Navigating the European Accessibility Act: Compliance Guide for Brokers, Fintechs, and Trading Technology Providers

The European Accessibility Act requires financial firms, especially retail trading platforms and fintechs—to make their digital services accessible to persons with disabilities, turning accessibility into both a legal requirement and a strategic opportunity.

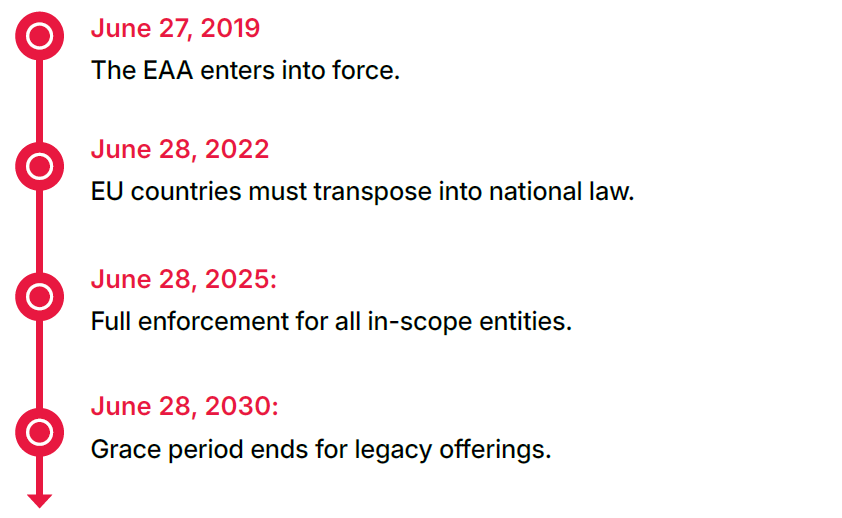

The European Accessibility Act (EAA) is a wide-ranging EU directive designed to improve accessibility across key sectors, with particularly important implications for the financial industry. As financial services increasingly move to digital platforms, the EAA requires firms, especially retail trading platforms, CFD brokers, and fintech companies, to ensure that their digital services are accessible to people with disabilities. Covering areas such as user interfaces, onboarding, trading tools, and customer support, the Act sets out both a regulatory requirement and an opportunity for firms to create more inclusive and future-ready client experiences.

Regulation Overview

The European Accessibility Act (EAA) is a broad EU directive aimed at improving accessibility across multiple sectors, including transport, banking, telecommunications, consumer electronics, and digital commerce. While it applies to a wide range of industries, its implications for the financial sector—particularly retail trading platforms, CFD brokers, and fintech firms—are especially significant.

As the financial world increasingly relies on digital platforms to deliver core services, the EAA mandates that these services be inclusive and accessible to persons with disabilities. This includes user interfaces, onboarding processes, trading platforms, educational tools, and support systems. For firms in the retail trading space, the Act represents not only a legal requirement but also an opportunity to build a more inclusive and scalable client experience.

The regulation harmonizes fragmented national accessibility laws into one EU-wide standard, supporting the broader goals of the UN Convention on the Rights of Persons with Disabilities and the EU Disability Rights Strategy 2021–2030.

Who Is Affected by the EAA in the Financial Industry?

The EAA applies to:

- Online Brokers: CFD, forex, multi-asset, and stock brokers offering trading via web or mobile platforms

- Fintech Platforms: retail investing apps, neobrokers, copy-trading providers

- Trading Infrastructure Vendors: technology firms that build front-ends, terminals, data tools, or execution engines

- Payments & KYC Providers: onboarding, verification, and transaction services used in trading environments

Microenterprises may be exempt from some service obligations, but any provider that supports mass-market retail finance must align with the EAA.

Impact Analysis: Who Is Affected and How?

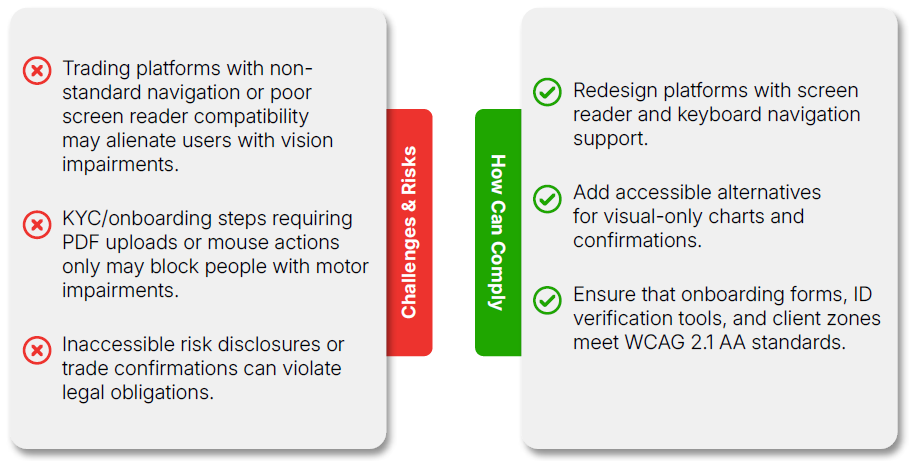

Brokers

Key Impact: Brokers must ensure that trading terminals, client areas, onboarding flows, and research tools are fully accessible to traders with disabilities.

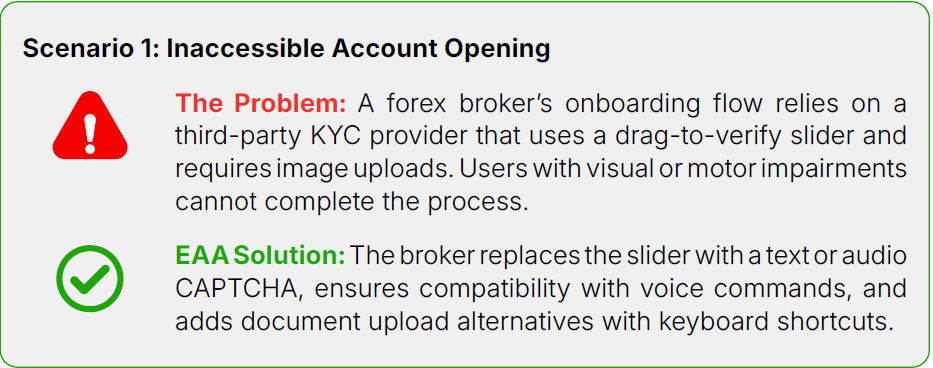

Example: A retail trader who is blind cannot complete onboarding because the platform uses a CAPTCHA that lacks audio alternatives. The broker risks legal complaints and user loss. Under the EAA, the broker must deploy inclusive forms and validation tools with accessible alternatives.

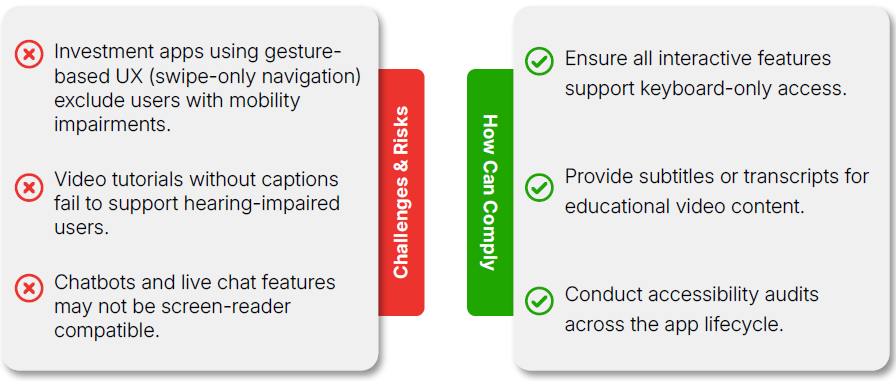

Trading Apps

Key Impact: Vendors offering white-label trading software, analytics dashboards, payment systems, or user portals must embed accessibility features in core product design.

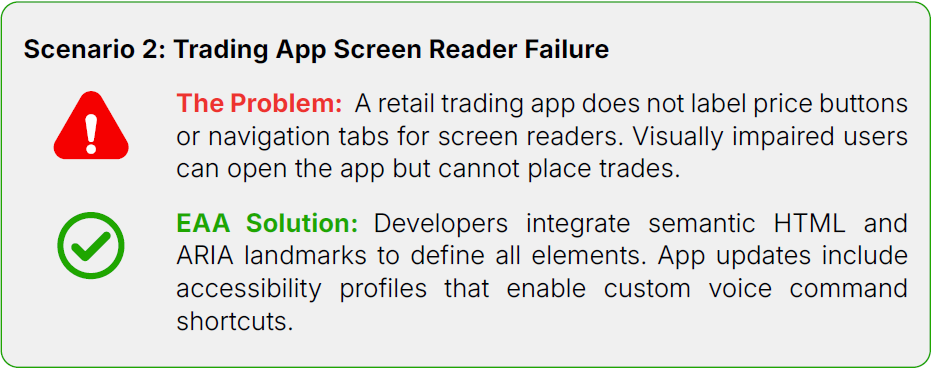

Example: A white-label terminal includes real-time news and trading alerts, but they rely on pop-ups that screen readers cannot interpret. Post-2025, brokers using this terminal may be in breach. The vendor must reengineer notification systems using ARIA roles and keyboard-focus logic.

Technology Providers

Key Impact: Trading apps and financial literacy tools targeting retail traders must provide accessible interfaces, content, and support flows.

Example: A mobile-only investing app relies on animated sliders and drag-and-drop portfolio management. A user with Parkinson’s disease struggles to use it. The company introduces accessibility modes with larger buttons, voice commands, and keyboard alternatives to meet the EAA requirements.

How Your Business Can Comply

CFD and Forex Brokers:

- Audit trading platforms and onboarding workflows for screen-reader and keyboard compatibility.

- Make all legal disclosures and support materials available in accessible formats.

- Work with UX experts to redesign high-traffic features for inclusive use.

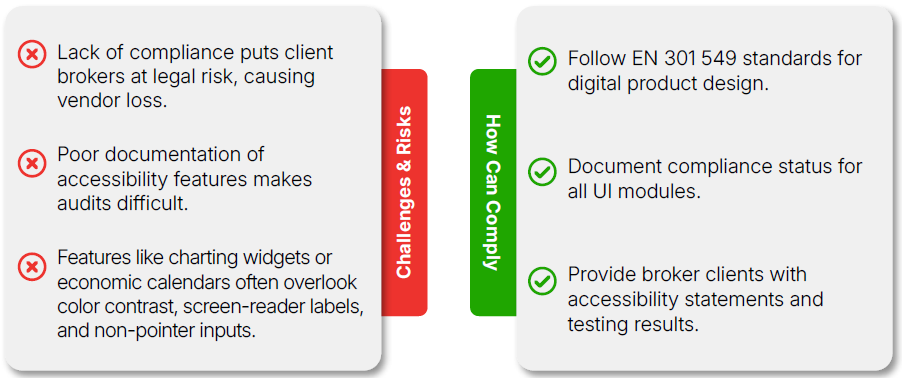

Technology Providers:

- Refactor charting, data feeds, and input forms for compliance with EN 301 549.

- Offer customization options for high contrast, text size, and narration.

- Partner with accessibility consultants for testing and certification.

Retail Fintech Services:

- Add voice navigation, adjustable text, and color contrast controls.

- Provide captioning and alternative text for all media content.

- Integrate accessibility settings in user profiles for persistent preferences.

Expert Opinion

“Fintech lives on conversion rates. You cannot grow if your buttons do not label correctly, or your forms time out on assistive tech. It’s like this: if your trading platform will not work for a user with impaired vision, it’s probably clunky for everyone else too. Accessibility upgrades end up being performance upgrades.

“This law will separate the builders from the bloated. Legacy interfaces built for desktop-only are going to struggle. Companies that figure this out early will gain a competitive edge.” — Eric Croak, President at Croak Capital.

Real-World Scenarios & Case Studies

Key Takeaways

- Inclusive Design = Broader Audience: Traders of all abilities gain confidence and autonomy.

- Compliance = Market Access: Brokers and vendors avoid regulatory penalties and gain EU-wide alignment.

- Innovation = Competitive Edge: Accessibility unlocks UX improvements and new feature innovations.

- Partnerships = Shared Responsibility: Brokers, vendors, and fintechs must collaborate to ensure compliance.

The European Accessibility Act is not just another compliance hurdle—it is a catalyst for a more inclusive, trustworthy, and resilient trading ecosystem. For brokers and fintechs that embrace it early, it may offer a strategic advantage in serving the next generation of retail traders.