CFD Brokers Had Over 5 Million Reasons to Cash In Record Profits in 2024

As financial markets soared to record heights in 2024, over 5 million thrill-seekers turned to CFD trading, fueling broker stocks to historic peaks and transforming Poland into an unexpected global trading powerhouse of the OTC leveraged instruments.

In 2024, financial markets experienced remarkable activity: the dollar tested century-high levels, gold surged 30% to record peaks, S&P 500 strengthened by 23% to all-time highs, and Bitcoin completed the puzzle by jumping 120% to a record $108,000. In these bullish market conditions, people rushed into investing, attracted by high returns. Unsurprisingly, the past year proved to be a gold mine for retail trading firms, particularly those offering contracts for difference (CFDs).

Over 5 Million People Turned to CFD Contracts

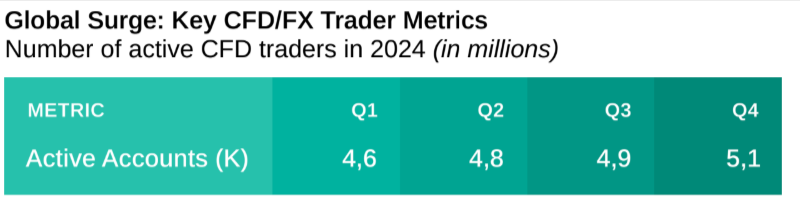

Data collected by Finance Magnates Intelligence shows that throughout 2024, we witnessed record growth in active CFD traders. In the last quarter of the year, the number exceeded 5 million.

This result is particularly significant considering that just two years ago, this figure was over 1.1 million lower. Emerging markets, primarily Asian ones, where market saturation potential remains untapped, were the main contributors to this growth.

The dynamics throughout 2024 were also striking, with the number of traders increasing by more than 500,000, from 4.59 million reported in Q1 to a record 5.07 million in Q4, growing by nearly 11%.

“We saw the CFD industry in 2024 undergo a noticeable shift, shaped by tighter regulations, increased trader awareness, and a more saturated market,” said Charlotte Day, the Director at Contentworks Agency, which works directly with CFD brokers.

“Regulatory pressure forced brokers to move away from gimmicks and embrace a more transparent, compliance-led approach. Our research and experience show that traders, particularly younger demographics, are more research-driven. They are favouring brokers that offer financial literacy tools, trustworthy branding, and consistent educational support.”

The leaders in terms of accounts served were IC Markets, which had 166,000 active traders, and XTB, which managed 555,000 accounts by the end of 2024. Finance Magnates Intelligence data shows that only 7 brokers exceeded the threshold of 100,000 active clients, meaning they capture 25% of the entire market.

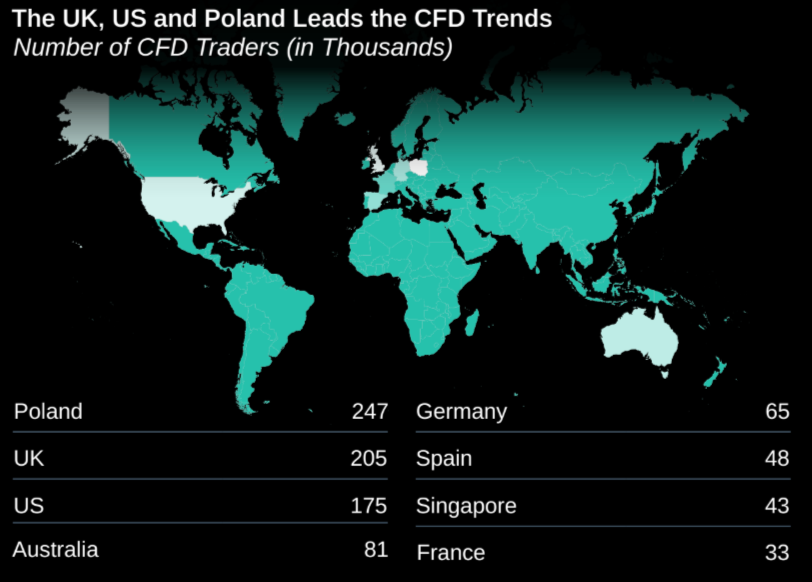

The data provided by XTB is also confirmed by the latest report from the Polish Financial Supervision Authority, which shows that Poland currently leads the CFD market in Europe and likely worldwide.

However, it is important to note that the numbers reported by the Polish broker also include non-CFD accounts, as the company does not disclose detailed figures for CFD accounts alone.

“At XTB, we observed a steady increase in clients' CFD activity in 2024,” commented Filip Kaczmarzyk, Head of Trading, XTB Board Member. “Although most of the clients are onboarded on equities and ETFs, CFD markets still attract new clients especially during periods of increased volatility.”

40% Growth in CFD Traders in Poland in 2024

The number of active investors in the Forex market in Poland increased by 40% in 2024, reaching nearly 117,000 participants, while total losses simultaneously rose by 18% to a staggering 1.29 billion zlotys ($325 million).

When considering all clients of Polish CFD firms, including those abroad, the number of people increases to more than 250,000, and the value of losses exceeds 2.08 billion zlotys ($550 million).

As a result, Poland is currently at the forefront, alongside the UK and United States, among countries where the number of OTC and CFD traders is highest. While these values are shrinking in other countries, Poland is showing clear growth dynamics.

This is likely the "XTB effect," which added 500,000 new clients throughout 2024, increasing its active customer base to 659,000. Although the company attracts most of these people with passive investment offerings in stocks, ETFs, and savings products, once they use xStation, they gain access to CFD contracts, which they evidently use eagerly. These still account for 95% of the publicly traded broker's revenue.

“In 2024, 96% of XTB's revenues are derived from CFDs. However, we are observing impressive growth in stocks and ETPs, with a year-on-year increase of 177%. Notably, stocks and ETFs are the primary asset classes for nearly 80% of our new customers in the EU,” said Kaczmarzyk.

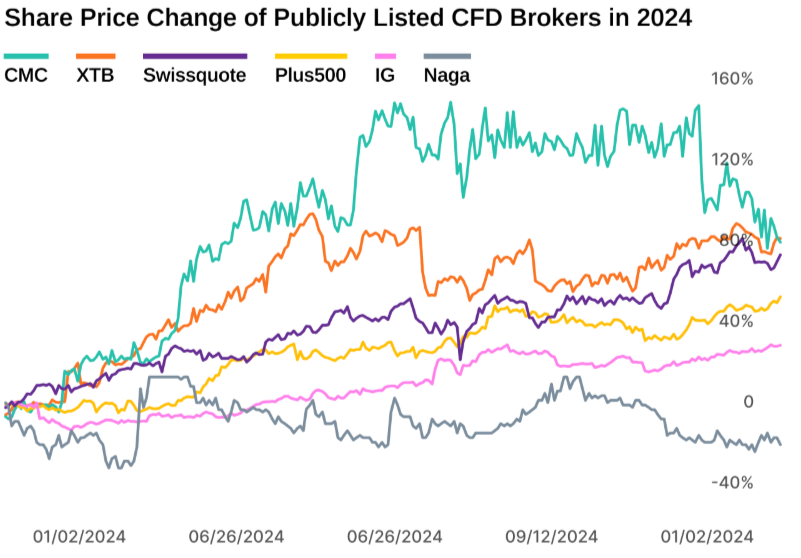

It's no wonder that shares of XTB and other publicly traded brokers reached historic highs in 2024.

CFD Broker Stocks at Record Highs

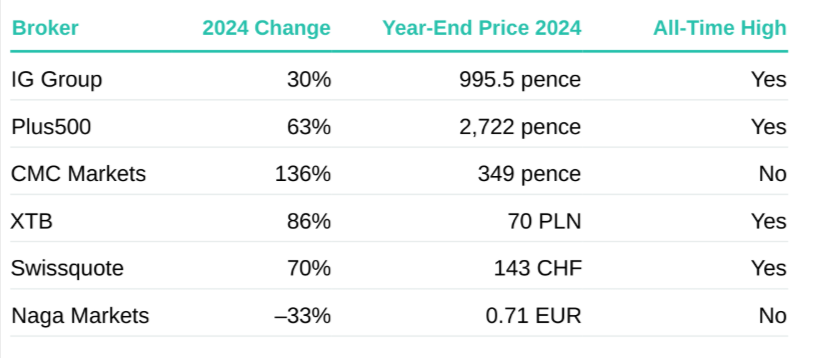

The development of the CFD industry is also reflected in the stock prices of the largest players in this sector. IG Group (LSE: IGG) shares rose by 30% throughout 2024, reaching 995.5 pence, the highest in history.

Plus500 (LSE: PLUS) recorded an increase of almost 63%, testing the level of 2722 pence, while CMC Markets (LSE: CMX) gained a record 136% during the same period, closing the year at 349 pence.

The growth was not limited to brokers listed on the London Stock Exchange. Polish XTB (WSE: XTB) added 86% to its valuation last year and closed the year at a record high of 70 PLN. Swiss-listed Swissquote (SIX: SQN) grew by 70% and closed the year at 143 CHF.

Notably, all of the above, except for CMC Markets, climbed to historic highs and continue their rally in the first months of 2025.

The only exception to this trend is German Naga Markets (XETR: N4G), whose shares are moving close to historic lows. In 2024, they fell by more than 33%, achieving penny stock status and ending the 12 months at 0.71 EUR. In the current year, they are losing another 24%.

Broker stocks rose along with the broader market, but also due to events that fueled volatility and investor activity. Which of these events was the most significant?

“Obviously, the most important event last year was the presidential election in the United States because that event created a broad impact on everything around us, including securities and currencies’ valuations and, ultimately, market trends,” John Murillo, Chief Dealing Officer of B2BROKER commented.

“The United States remains by far the most significant financial market in the world. U.S. has the biggest economy in the world and most underlying assets are based in the U.S. That's why there’s no doubt this was the event of the year. Will I expect any major changes going forward? Well, many things will happen during the next several years, and, most likely, markets themselves will greatly evolve under the impact of these changes,” he added.

But stock prices aren't everything. Let's also look at brokers' financial results and how they changed throughout 2024.

Higher Revenues and Client Growth

In terms of revenue, most companies recorded year-on-year growth. Swissquote emerged as one of the strongest performers, increasing its revenue by 30.1 percent to CHF 530.9 million, driven by the strength of its diversified fintech offerings. CMC Markets also posted notable gains, up 15.4 percent, reflecting the continued expansion of its B2B and investment platforms. IG Group reported an 11 percent increase in revenue, reaching £522.5 million, as improved revenue per client offset the stagnation in client numbers.

“CFDs are similarly geared into the growing popularity of stock trading – they provide an alternative way of gaining exposure to the same underlyings,” said Martin Price, Head of Investor Relations at IG Group.

Not all brokers, however, saw positive top-line trends. XTB experienced a significant revenue contraction of 24.2 percent, falling to PLN 1.1 billion, following an exceptional 2023 marked by elevated trading volumes. Similarly, NAGA's revenue dropped 19.6 percent to €62.3 million amid a year of operational transition, including its merger with CAPEX and a shift toward platform unification.

For XTB, client acquisition metrics were much more important. The total number of clients exceeded 1 million, and the number of active clients reached 658,000, putting the Polish fintech at the forefront in this regard. Plus500 significantly expanded its customer base, with new client numbers rising nearly 30 percent to over 118,000 in 2024. Meanwhile, IG Group's new and active client figures remained virtually unchanged year-on-year, suggesting either a mature client base or a strategic emphasis on client quality over quantity.

“IG reported a 2% increase in Group-wide active clients in the first nine months of FY25 relative to the prior year period,” Price commented.

Brokers Summarize 2024

Finance Magnates Intelligence conducted a survey among popular CFD brokers, asking them about key financial indicators throughout 2024. Early indications from leading CFD brokers point to a stable but cautiously expanding market environment in 2024, with firms reporting client growth, moderate revenue gains, and disciplined spending strategies.

“From our standpoint as a financial marketing agency, 2024 was a year of maturity for the CFD sector,” added Day. “While some brokers found it difficult to pivot, those that leaned into compliance and content-driven marketing emerged stronger. Thriving brokers still want acquisition of course, but their approach is more measured.”

Most respondents indicated a significant increase in active clients in 2024, suggesting that retail investor engagement remained elevated despite a more volatile macroeconomic backdrop. This trend supports observations that, while retail activity has cooled from its 2020–2021 peaks, demand for leveraged products like CFDs remains resilient.

More clients also mean higher costs, and respondents noted a slight increase in their overall budget, which includes areas such as marketing and operations. However, operational costs remained stable, indicating careful resource allocation and cost discipline.

When asked about CFD revenues, respondents indicated they either "increased significantly" or "increased slightly." CFD brokers may have benefited from a mix of range-bound indices, forex volatility, and retail rotation into commodities, all of which are commonly traded via CFDs.

Which instruments turned out to be the most popular outside of CFDs? All equity-based ones - both real stocks and derivatives such as options and futures linked to the stock market.

“Our goal is to offer our customers the best possible product range to accommodate their diverse risk appetites. CFDs have a distinctly different risk profile and present unique opportunities compared to stocks,” said Kaczmarzyk. “During turbulent market conditions, we observe that our clients actively seek various investment options across many asset classes.”

What Will 2025 Bring for the CFD Industry?

The online trading industry is entering 2025 with a mixed outlook, as firms prepare to navigate both rising market opportunities and persistent threats. Price of IG Group emphasized the company's strategic focus in response to emerging market conditions.

“Our focus is on closing product gaps and enhancing our existing product range/UX in response to customer demand. This will be necessary to grow active users and take market share,” he said. IG is betting on user experience and product innovation to drive engagement in an increasingly crowded landscape.

According to Kaczmarzyk from XTB, market unpredictability remains a double-edged sword. “Volatility can be both a threat and an opportunity,” he said, pointing to global uncertainty driven by U.S. politics and tariffs. While such volatility may unsettle markets, it also fuels trading activity - creating openings for agile platforms.

Kaczmarzyk noted a growing trend that bodes well for platforms focused on long-term value. “An opportunity for companies like XTB lies in the increasing interest in investing overall, particularly in long-term investments, whether for retirement or to take advantage of favorable taxation,” he said. This shift could help platforms diversify beyond short-term trading and attract more stable, recurring users.

The crypto sector also remains another promising frontier. Brokers are closely monitoring developments around the Markets in Crypto-Assets (MiCA) regulation. Regulatory clarity could unlock new products and bring more mainstream investors into the fold.

In a year where financial markets soared to dizzying heights, CFD trading became the roller coaster ride of choice for over 5 million thrill-seekers in 2024. As brokers like XTB and IC Markets raked in clients faster than a Bitcoin rally, their stocks climbed to historic peaks, which apparently forgot to read the "stonks only go up" memo. Brokers are now eyeing 2025 with the cautious optimism of a cat that's spotted an unattended fish tank, preparing to navigate market volatility, regulatory changes, and the looming shadows of fintech giants like Revolut and Robinhood, who are circling the profitable CFD waters.