SEPA Instant Payments: Compliance, Client Experience, and Market Impact

The SEPA Instant Payments Regulation (EU 2024/886) establishes a mandatory, 24/7/365 standard for euro transfers to be completed within 10 seconds (effective Oct 2025). This instantly removes client deposit friction but introduces new operational and compliance pressures for all regulated firms in the SEPA zone .

- 24/7/10s Operations: Deposits and withdrawals must be processed instantly, requiring brokers to secure weekend and overnight liquidity coverage.

- Enhanced Security (VoP): Mandatory Verification of Payee (VoP) integration is required across trading and withdrawal systems (by Q4 2025).

- Fraud & Sanctions: Firms must implement faster fraud detection and shift to daily sanctions screening (proactive compliance model).

- Regulatory Outlook: Regulators in 2026 will closely review the effectiveness of VoP, liquidity management, and consumer protection for instant transactions.

Regulation Overview

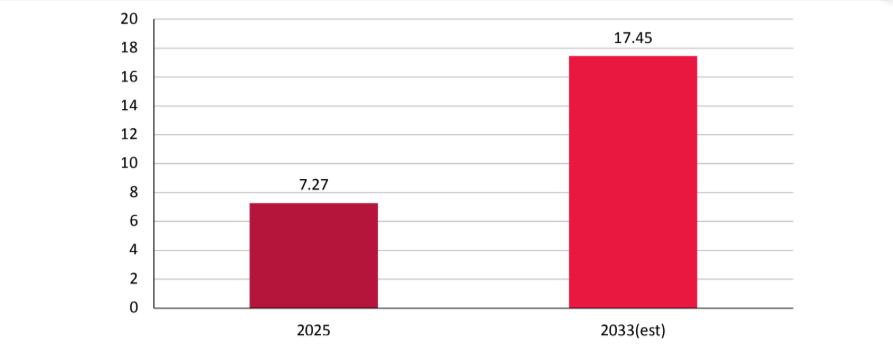

Europe’s retail trading and payments landscape is moving into a new phase. The SEPA Instant Payments Regulation (EU) 2024/886, in force since April 2024, is transforming how money moves across borders and between platforms. Following the 9 October 2025 implementation deadline, all euro-area payment institutions must not only receive but also send instant euro transfers within ten seconds, at any time of day.

By requiring instant euro transfers within 10 seconds, available 24 hours a day, the EU is setting real-time payments as the new standard for both consumers and businesses. For brokers, crypto exchanges, and fintech firms, this means deposits, withdrawals, and client fund transfers will need to be processed instantly and around the clock, including weekends and holidays.

Who This Regulation Affects

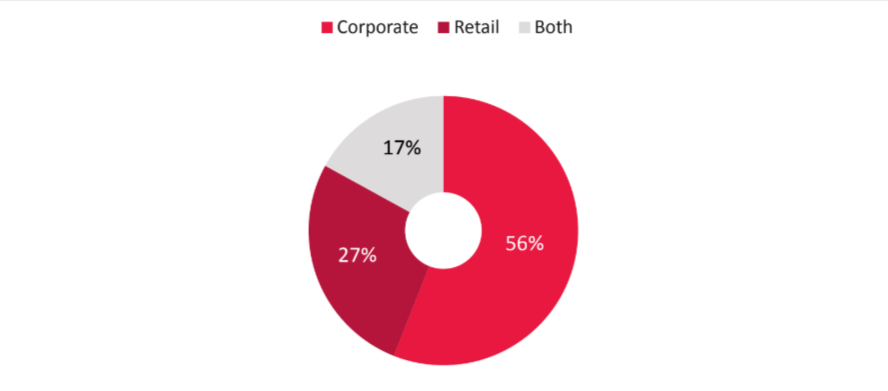

The SEPA Instant framework directly impacts:

- Retail brokers and CFD platforms handling client deposits and withdrawals in euro

- Crypto exchanges and wallet providers offering fiat on/off-ramps

- Payment processors and fintechs connecting these firms to the SEPA network

- Corporate and treasury teams managing liquidity for instant settlement

- Technology vendors supporting payment orchestration and KYC verification

Banks are primarily the technical enablers, but the compliance responsibility extends to any regulated firm offering euro payments to EU clients.

Compliance Roadmap 2024–2027

| Date | Obligation | Impact on the Trading Industry |

|---|---|---|

| 9 Jan 2025 | Euro-area payment institutions must receive instant euro transfers | Brokers and exchanges must be able to accept real-time client deposits via SEPA Instant |

| 9 Oct 2025 | Sending instant payments becomes mandatory | Firms must be ready for instant withdrawals and refunds |

| Apr–Jul 2027 | Non-euro PSPs follow | UK, Swiss, and EEA firms offering euro accounts must adapt |

| Jun 2028 | Extension to non-euro accounts | Multi-currency brokers may need full instant infrastructure |

As of November 2025, all EU-based PSPs must already receive instant payments, and sending capability is now required. Non-EU providers operating in the SEPA zone are next in line.

The SEPA Instant Landscape for Retail Brokers and Crypto Firms

Instant payments change how trading and investing platforms handle money movement. Clients now expect the same speed in deposits and withdrawals as they do in trade execution.

Key Features Affecting the Sector

- 10-second payment window: Deposits must reach accounts almost instantly – no cut-off times, no weekend delays.

- 24/7/365 availability: Funding and withdrawals occur outside normal banking hours, including holidays.

- Verification of Payee (VoP): Names and account numbers must match before transfers are completed, improving security but adding a step to user onboarding.

- Daily sanctions checks: Instead of screening every transaction, firms must verify customer lists daily, shifting compliance to a proactive model.

- Fraud and APP (Authorised Push Payment) risk: Instant, irreversible payments require faster fraud detection and more client education.

For brokers, the change removes one of the biggest friction points in client onboarding: delayed deposits. But it also introduces new pressure on liquidity, fraud prevention, and service availability.

Compliance and Operational Challenges

| Metric | Value |

|---|---|

| Real-Time Funding and Withdrawals | Brokers must ensure that instant deposits immediately reflect in trading balances. This demands integration between payment gateways, back-office systems, and trading platforms. Withdrawals are equally critical. Once SEPA Instant sending obligations are enforced, clients will expect funds in their bank account within seconds, not hours. Firms will need automated validation, settlement, and AML checks that run continuously. |

| Liquidity Management | Traditional treasury practices, built around weekday settlement cycles, no longer apply. Firms will need 24/7 liquidity coverage in their payment accounts to process weekend withdrawals and margin transfers. |

| Verification of Payee (VoP) | From October 2025, euro-area PSPs must verify that the recipient’s name matches the IBAN before executing payments. For brokers and crypto exchanges, this means additional name-matching layers between trading accounts and client bank details. A mismatch could delay or block a withdrawal. Firms should plan user communication strategies to explain VoP prompts clearly and avoid client frustration. |

| Fraud and Sanctions Compliance | Instant settlement leaves no time for manual review. Compliance systems must detect anomalies in real time, identifying high-risk transactions or unusual transfer behaviour automatically. Advanced behavioural analytics and machine learning-based screening are being adopted to reduce false positives and maintain the 10-second service-level target. |

| Client Experience | Instant deposits will become a minimum expectation. Platforms unable to match that speed risk being perceived as outdated. Instant refunds and pay-outs can also enhance trust, especially in a market where transparency and withdrawal reliability drive client loyalty. |

Policy and Supervisory Outlook

Supervisors view SEPA Instant as a cornerstone of a more integrated European financial system. For trading and crypto platforms, this translates to greater transparency and accountability in fund handling.

In 2026, regulators are expected to review:

- The effectiveness of Verification of Payee in preventing fraud;

- The adequacy of liquidity management and risk controls for 24/7 operations;

- Consumer protection and dispute mechanisms for instant transactions.

Firms operating cross-border or with crypto-fiat interfaces should anticipate closer scrutiny of AML, KYC, and customer funds safeguarding in real-time payment contexts.

Expert Opinions

The implementation of the Instant Payments Regulations (IPR) and the requirements it places on financial institutions creates opportunities and challenges for these institutions. The IPR levels the playing field for FinTechs with banks regarding infrastructure demand, creating new expectations for speed, security and compliance.

By April 9, 2027, payment and e-money institutions offering euro credit transfers must provide instant payment services, requiring upgrades such as real-time processing and 24/7 availability. While this may reduce revenue from premium services due to equal-pricing rules, it also enhances competitiveness with banks, creates opportunities for value-added services like request-to-pay and embedded finance, and improves customer satisfaction through instant fund availability

This marks more than a compliance milestone – it’s a turning point for how fintechs manage liquidity, risk, and customer trust in a real-time economy. For firms handling deposits, withdrawals, or retail trading flows, this shift to 24/7 settlement demands pre-transaction fraud intelligence, dynamic liquidity management, and new transparency standards. Instant payments compress every operational process into seconds – meaning resilience, explainability, and user reassurance must be built into every transaction.

Sector Implications

For CFD and Retail Brokers | |

| ✅ | Instant deposits and withdrawals enhance trading experience and conversion rates. |

| ✅ | Lower chargeback exposure thanks to verified instant transfers. |

| ❌ | Higher operational demands for liquidity and continuous availability. |

| ❌ | Compliance risk from real-time fraud and sanctions obligations. |

For Crypto and Digital Asset Platforms | |

| ✅ | Faster fiat-crypto transfers strengthen customer trust and retention. |

| ✅ | Alignment with regulated payment infrastructure improves perception among regulators. |

| ❌ | Complexity in name matching between wallet IDs, exchanges, and client bank accounts. |

| ❌ | Continuous AML monitoring required across weekends and holidays. |

For Fintech and Payment Providers | |

| ✅ | Demand surge for instant-ready gateways, VoP integration, and AML automation tools. |

| ✅ | New opportunities to partner with brokers and exchanges for white-label instant payment solutions. |

| ❌ | Regulatory oversight tightening around uptime, data handling, and fraud detection. |

Key Takeaways

Compliance Checklist for Fintech Firms Accepting Deposits

- Confirm SEPA Instant sending and receiving capability across all euro payment flows.

- Integrate Verification of Payee with trading and withdrawal systems by Q4 2025.

- Implement real-time fraud and sanctions screening mechanisms.

- Review liquidity policies to ensure weekend and overnight coverage.

- Clean and validate customer data to avoid VoP rejections.

- Communicate instant payment changes clearly to clients and partners.