The core proposal is deceptively simple yet profoundly disruptive: regulate products based on their risk profile, not their label. CFDs, leveraged ETPs, margin lending, structured products, and crypto proxies would face consistent treatment across disclosure, appropriateness testing, and consumer access. For an industry built around product-specific carve-outs, this represents a fundamental philosophical shift.

When 80% Lose Money, Regulators Take Notice

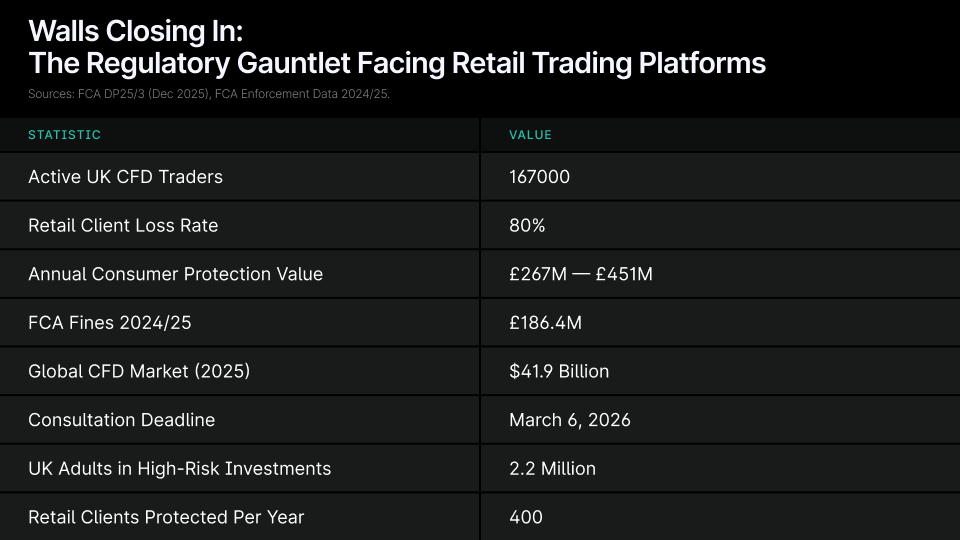

The UK CFD market is contracting but intensifying. Active leverage traders fell to 167,000 in 2025, down from 173,000 the previous year, according to Investment Trends. Yet dormancy rates hit a five-year low, suggesting a smaller but more engaged cohort. Meanwhile, retail loss rates remain stubbornly high - approximately 80% of CFD customers lose money, with broker-reported figures ranging from 46% to over 80%.

The FCA's existing leverage caps and negative balance protections prevent nearly 400,000 clients annually from risking more than their stake, delivering consumer protection valued between £267 million and £451 million per year. Against this backdrop, enforcement actions have surged. FCA penalties jumped 337% year-over-year to £186.4 million in 2024/25.

.png)

Five Regulatory Time Bombs Ticking Down

The discussion paper targets five distinct areas that should keep compliance officers awake at night:

Speculative product harmonization sits at the center. A CFD on the FTSE 100 and a leveraged ETP tracking the same index currently face different disclosure requirements despite exposing consumers to comparable risks. The FCA sees this as regulatory arbitrage waiting to happen.

Digital engagement practices are under scrutiny. Leaderboards, push notifications, streak rewards, and default investment amounts can nudge users toward riskier behavior. A 2025 Cambridge University study found that 58% of demo-mode CFD apps positioned risk warnings at the bottom of screens, with 26% using smaller fonts.

Financial promotion rules inherited from EU-era law create what the FCA describes as a "complex and unwieldy framework". A reclassification exercise could shift where CFDs sit in the promotional hierarchy, potentially triggering stricter marketing restrictions.

Appropriateness testing remains the key friction point in client onboarding. The regulator is asking whether current tests create barriers disproportionate to risk or fail to prevent unsuitable sales. The answer will determine whether ESMA-style rotating questions and mandatory cool-off periods become the UK standard.

Consumer Duty integration poses the philosophical question: when principles-based obligations already require good outcomes, are specific prescriptive rules redundant or essential?

The Price Tag: From £640K to £2.65M Per Broker

According to Finance Magnates Intelligence estimates, a three-scenario cost model projects the financial impact on mid-size brokers handling 20,000 to 80,000 active UK clients. Under a conservative scenario with minor harmonization, incremental annual costs reach £640,000. A base case with moderate changes including standardized warnings and enhanced testing hits £1.47 million. An aggressive scenario with full risk-based classification climbs to £2.65 million.

Revenue impact compounds the pain.

|

Cost Category |

Conservative |

Base Case |

Aggressive |

|

Technology Upgrades |

£150K |

£350K |

£600K |

|

Legal & Compliance Staffing |

£200K |

£400K |

£650K |

|

Risk Warning Redesign |

£50K |

£120K |

£250K |

|

Marketing Overhaul |

£80K |

£200K |

£400K |

|

Appropriateness Testing |

£60K |

£150K |

£300K |

|

Reporting Systems |

£100K |

£250K |

£450K |

|

TOTAL |

£640K |

£1.47M |

£2.65M |

Source: Cost estimates based on industry benchmarks, RegTech vendor pricing, and compliance staffing surveys. Figures represent incremental annual costs for a mid-size FCA-authorised CFD broker.

According to Finance Magnates Intelligence forecasts, enhanced appropriateness testing could shrink the addressable client base by 5% to 10%, translating to revenue drops of 3% to 7% under the base case. The aggressive scenario risks 8% to 15% first-year revenue decline as clients migrate to offshore alternatives.

Revenue-Based Fines: The FCA's Nuclear Option

Recent penalties reveal the FCA's shifting approach. Infinox Capital paid £99,200 for failing to report 46,000 single-stock CFD transactions - the first action for transaction reporting breaches under UK MiFIR. More tellingly, Sigma Broking faced a £531,600 fine calculated at 15% of CFD desk revenue rather than per-transaction, a significantly more punitive methodology.

The regulator also flagged in October 2025 that some CFD firms used fake celebrity endorsements and pressure tactics to push clients into professional status, forfeiting retail protections. One firm alone generated £75 million in losses across 90,000 retail investors.

March 6 Deadline: Speak Now or Forever Hold Your Peace

The March 6, 2026 consultation deadline isn't just administrative theater. Legal experts at Allen & Overy Shearman called it a "once-in-a-lifetime opportunity" to reset the UK retail framework. Firms that submit data-driven responses addressing specific questions in DP25/3 can influence rules that define the competitive landscape for years.

Smart strategies include:

- Supporting risk-based classification in principle while advocating for calibrated implementation that distinguishes well-designed products

- Proactively removing gamification features like leaderboards that encourage overtrading

- Conducting gap analyses against the likely risk-based framework before final rules emerge

- Upgrading appropriateness testing infrastructure to support adaptive, reconfigurable platforms

- Stress-testing business models against the aggressive compliance scenario to identify necessary diversification

The global CFD market continues growing despite regulatory headwinds, with forecasts pointing to steady expansion driven by mobile adoption and emerging market participation. Europe accounts for roughly 43% of global CFD volume, with the UK and Cyprus serving as primary hubs. Historical evidence from 2019 leverage restrictions suggests short-term contraction followed by stabilization as compliant firms capture market share from exiting competitors.

Adapt Now or Pay Later

The FCA has made its position clear: retail CFD loss rates remain unacceptably high, enforcement penalties are rising sharply, and further action is coming. But the regulator also signaled it doesn't want to stifle innovation or push activity offshore. Firms demonstrating genuine commitment to consumer protection while presenting practical alternatives to blunt instruments will shape the rules.

The real risk isn't the direct cost of compliance - it's the strategic cost of inaction. Being caught unprepared when rules change, losing market share to better-prepared competitors, or becoming the subject of an FCA enforcement action that's faster and more expensive than anything the industry has seen before represents the genuine existential threat. The consultation window is open. How the industry responds will determine whether 2026 becomes the year of collaborative regulatory evolution or imposed regulatory revolution.