking to expand into African markets.

The country’s financial markets are overseen by the Financial Sector Conduct Authority (FSCA), which is known for its rigorous licensing and oversight standards. By ensuring that brokers comply with clear operational and market conduct rules, the FSCA helps establish trust and stability. This has made South Africa a reliable base for brokers entering the region. Recently, the FSCA has turned its focus to the growing cryptocurrency market.

Since introducing crypto asset service provider (CASP) licensing in mid-2023, the FSCA has approved 248 licenses, rejected nine applications, and is reviewing another 56. This significant regulatory activity underscores the country’s role as a leader in Africa for financial innovation and oversight.

For brokers, this dual focus on traditional and digital financial products creates a dynamic environment. South Africa not only serves as a reliable local market but also provides a springboard to access other parts of Africa. Its solid regulatory framework ensures that only compliant firms can operate, offering stability and protecting clients in both FX/CFD and cryptocurrency markets.

As the FSCA continues to license and regulate new market participants, South Africa strengthens its position as both an FX/CFD and cryptocurrency hub. Brokers looking for a secure and regulated environment in Africa find South Africa to be an attractive platform for growth and innovation.