Are Tokenized Stocks Coming for Your CFD Business? The $700 Million Problem Brokers Cannot Ignore

Tokenized stocks represent a fundamental shift in equity access, growing into a $700M market that is doubling annually. They pose a significant threat to CFD brokers by offering synthetic stock exposure with crypto benefits (24/7 trading, instant settlement, borderless access) via blockchain technology. Major platforms like Robinhood and exchanges like Kraken are already entering the space, forcing traditional brokers to adapt to this rapidly growing sector or risk being left behind by crypto native traders.

Tokenized stocks have rapidly evolved into a 700 million dollar market, doubling in size annually, creating a major disruption for CFD brokers who specialize in synthetic stock exposure. Tokenized stocks are digital representations of traditional equities issued on a blockchain and backed by a licensed custodian holding the underlying share. They offer similar benefits to CFDs, such as synthetic exposure and fractional ownership, but add crucial crypto native features like 24/7 trading, instant settlement, and borderless access via blockchain wallets. This technology is gaining mainstream traction, with major institutions like BlackRock and JPMorgan investing heavily, and platforms like Kraken and Robinhood actively offering the products. Robinhood’s CEO, Vlad Tenev, has stated that "tokenization is going to eat the entire financial system." Although the market is still small compared to the broader financial industry, its explosive growth and adoption by large exchanges pose an existential threat to traditional brokers who must quickly integrate this technology to remain competitive with the crypto native trading community.

Overview

Tokenized stocks have quietly evolved from a crypto curiosity to a $700 million market that’s doubling annually. Major exchanges like Kraken are seeing $300 million in trading volume within weeks, while platforms promise 24/7 access and fractional ownership. The question is no longer whether tokenization will disrupt synthetic stock trading, but how quickly traditional brokers will adapt before they’re left behind. eToro and Robinhood have already realized this. What about you?

Cryptocurrency exchanges and traditional brokerages alike are racing to offer digital versions of Apple, Tesla, and thousands of other stocks. These aren’t just wrapped derivatives or clever marketing tricks. They represent a fundamental shift in how equities can be accessed, traded, and integrated into the broader financial ecosystem.

For CFD brokers who have built empires on synthetic stock exposure, the rise of tokenized equities presents both opportunity and existential threat. The technology promises 24/7 trading, instant settlement, and borderless access: features that sound remarkably similar to what contracts for difference already provide, except now they’re packaged in blockchain wallets that speak directly to a new generation of crypto-native traders.

As institutional players like BlackRock and JPMorgan commit billions to tokenization infrastructure and retail platforms report explosive growth, the question facing traditional brokers is no longer whether tokenized stocks will matter, but how quickly they’ll need to respond.

Tokenization Meets Equities

The idea of tokenizing real-world assets (or RWAs), converting claims on tangible or financial instruments into cryptographic tokens on a blockchain, has been widely discussed for years.

The landscape, however, shifted dramatically in 2024 and accelerated through 2025, with tokenized stocks emerging from niche experimentation into mainstream adoption across cryptocurrency exchanges and more traditional brokerage firms alike.

They are digital representations of equities issued on blockchains, and each token is backed by a corresponding share held by a licensed custodian. The tokens track the price of the underlying stock and can be traded on cryptocurrency exchanges or decentralized finance (DeFi) platforms.

Unlike traditional shares, however, most tokens do not confer shareholder rights such as voting or dividends. As a result, regulators and traditional exchanges have warned that tokenized equities might blur the lines between genuine stock ownership and synthetic derivatives.

Retail traders don’t seem to mind. At least not yet. Experts argue that if the current growth rate continues, tokenized equities could become serious competition for stock CFDs, which represent an increasingly significant market share and growing source of revenue for a rising number of retail brokers.

Robinhood is one of the most vocal advocates of this solution, and the founder and CEO of the zero-fee trading giant has repeatedly stated that “tokenization is going to eat the entire financial system,” most recently at the Token2049 Singapore conference in October.

“It really starts to get interesting when all of those assets, public and private, get on crypto technology,” Vlad Tenev added. Robinhood has been offering tokenized equities since early summer, which immediately drew a response from regulators. Despite this, the market continues to grow rapidly.

Rapid but Still Small Market

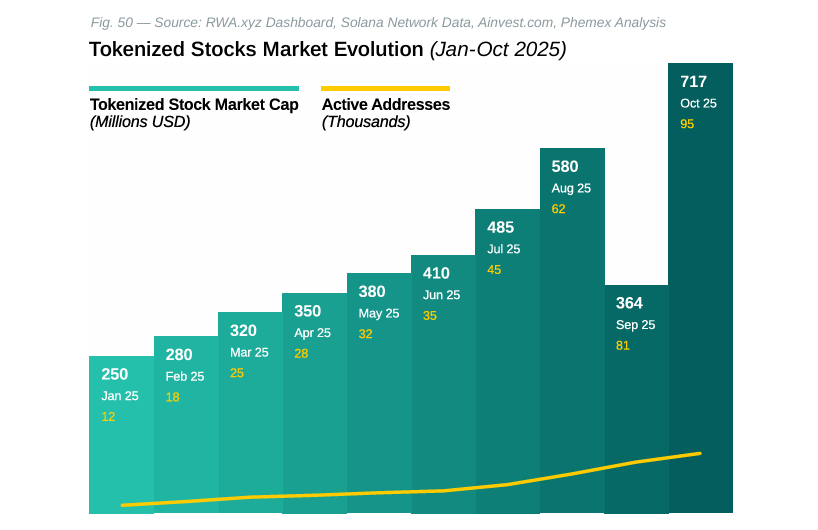

The market for tokenized stocks remains modest but is expanding quickly. Real-world asset (RWA) platform RWA.xyz estimates that the value of tokenized stocks reached around $717 million in October 2025.

Although this is a minute fraction of the broader tokenization universe, estimated at roughly $25 billion, the stock segment has doubled within a year. Monthly transfer volume surged to $480 million in September 2025, with almost 34,000 active addresses and 81,000 holders, signalling that engagement is growing even if still nascent.

A handful of platforms dominate issuance: Ondo Finance accounts for roughly $302.9 million, Securitize $249.6 million, Backed Finance $81.6 million, Archax $55.4 million and WisdomTree around $22.1 million. These figures underscore rising institutional involvement even though tokenized equities are minuscule compared with the trillions traded in conventional stock markets.

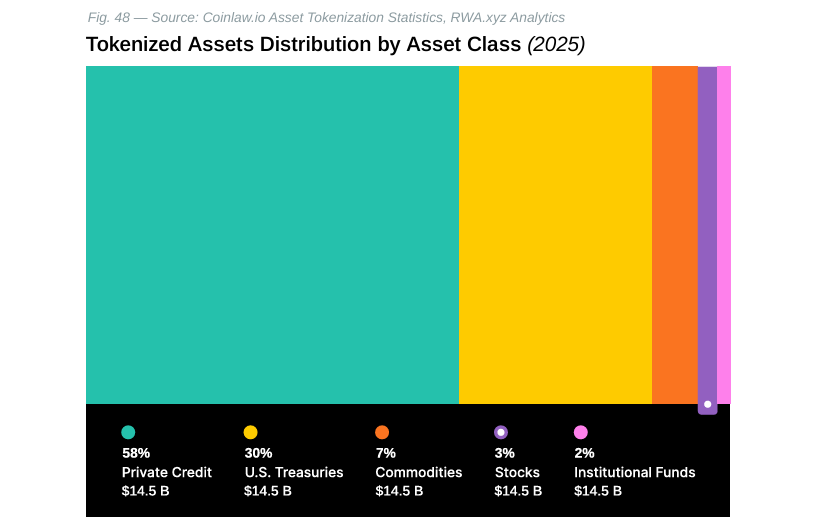

The most popular asset classes undoubtedly remain private credit and U.S. Treasuries, which currently constitute the majority of the tokenized market. However, equities have the greatest potential when it comes to retail trading, and they’re gaining significance with each passing month, although they currently account for 3% of total market share.

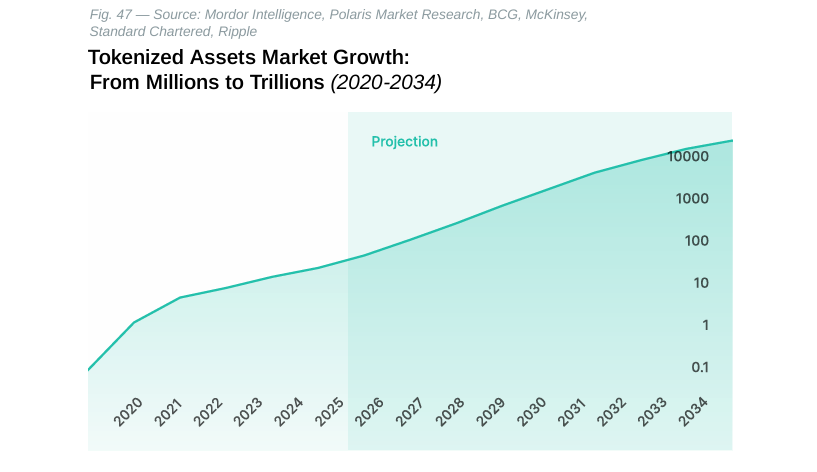

Industry projections suggest this is merely the beginning of a multi-trillion-dollar transformation. McKinsey estimates the tokenized market could reach $2–4 trillion by 2030, while more aggressive projections from Ripple and BCG forecast $18.9 trillion by 2033. Standard Chartered’s long-term outlook anticipates the market reaching $30 trillion by 2034.

Growing Participation of Institutional and Retail Players

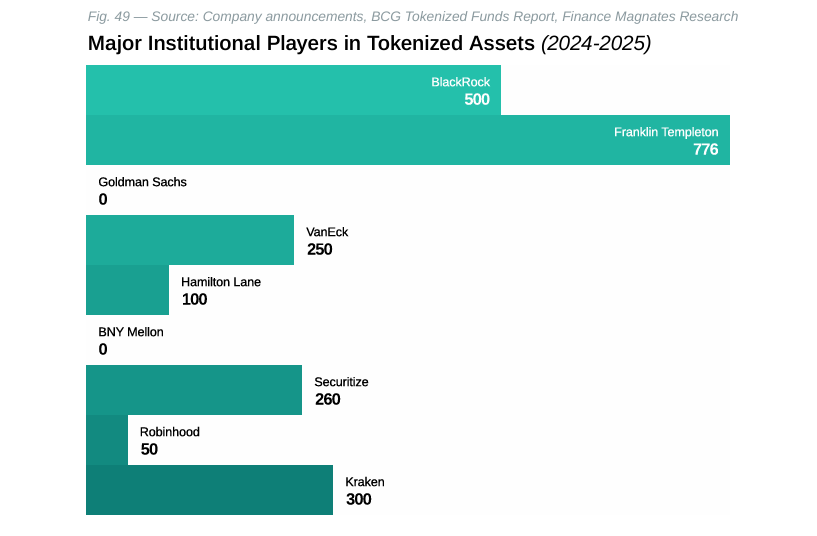

Major financial institutions have moved beyond pilot programs into full-scale deployment of tokenized offerings. BlackRock’s BUIDL fund has attracted over $500 million in assets under management, establishing itself as the largest tokenized asset fund globally. Franklin Templeton’s BENJI fund follows with $776 million, while VanEck’s VBILL provides multi-blockchain access to U.S. Treasury bills.

JPMorgan’s Kinexys network has processed $1.5 trillion in tokenized transactions by end-2024, demonstrating institutional-scale adoption. Goldman Sachs is preparing three tokenized products for rollout by year-end 2025, while partnerships between established firms like BNY Mellon and Goldman Sachs signal broad industry acceptance.

The institutional landscape includes over 119 active issuers tokenizing diverse asset classes, serving 81,304 tokenized asset holders. This institutional endorsement provides critical validation for the technology’s viability and regulatory compliance.

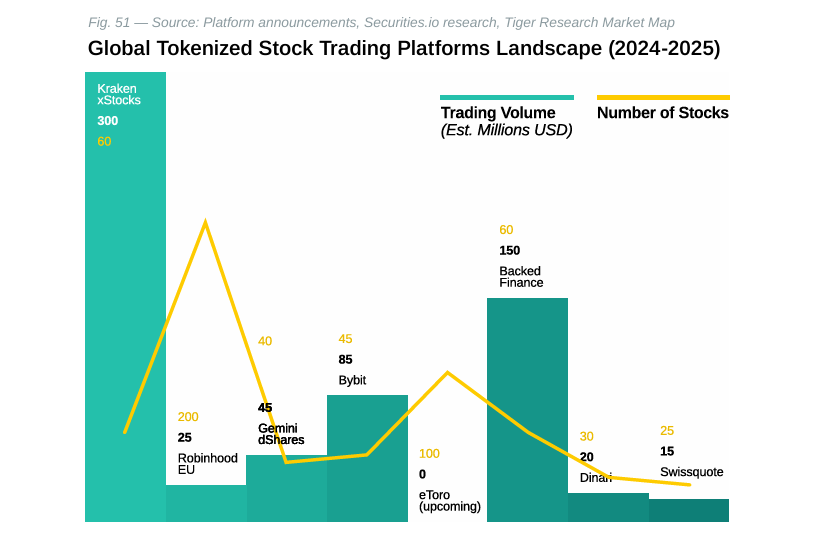

In retail trading, cryptocurrency exchanges have become the primary venues for tokenized stock trading, with major platforms launching comprehensive offerings throughout 2024 and 2025. Kraken’s xStocks platform, developed in partnership with Backed Finance, achieved over $300 million in trading volume within four weeks, demonstrating significant market appetite.

Retail brokerage Robinhood rolled out a pilot allowing European customers to trade more than 200 U.S. stocks and ETFs via the Arbitrum layer-2 network and signaled plans to tokenize shares of private companies such as SpaceX and OpenAI. Meanwhile, eToro announced that it would issue ERC-20 tokenized shares, aiming for a fully twenty-four-hour market. Fintech startup Dinari introduced FINRA-approved dShares, and Gemini integrated these tokens via a partnership.

In early October, self-clearing broker-dealer Alpaca introduced the Instant Tokenization Network, which allows institutions to perform “instant in-kind minting and redemption of traditional brokerage-held stocks to their various tokenized counterparts, 24/7.” The project also involves xStocks, Ondo Finance, Dinari, and DRW, some of the most prominent blockchain brands in the tokenization market. The entire system is designed to run on Solana.

Traditional market operators have also stepped in: Nasdaq submitted a proposal to the U.S. Securities and Exchange Commission seeking permission to list tokenized securities on its exchanges, highlighting the seriousness with which mainstream finance is now treating the sector.

Why the Appeal?

Tokenized stocks attract interest for several reasons. They are available for trading beyond traditional exchange hours, with some platforms offering twenty-four-hour or at least twenty-four-five access. This constant availability appeals to retail investors across different time zones and aligns with the always-on ethos of cryptocurrency markets.

Another lure is fractional ownership: tokens can represent fractions of a share, lowering the threshold for participation. Although many traditional brokers already allow fractional shares, tokenization embeds this capability directly into blockchain wallets and DeFi applications, making it more seamless for crypto-native users.

The technology also offers fast settlement, as transactions recorded on blockchains are near-instant. This reduces counterparty risk and enables tokens to be used as collateral in DeFi protocols, potentially supporting innovative strategies like real-time portfolio rebalancing.

Finally, tokenized stocks transcend geographic barriers because they are not tied to a specific brokerage account. Investors simply need a crypto wallet and access to a participating platform to trade or transfer them, broadening cross-border participation.

Despite these benefits, tokenized stocks remain experimental and raise potential risks, at least according to regulators.

Concerns Over Investor Protection

The World Federation of Exchanges (WFE) and major stock exchanges have urged regulators to clamp down on tokenized equities. They argue that tokens mimic equities without offering the same rights and protections, creating new investor risks and potential harm to market integrity. The WFE called for securities laws to be expanded to…

…cover custody, disclosures and marketing of these instruments.

The European Securities and Markets Authority (ESMA) echoed similar concerns. Executive director Natasha Cazenave warned that tokenized instruments provide “always-on access and fractionalization but typically do not confer shareholder rights,” which can lead to investor misunderstanding. She emphasized the need for clear communication and safeguards, noting that most initiatives remain small and illiquid.

U.S. regulators have been cautious. SEC commissioner Hester Peirce said tokenized securities are still securities and cannot circumvent existing laws. Nasdaq’s proposal stresses that tokenized securities must “have the same material rights and privileges” as traditional shares and that the exchange will treat them as separate instruments if those rights are not present.

Critics argue that tokenized stocks are essentially synthetic wrappers rather than true equity and that they resemble CFDs. Anton Golub, Chief Business Officer at Freedx, has described tokenized stocks as “a wrapper… not real equity” because holders rely on issuer promises and custody arrangements without direct recourse to underlying shares.

“No market maker can hedge exposure on Saturday or Sunday,” Golub said. “That means there is no liquidity and you’ll be quoted a fake price with wide spreads.”

He and others note that while tokenization is marketed as democratizing access, European CFD brokers have offered fractional shares and leverage for years, so the innovation lies more in packaging than substance.

Not everyone, however, agrees with this view.

CFD Brokers Should Stay Alert

Some CFD brokers are exploring tokenized stocks as a way to diversify their product suite and appeal to younger, crypto-savvy clients. Charlotte Day, director at Contentworks Agency, explained that at her…

agency they see tokenized stocks as “both an exciting innovation and a direct challenge to the established CFD industry.” From a marketing perspective, Day observed that the race for Google dominance around tokenized stock keywords has already begun, reflecting growing interest among CFD broker clients. For brokers, tokenization offers “a new avenue for product diversification and to reach a fresh new audience,” she said.

However, the lack of liquidity, potential regulatory whiplash, and operational challenges of managing custody and hedging make tokenized stocks a risky proposition. CFDs for now remain a better understood and more tightly regulated way to trade equities synthetically.

Another voice shaping the debate comes from Arkadiusz Jóźwiak, an analyst, financial journalist and editor-in-chief of financial media outlet Comparic.pl. He stresses that tokenized instruments are unlikely to compete with real stock trading because holders do not receive shareholder rights or dividends, but he contends that they could dramatically reshape the CFD market.

In Jóźwiak’s view, the crucial variable is leverage: if tokenized equities end up offering greater leverage than standard CFDs, he argues that “we’re looking at nothing short of a seismic revolution in retail trading accessibility and risk dynamics,” potentially democratizing high-stakes opportunities for everyday investors while forcing traditional brokers to innovate or be left behind.

Jóźwiak also provides historical context on the convergence of crypto and equities. During the 2016–2017 period, he recalls, crypto enthusiasts and stock traditionalists were at odds. Bitcoin was derided as a scam, while crypto advocates mocked stocks as relics. The bull runs of 2017 and 2021 minted crypto millionaires who subsequently diversified into technology stocks, dividend payers and emerging markets to spread risk.

Meanwhile, Wall Street veterans began to view crypto as legitimate, embracing futures and exchange-traded products tied to Bitcoin. As a result, capital flowed predominantly from crypto into equities rather than the other way around.

In this context, tokenized stocks fit crypto natives “like a glove,” blending borderless access and leverage to fuse markets into one alpha-chasing arena, according to Jóźwiak.

Threats and Challenges

Several factors could hinder the widespread adoption of tokenized stocks among CFD brokers. One is the potential cannibalization of existing CFD volumes. Because tokens offer similar synthetic exposure without the leverage caps imposed on regulated CFDs, they may attract retail traders seeking constant access and fluid transfers, drawing volume away from stock CFDs and appealing especially to younger, crypto-savvy investors.

Another issue is regulatory uncertainty. Brokers that add tokenized stocks to their product lineup confront ambiguous rules and may eventually need to meet the same disclosure and investor-protection standards required for securities. Compliance costs are likely to rise as a result.

Operational complexity adds to the challenge. Managing on-chain custody, securing digital wallets and building cross-chain integrations require technical expertise, and maintaining adequate liquidity during off-hours will demand new market-making capabilities to avoid wide spreads and unhedged positions.

Counterparty risk and trust remain central concerns: even when brokers partner with reputable issuers, clients are exposed to the custodian’s integrity. The collapse of several crypto intermediaries in recent years has heightened skepticism and underlines the need for rigorous due diligence and robust client education.

Outlook for Brokers

Despite the challenges, tokenization could become a significant complement to CFD offerings rather than a wholesale replacement. Nascent initiatives from eToro, Robinhood and Kraken show that brokers see potential for new revenue streams and user acquisition.

If regulatory clarity improves and market infrastructure matures (for example, through Nasdaq’s proposal or the EU’s DLT pilot), tokenized stocks could be offered in a regulated environment alongside CFDs. For now, CFD brokers should monitor developments closely, educate clients on the differences between tokens and CFDs, and consider pilot programs in jurisdictions with clear rules.

"It's a wrapper. It's not real equity."

"When it comes to CFDs, tokenized stocks could very well shake things up."

"If the tokenization trend continues and matures, the pressure will be on CFD brokers to adapt or risk losing ground."

"Tokenization is going to eat the entire financial system," quote from Token2049 Singapore.