Navigating DORA: Implementation Guide for the Financial Industry

DORA is an EU regulation that strengthens cybersecurity and operational resilience in financial institutions, ensuring they can manage and recover from digital and IT-related disruptions.

The Digital Operational Resilience Act (DORA) is an EU regulation designed to strengthen cybersecurity, IT risk management, and operational resilience in the financial sector. It establishes a harmonized framework to help financial institutions prevent, withstand, and recover from digital disruptions, addressing growing risks from cyber threats, third-party IT providers, and reliance on digital and cloud technologies.

Regulation Overview

The Digital Operational Resilience Act (DORA) is a game-changing regulatory framework aimed at bolstering cybersecurity, IT risk management, and operational resilience across the financial services industry in the European Union. With the increasing reliance on digital infrastructure, third-party IT services, and cloud-based solutions, the financial sector faces growing risks from cyber threats, service disruptions, and operational failures. DORA provides a standardized and harmonized framework to ensure all financial institutions can prevent, respond to, and recover from digital operational disruptions.

The regulation goes beyond previous cybersecurity rules by enforcing mandatory incident reporting, ongoing resilience testing, third-party risk management, and ICT governance structures. By applying a unified framework across the EU, DORA ensures that financial institutions, technology providers, and third-party vendors meet the same stringent security standards.

Who Does DORA Apply To?

Unlike previous regulations that primarily focused on banks and investment firms, DORA applies to a broad spectrum of financial entities, including:

●Brokerages: forex trading platforms, CFD providers, and algorithmic trading firms.

●Cryptocurrency Firms: crypto exchanges, custodial wallet providers, CASPs (Crypto-Asset Service Providers), and issuers of stablecoins.

●Payment Providers: fintechs, Payment Service Providers (PSPs), and transaction processing companies.

●Other Financial Institutions: banks, insurers, asset managers, credit rating agencies, and trading venues.

Timeline and Implementation

Timeline and Implementation

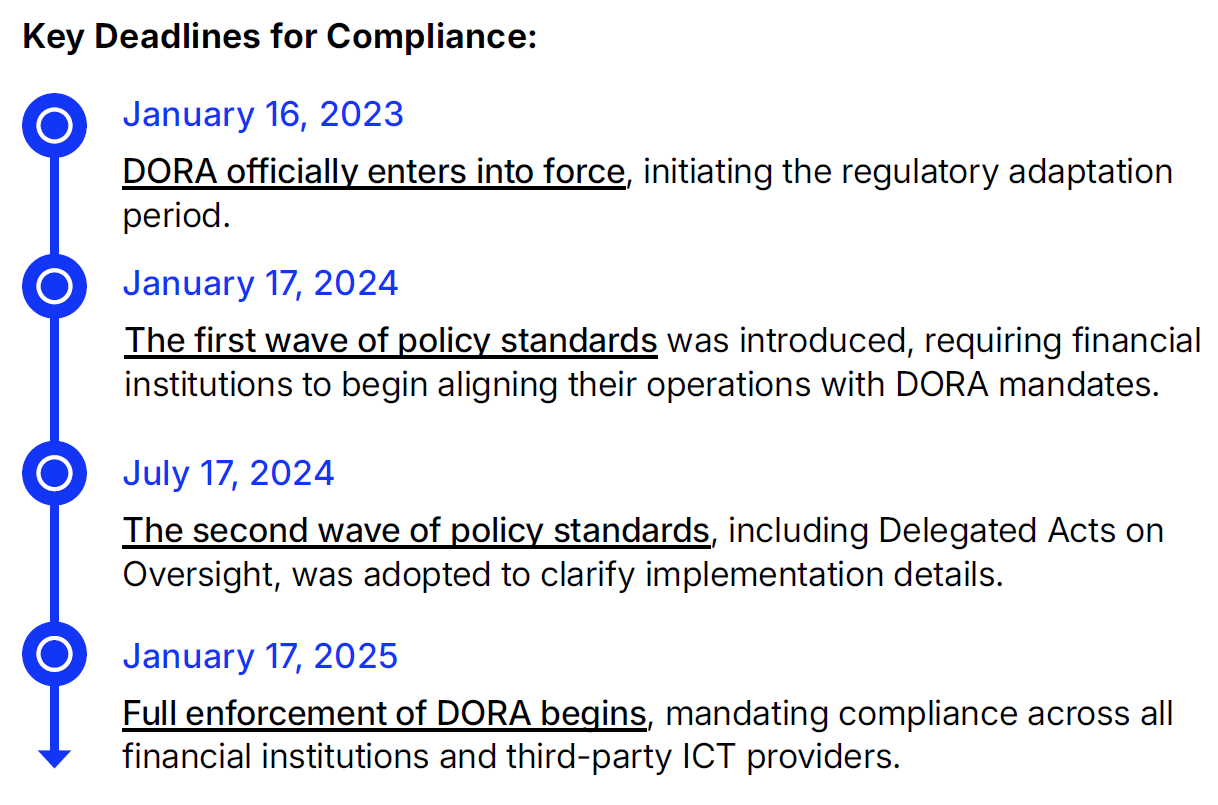

DORA was introduced in phases and has been fully enforced since January 17, 2025. Financial institutions are now required to comply with its strict operational resilience and cybersecurity mandates.

Key Deadlines for Compliance:

From 2025 onwards – Oversight activities for the European Supervisory Authorities (ESAs) commence, including the designation and monitoring of Critical Third-Party Providers (CTPPs).

What This Means: Financial firms must act now to ensure compliance by conducting IT security assessments, updating resilience strategies, and reviewing vendor contracts before the deadline.

Impact Analysis: Who Is Affected and How?

DORA's introduction marks a significant shift in the way financial institutions approach cybersecurity, ICT risk management, and operational continuity. It touches every financial firm and every technology firm that works with them.

Below, we explore how three different types of financial firms are affected:

Investment Firms (FX/CFD, Multi-asset brokers, Trading Platforms)

Key Impact: Online trading platforms must ensure their ICT infrastructure, trading systems, and market data feeds are secure, resilient, and continuously monitored.

Challenges & Risks:

❌ Cyberattacks on algorithmic trading can manipulate market data and cause trading losses.

❌ Server outages or system failures can lead to downtime, missed trades, and liquidity issues.

❌ Failure to report security incidents in a timely manner can lead to regulatory penalties and reputational damage.

✅ How Brokers Can Comply:

✔️ Conduct advanced penetration testing on trading platforms to detect vulnerabilities.

✔️ Ensure 24/7 market access through redundant data centers and disaster recovery solutions.

✔️ Implement automated compliance tools to ensure incident response and reporting deadlines are met.

Cryptocurrency Firms (Exchanges, CASPs)

Key Impact: Crypto businesses must meet high security standards to prevent theft, fraud, and infrastructure failures while ensuring the continuity of digital asset services.

Challenges & Risks:

❌ Hot wallet hacks and private key leaks pose a major financial and reputational risk.

❌ Cloud service downtime can halt withdrawals, causing market instability and loss of user trust.

❌ Lack of vendor oversight can expose firms to supply chain vulnerabilities from IT service providers.

✅ How Crypto Firms Can Comply:

✔️ Secure hot wallets with multi-signature authentication and cold storage solutions.

✔️ Develop contingency plans for IT failures, ensuring continuous access to exchange services.

✔️ Conduct quarterly security audits to meet regulatory expectations and mitigate third-party service risks.

Payment Service Providers (Fintechs, Digital Wallets, Processors)

Key Impact: Payment firms must enhance fraud prevention, secure transaction processing, and strengthen third-party risk management to protect user funds and ensure regulatory compliance.

Challenges & Risks:

❌ Payment fraud spikes due to weak cybersecurity defenses.

❌ Failure of a fraud detection service provider can expose millions of transactions to risk.

❌ Data breaches compromise sensitive payment details, violating GDPR and DORA requirements.

✅ How Payment Providers Can Comply:

✔️ Enhance fraud detection with AI-driven monitoring tools.

✔️ Conduct penetration testing on transaction processing systems to detect weaknesses.

✔️ Audit all third-party vendors to ensure compliance with DORA’s ICT security mandates.

How Your Business Can Comply

Key Steps for Compliance:

Investment firms

- Establish 24/7 cybersecurity monitoring of trading platforms.

- Implement automated compliance reporting for quick response to cyber incidents.

- Ensure market data providers meet DORA security standards.

Cryptocurrency Firms

- Secure wallet infrastructure against cyber threats.

- Conduct routine stress tests on trading and custody services.

- Implement immediate breach reporting systems.

Payment Service Providers

- Improve fraud detection through machine learning tools.

- Conduct penetration testing on payment networks.

- Ensure third-party vendors comply with DORA’s oversight requirements.

Expert Opinion

We used to have different requirements for different types of financial service providers. Many of these came in the form of guidelines from regulators. Now we have a mandatory law setting out uniform requirements for most areas of the financial sector. In addition, certain technology providers will be directly subject to the supervision of financial services supervisory authorities, even if they themselves do not provide regulated financial services.

If you have not already done so, check whether you are in scope. If so, check your IT landscape, including your providers’ subcontractors, and designate providers that are critical or important to you. Review your risk assessment processes. Revise your contracts with your IT and communication service providers – there are detailed rules now regulating which types of clauses must be included.

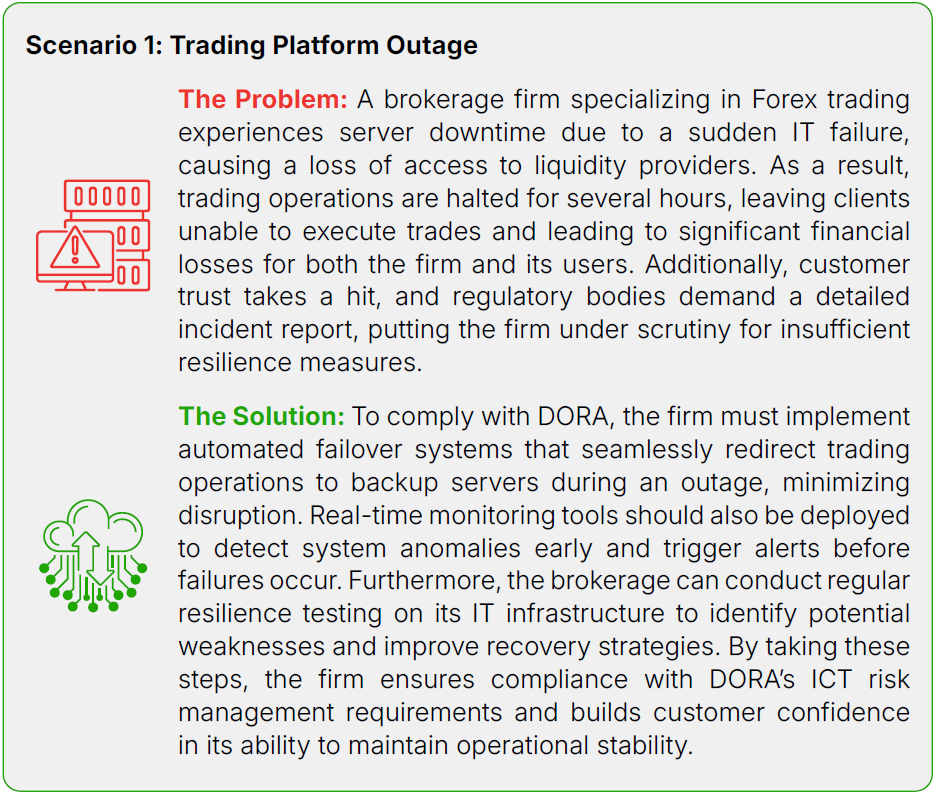

Real-World Scenarios & Case Studies

Lessons from DORA Implementation. Why DORA Compliance Matters

Firms must act to secure their digital operations, build trust, and avoid regulatory penalties. What steps should financial institutions take to effectively minimize risk and enhance resilience? Here are key takeaways and actionable suggestions for successful implementation:

- Integrated Risk Management: A centralized and structured approach to ICT risk management enhances visibility, control, and decision-making, ensuring a comprehensive defense strategy.

- Advanced Automation: Utilizing intelligent monitoring and reporting tools improves incident detection, response efficiency, and risk mitigation, reducing downtime and operational disruptions.

- Continuous Adaptation: Regular reviews and updates to risk management frameworks align organizations with evolving threats and regulatory requirements, maintaining long-term resilience.

- Realistic Testing & Preparedness: Conducting scenario-based resilience tests helps organizations identify vulnerabilities, refine response strategies, and enhance operational stability.

- Collaborative Ecosystem: Engaging with third-party providers and partners strengthens ICT resilience across interconnected systems, ensuring comprehensive security measures.

- Standardized Processes: Implementing uniform templates and structured reporting procedures simplifies incident reporting, improves compliance efficiency, and ensures regulatory adherence.

- Dedicated Response Teams: Establishing specialized incident response teams enhances the speed, coordination, and effectiveness of crisis management.

- Ongoing Employee Training: Regular training programs and awareness initiatives equip staff with essential skills to identify, manage, and respond to ICT incidents effectively.

The Digital Operational Resilience Act (DORA) is transforming how financial firms, including Forex, CFD, crypto and payments providers, manage digital risks. By enforcing higher standards for cybersecurity and stronger third-party oversight, it compels companies to enhance their ICT resilience frameworks.

While the long-term benefits include stronger investor safeguards and greater market stability, many smaller firms may struggle to meet the extensive compliance requirements, potentially leading them to scale back operations or exit the market entirely. By setting higher operational standards, DORA aims to create a resilient financial ecosystem capable of withstanding cyber threats and modern operational challenges.