SEC Regulatory Outlook Under Trump’s Second Term

A shift toward deregulation and reduced enforcement will reshape compliance obligations for brokerages, crypto firms, and payment providers. We break down what’s changing and how businesses should prepare.

Under President Trump’s second term (2025–2029), the SEC is expected to pursue significant deregulation, emphasizing business-friendly rulemaking over aggressive enforcement. With Mark Uyeda as Acting Chair and Paul Atkins pending confirmation, this marks a clear shift away from the enforcement-focused approach of former Chair Gary Gensler.

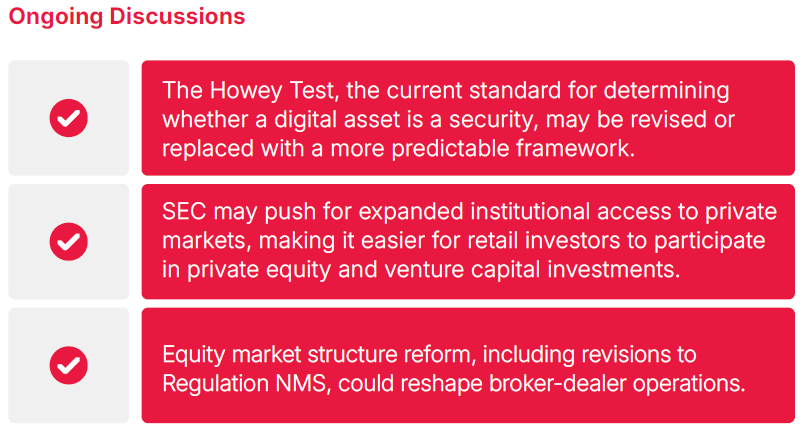

Upcoming Regulations & Trends

What to Expect

The SEC under President Donald Trump’s second term (2025-2029) will undergo significant deregulatory changes, shifting its focus away from aggressive enforcement actions and toward business-friendly rulemaking. With Mark Uyeda currently serving as Acting SEC Chair and Paul Atkins awaiting Senate confirmation, businesses should anticipate a substantial departure from the enforcement-heavy approach of former SEC Chair Gary Gensler.

Key Trends Already Emerging

- Crypto regulation will shift from litigation-based enforcement to structured rulemaking.

- SEC compliance burdens on brokerages, cryptocurrency firms, and payment providers will be significantly reduced.

- Large corporate penalties will be less common, with enforcement efforts focusing on fraud and investor protection rather than regulatory overreach.

- Environmental, Social, and Governance (ESG) disclosure mandates will likely be repealed or significantly weakened.

- Greater transparency and procedural fairness in SEC investigations will be introduced.

Predictions

Political and market observers are competing in analyzing the future of the SEC. Their opinions are sometimes extremely interesting. Among many of them, we have managed to identify a few predictions about the future, with a somewhat speculative nature

- Capital formation policies will be revised to facilitate easier fundraising for businesses.

- Payment providers will face fewer compliance restrictions, particularly on digital asset integration and custody.

- Brokerages may see trading rule adjustments, improving liquidity and efficiency in trade execution.

- Regulatory oversight of self-regulatory organizations (SROs) like FINRA and PCAOB may increase, ensuring more industry transparency and accountability.

Impact Analysis: Who Is Affected and How?

Impact on Brokers/Dealers

✅ Less Burdensome Compliance & More Market Liquidity:

- Possible easing of reporting requirements for broker-dealers.

- Regulatory relief on trade execution and market-making obligations.

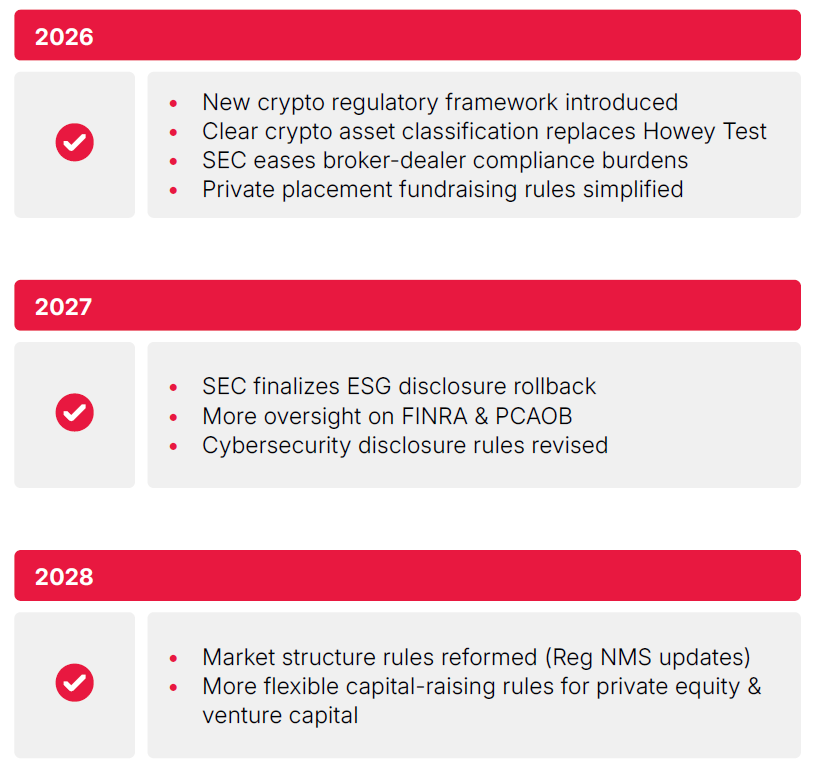

- Changes to Regulation NMS may improve execution speeds and price competition for retail orders.

⚠️ Potential Challenges:

- Increased SEC scrutiny of self-regulatory organizations (SROs) like FINRA may require brokerages to adjust compliance processes accordingly.

- Less aggressive corporate penalties could raise concerns over potential market manipulation risks.

Impact on Cryptocurrency Firms

✅ Regulatory Clarity & Industry Expansion:

- Crypto firms will benefit from a shift away from lawsuits and unclear enforcement policies.

- A structured compliance pathway for registering digital assets will likely emerge, providing regulatory certainty.

- SEC collaboration with the CFTC will streamline oversight, reducing regulatory conflicts.

⚠️ Potential Challenges:

- Regulatory transition periods may cause short-term uncertainty as new rules replace previous enforcement-based policies.

- State-level regulators could still impose stricter requirements on crypto transactions, despite SEC rollbacks.

Impact on Payment Sector

✅ Easier Integration of Digital Assets & Streamlined Compliance:

- Payment firms will likely experience reduced regulatory scrutiny on handling crypto-related transactions.

- The rollback of the SEC’s "Safeguarding Rule" will ease compliance burdens for firms providing custody services.

- Clearer SEC guidance on crypto transaction oversight will improve business planning and risk assessment.

⚠️ Potential Challenges:

- Uncertain treatment of stablecoins may impact payment provider strategies.

- Anti-money laundering (AML) and know-your-customer (KYC) compliance requirements may remain stringent despite SEC deregulation.

Expert Opinion

“During the second Trump Administration, the SEC will likely remain active in enforcing the securities laws, but its focus will probably shift towards cases that involve retail investor harm and true fraud, and away from cases about crypto intermediaries and negligent corporate disclosure failures. We also expect the agency to be less aggressive in seeking penalties from public companies, because a majority of the Commission probably views such penalties as harming company shareholders without significant deterrence value.” - Josh Hess, Bryan Cave Leighton Paisner LLP.

"Each new presidential administration comes with shifts in the tenor and priorities of the SEC with respect to enforcement and rule-making. However, as with the general approach of the new administration, we expect more changes in this transition than most, especially given the control held by the Republican appointed commissioners. We expect the headline grabbing announcements at the SEC to continue, especially on matters that have drawn attention in recent years (crypto, environmental and social initiatives, etc.). While the SEC’s core mission will stay the same, the execution of this core mission will also likely change. We are already seeing changes in internal procedures, staffing resources, and approach to industry engagement. Still, the basic functions of the SEC will likely stay the course.”- Alison M. Pear, Buchalter.

Recommendations: Preparing for the New SEC Era

For Brokers/Dealers

✅ Monitor SEC rulemaking updates regarding market structure changes and SRO oversight.

✅ Review compliance frameworks to align with expected reporting and execution rule adjustments.

✅ Prepare for potential trading regulation shifts, including possible changes to Regulation NMS and execution standards.

For Cryptocurrency Firms:

✅ Stay informed on regulatory changes impacting crypto asset classification and compliance pathways.

✅ Engage with regulators—consider participating in public comment periods to shape future policies.

✅ Reevaluate risk management strategies based on potential changes in SEC-CFTC jurisdiction over digital assets.

For Payment Sector:

✅ Assess compliance programs to align with expected crypto custody and transaction oversight adjustments.

✅ Prepare for potential stablecoin regulatory changes that could impact digital asset transaction processing.

✅ Explore new opportunities in cross-border payments and digital asset integration, as SEC deregulation could spur fintech growth.

Expected SEC Policy Shift Timeline

Conclusion

Under the leadership of President Trump’s second administration, the SEC is set to undergo a significant shift toward a more business-friendly regulatory environment. With a focus on reducing compliance burdens and fostering economic growth, the agency aims to create clearer and more predictable guidelines for financial markets. This transition is expected to bring greater stability to brokerages, cryptocurrency firms, and payment providers, allowing them to operate with increased confidence and reduced regulatory uncertainty.

🔹 SEC under Trump’s second term will focus on deregulation, business growth, and increased market efficiency.

🔹 Brokerages, crypto firms, and payment providers will experience a more predictable regulatory landscape.

🔹 Compliance professionals should actively monitor SEC rulemaking changes and prepare for potential reforms.

Final recommendations:

✅ Stay updated on SEC announcements—subscribe to Finance Magnates regulatory updates.

✅ Engage in industry discussions to contribute to new policy frameworks.

✅ Ensure compliance strategies remain adaptable to evolving SEC priorities.