100 Prop Firms Fold, But One Buys Major FX Broker

Despite MetaQuotes abandoning the sector in February 2024, the industry grew by 1,264% over the past decade, with established brokers like ATFX launching their own prop trading platforms and 300,000 traders adapting to new multi-platform trading environments.

The prop trading numbers tell a story of an industry in flux: platform monopolies crumbling, 80-100 firms shuttering their doors, challenge pass rates dropping, and average trader investments cut in half. Yet beneath these turbulent shifts, a more resilient and sophisticated market has emerged – one where the biggest players are sitting on cash reserves and are able to acquire formerly leading brands in the FX/CFD sector.

Only few sectors in the world of financial markets experienced as dramatic a transformation in 2024 as prop trading. As hundreds of thousands of traders navigated platform changes, firm closures, and evolving market dynamics, a new industry landscape emerged—one that would forever change how retail traders approach the markets.

The catalyst for this transformation wasn't a market crash or regulatory crackdown, but rather a single decision that sent shockwaves through the industry.

"The most impactful event was MetaQuotes' decision to not actively and/or openly support prop trading firms," reveals Justin Hertzberg, the FPFX Tech CEO and Founder in an exclusive interview with Finance Magnates. This watershed moment triggered a cascade of changes that would reshape the entire prop trading ecosystem.

We have hard data based on 300,000 prop trading accounts, revealing how the industry transformed throughout 2024. Let's check them together.

The Dawn of Multi-Platform Trading

The MetaQuotes exodus from February 2024 created an unprecedented opportunity for alternative platforms. cTrader, DXtrade, MatchTrader, and TradeLocker rushed to fill the void, transforming what was once a near-monopoly into a vibrant, competitive marketplace. This diversification proved to be a blessing in disguise, removing what the FPFX Tech CEO describes as "one of the single points of failure for prop firms."

The numbers, provided by FPFX Tech and based on data from 300,000 proprietary trading accounts, tell a compelling story of adaptation. While 10% of traders now maintain relationships with multiple firms, the average trader's portfolio has expanded from 2.2 to 2.5 firm relationships in 2024. This shift represents more than just diversification – it's a fundamental change in how traders approach risk and opportunity.

"Given the short life span of a retail trader and the explosive growth of the prop trading space, hundreds of thousands of traders are learning on or simply being forced to trade with platforms other than MT4/5,"Hertzberg added.

James Glyde, the CEO of the prop trading firm PipFarm, takes the same position, stating that "MetaQuotes did a huge favor for their competitors." He adds that the creators of MetaTrader denounced the prop trading challenge model. "This was hugely helpful for the firms that retained their licenses and created a never-before-seen platform boom, greatly benefiting cTrader, TradeLocker, MatchTrader, and DXtrade," Glyde remarked.

However, data provided to Finance Magnates by PipFarm suggests a different outcome, at least for now. Despite the industry's recent platform diversification, MetaTrader 5 remains the dominant choice, commanding 61.9% of trader preferences. Interestingly, traders are willing to invest in quality – 53.7% would pay an additional 20 dol. for access to a premium trading platform, suggesting a market that values reliability over cost-cutting.

The Great Consolidation

As the industry matured, it underwent a brutal process of natural selection. Approximately 80 (or even 100 according to ATFX) firms closed their doors in 2024, a trend that shows no signs of slowing. "I expect many more prop firms to close, cease or halt operations and/or find themselves on the wrong end of lawsuits and social media attacks," warns the FPFX Tech CEO. This consolidation, while painful for some, is strengthening the industry's foundation.

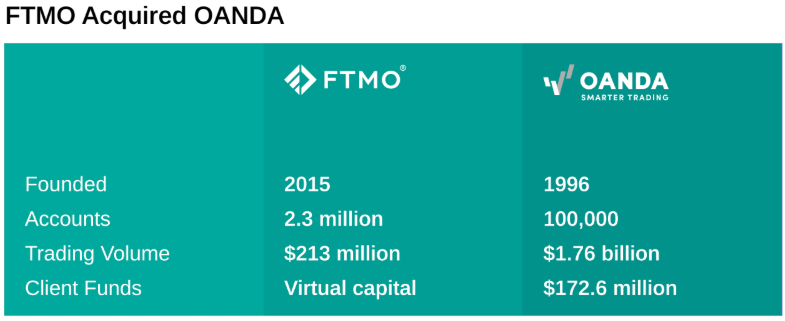

One of the sector's current leaders, the Czech-based FTMO, spoke earlier in 2023 about industry consolidation.

- In a conversation with Finance Magnates, its founders predicted that three players would seize 80% of the market.

- Now, FTMO CEO Otakar Suffner and CTO Marek Vasicek appear to be accomplishing what previously seemed impossible: acquiring OANDA - a broker that has operated in the FX/CFD market for years and was until recently regarded as one of the industry's giants.

Despite having operated for less than a decade, FTMO is far from a fly-by-night company. It closed out 2023 with 82 million dol. in free cash, which presumably helped finance the purchase of OANDA, valued at 175 million dol. in 2018. The acquisition was completed on December 1, 2025, after securing approvals from five regulatory bodies in a process that took approximately eight months.

The geographical distribution of traders also reveals consolidation, with the United States commanding 20% of the market share, followed by Great Britain at 10%. Emerging markets, particularly India and Uzbekistan, have established themselves as significant players, demonstrating the industry's increasing democratization. According to PipFarm's take on emerging markets, Nigeria leads with 10.7% of respondents, followed by Indonesia (9.8%) and Russia (8.9%).

The one thing that is not changing, however, is the industry's demographic profile: it remains predominantly male (78%) and youthful, with 73% of traders under 35.

Which Country Has the Most Prop Traders?

| Country | Market Share |

|---|---|

| USA | 21% |

| UK | 11% |

| India | 5% |

| Germany | 4% |

| Canada | 4% |

| Italy | 4% |

| Czechia | 4% |

| Thailand | 4% |

| Turkey | 4% |

| Spain | 4% |

The Economics of Modern Prop Trading

Perhaps the most striking evolution is in the financial dynamics. The average trader investment in challenges has plummeted from 800 dol. to 400 dol., while success metrics tell an intriguing story. Challenge pass rates have declined from 14% to 12%, yet overall payout achievement has improved from 7% to 8%. This suggests a more efficient market where quality prevails over quantity.

What stood out in 2024 - and ranks as the third most important event in the industry after MetaQuotes' move and FTMO's acquisitions - was the large-scale entry of FX/CFD brokers, who recognized a major business opportunity. Hantec, IC Markets, and AXI each operate their own brokerage brands, just like the newly acquired OANDA. Recently, one of the brokers with the highest trading volume, ATFX, joined their ranks by launching ATFunded in December 2024.

"We built ATFunded to feed the AT ecosystem. There are traders who have needs that can be met by all of our services and Prop is just one faction of that," said Siju Daniel, the Chief Commercial Officer of ATFX. "By adding ATFunded to our arsenal we have now increased our service offering to our already world class brokerage services. We look forward to bringing future products to market and engaging more with traders world wide."

An increasing number of cryptocurrency-focused prop trading firms has also been emerging. In 2024, Crypto Fund Trader entered the market, and Hydra Funding expanded its offering to include digital assets. Although this segment is still in its infancy, experts believe it may have a promising future.

"Crypto plays a small role and there are still opportunities for trading cryptocurrencies, with strategies from buy to hold and short term HFT that make it portable into the prop trader's toolkit," commented Paul Howard, the Director of digital asset company Wincent.

But why prop trading? Of course, due to its popularity. However, there are also three other important reasons. Faced with suffocating EU regulations that squeezed their retail business model, financial companies discovered a clever workaround in prop trading. The move wasn't just about dodging regulatory hurdles – it opened up lucrative new revenue streams through challenge fees and profit-sharing, tapping into an industry that grew by a staggering 1,264% in less than a decade.

With established brokers launching their own prop trading brands, the move became necessary to remain competitive. These broker-backed prop firms gained immediate credibility due to their regulatory oversight and established operational structures, with nearly 60% of prop traders preferring them over independent firms.

The Future Landscape

Looking ahead, the FPFX Tech CEO offers a sobering perspective: "The end-consumer is getting smarter and exploiting vulnerable prop firm operators to the point that prop challenges conditions will likely be tightened."

The myth of scaling plans has also been exposed, with recent data revealing them as "more marketing gimmick than practical application." This reality check may represent a broader industry trend toward transparency and sustainable business models.

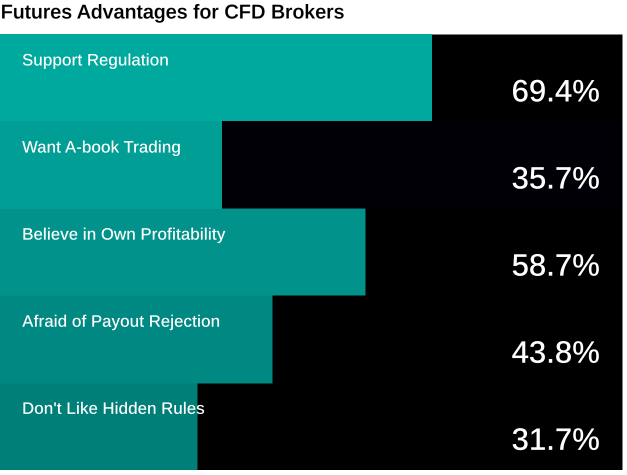

An overwhelming 69.4% of traders believe prop firms should be regulated, signaling a growing demand for industry oversight. This sentiment isn't just about basic protection – traders specifically want comprehensive reporting obligations, transparency requirements, and established business conduct standards. The industry appears ready to shed its "wild west" image in favor of a more structured approach.

"In 2025, we will see a series of significant but necessary changes in the prop trading market," forecasted the PipFarm CEO. "Overcompetition caused the industry to push prices and rules to the absolute limit, giving traders and cheaters far too much of an edge in this model. This mistake has wiped out many participants and caused much collateral damage."

"However, what firms want and what traders accept are two different stories. Could it be time limits, consistency scores, profit caps, trailing drawdown, buffers, or something else?"

As we move deeper into 2025, the prop trading industry stands transformed. The days of platform dependency and unsustainable business models are fading, replaced by a more resilient, diverse, and sophisticated ecosystem.

ATFX's Siju also stays "bullish on prop in 2025." He thinks that "prop trading is just one element of retail trading, its a new part of an ever growing ecosystem. Its up to us as providers to come up with ways to make it a win win between company and trader. There is room for Prop, brokerage, education and more in this ecosystem."

For those who can adapt to these changes, the opportunities have never been greater. The great prop trading reset of 2024 wasn't just a period of change – it was the birth of a new era in retail trading.