MiFID II Review Takes Effect, Tightening CFD Broker Oversight

The updated MiFID II/MiFIR reforms introduce several key changes for EU brokers, including the abolition of PFOF, simplification of Best Execution reporting (RTS 27/28 reports removed), and the future implementation of the Consolidated Tape (CT) to centralize market data and improve transparency.

Regulation Overview

The European Union’s overhaul of its financial markets framework under the MiFID II / MiFIR Review has now taken effect. As of 29 September 2025, all Member States were required to transpose the revised MiFID II directive provisions into national law, complementing the MiFIR regulation changes that have been phased in since March 2024.

For CFD brokers, a sector long scrutinized for its retail-facing high-risk products, this marks the beginning of a stricter regulatory environment. Investor protection measures, transparency rules, and conduct requirements are no longer on the horizon. They are now enforceable obligations.

Overview of the MiFID II / MiFIR Review

MiFID II/MiFIR Reforms and Key Features

The review is a core component of the EU’s Capital Markets Union, introducing reforms to strengthen transparency, investor safeguards, and market efficiency. Key features now in effect include:

- Consolidated Tape (CT): ESMA is in the process of appointing consolidated tape providers for bonds and equities/ETFs, with the first services expected in 2026. This system is designed to centralize trade data across EU markets and lower data fragmentation.

- Designated Publishing Entity (DPE) Regime: Investment firms can now assume responsibility for publishing OTC trades without SI registration, with ESMA maintaining a public DPE register.

- Best Execution Reporting Simplification: RTS 27/28 reports have been abolished, with execution quality information expected to flow via the consolidated tape instead.

- Ban on Payment for Order Flow (PFOF): PFOF is prohibited for retail and elective professional order flow. Some jurisdictions allowed transitional use until mid 2026, but most brokers have already terminated such arrangements.

- Pre and Post Trade Transparency Reform: Dark trading is capped under a new single volume cap. OTC derivatives and equity Systematic Internalizers (SIs) face broader disclosure duties, while post trade transparency now extends further into the OTC space.

- Commodity Derivatives: Position limits are narrowed to critical contracts only, easing burdens for less significant markets.

Together, these reforms create a tighter rulebook that reshapes how CFD brokers execute, report, and market their products.

Impact on CFD Brokers and New Compliance Reality

| 1. Investor Protection and Marketing |

| CFD brokers are now bound by a full inducement ban for retail clients. PFOF arrangements must have been dismantled, and execution policies must demonstrate client-first routing. Supervisors are expected to closely examine whether brokers are aligning with the intent of the rules, eliminating conflicts, not just disclosing them. Regulators have already issued warnings against offshore relocations or incentivizing professional client status as workarounds. Brokers found promoting these practices post-deadline are at risk of enforcement actions. |

| 2. Leverage and Suitability |

| Leverage caps, already entrenched across the EU since 2018, remain a supervisory priority. Some regulators are going further: for example, in 2025 the Cyprus Securities and Exchange Commission introduced stricter 10:1 leverage caps on non-major commodity and exotic index CFDs. Firms are expected to ensure that suitability and appropriateness tests are applied rigorously, with supervisors likely to review client files for evidence that inappropriate clients were screened out. |

| 3. Transparency and Reporting |

| CFD brokers internalizing trades must now comply with expanded post-trade transparency obligations, reporting certain OTC CFD transactions that reference venue-traded instruments through Approved Publication Arrangements (APAs). While pre-trade obligations for non-equity SIs were lifted, brokers acting as SIs in equities must prepare to publish quotes above the regulatory threshold once Level 2 standards are applied. On the transaction reporting side, brokers are required to follow updated schemas (RTS 22), with additional instruments now in scope. National regulators have already begun checking for accuracy and completeness in reporting. |

| 4. Product Governance |

| The product governance regime is fully operational, and supervisors are demanding evidence that CFDs are designed and distributed only to suitable target markets. Brokers must demonstrate that product reviews are ongoing and that risk disclosures, negative balance protection, and margin close-out rules are working as intended. |

| Date | Milestone | Status |

|---|---|---|

| Mar. 2024 | MiFIR Review entered into force | Completed |

| 29 Sep. 2025 | MiFID II Review transposition deadline | Upcoming |

| Oct. 2025 | MiFID II Review transposition deadline | Upcoming |

| 30 Jun 2026 | Final end date for any PFOF transitional use | Upcoming |

Source: Finance Magnates Intelligence

What Are The Key Challenges Post-Deadline And Priorities Now

Supervisory Scrutiny: Regulators are expected to initiate thematic reviews and inspections in late 2025 and 2026. CFD brokers that failed to update policies, reporting systems, or marketing materials are at risk of fines. Such intentions were announced by, among others, the German BaFin and the Cypriot CySEC.

Data Accuracy: Early indications suggest transaction reporting quality remains uneven, with NCAs flagging errors in OTC trade reporting.

Client Communications: Firms that reduced leverage or removed certain products have faced client pushback, requiring careful communication strategies

At this stage, your CFD brokerage should already have:

- ✓ Eliminated PFOF and updated order execution and conflicts of interest policies.

- ✓ Established APA connections for trade reporting and tested transparency workflows.

- ✓ Revised marketing and client onboarding practices to avoid inducements and misclassification.

- ✓ Conducted product governance reviews and documented target market justifications.

- ✓ Trained staff on the new obligations and rationale.

Firms still catching up must treat remediation as urgent. Supervisors are unlikely to accept “work in progress” explanations this far past the deadline.

10 Compliance Strategies for Your CFD Brokers (Post-Deadline)

Now that the MiFID II / MiFIR review is in force, CFD brokers must shift from preparation to sustained compliance and remediation. Practical strategies include:

| 1. Post-Deadline Audit |

| • Conduct a thorough review of execution policies, reporting, and client categorization. • Address any gaps quickly and document corrective measures. |

| 2. Stronger Governance |

| • Elevate MiFID II / MiFIR compliance to board level. • Record management decisions on leverage, inducements, and client treatment. |

| 3. Tighter Reporting Controls |

| • Automate APA reporting and reconciliation. • Test systems regularly to avoid omissions or late publications. |

| 4. Clear Client Communication |

| • Update onboarding materials and disclosures to reflect new rules. • Explain why leverage, inducements, or features have changed. |

| 5. Robust Product Governance |

| • Reassess CFDs quarterly against client outcomes. • Narrow target markets or adapt product features if harm persists. |

| 6. EU-Wide Consistency |

| • Where national regulators impose stricter standards, adopt them across all EU operations. • This prevents fragmentation and supervisory conflicts. |

| 7. Inspection Preparedness |

| • Keep detailed evidence of changes: updated policies, staff training, reporting samples. • Be ready to demonstrate compliance to NCAs on demand. |

| 8. Staff Training and Awareness |

| • Train staff on new obligations and rationale, from PFOF ban to transparency rules. • Emphasize consistent, client-first behavior in daily operations. |

| 9. Risk Monitoring |

| • Enhance monitoring of leverage, client losses, and suspicious trading. • Use findings to adjust controls before regulators intervene. |

| 10. Scenario Testing |

| • Run mock inspections and reporting stress tests. • Verify that appropriateness tests and governance procedures hold under scrutiny. |

Expert Opinions

The September MiFID deadline is split into two parts. First, you fix the basics. Then, brace for the data pipes scheduled to deploy throughout 2026. Mid-tier brokers would do well to schedule lean, agile tape integrations, and remain light on their feet. The firms that transform compliance from simply filling a legal obligation to a trust signal will win. You transform compliance by getting out of the box and showing the actual metrics of execution along with independent verifications and other real value-based propositions. You show clients that you are dedicated for the long run and stand by their offering.

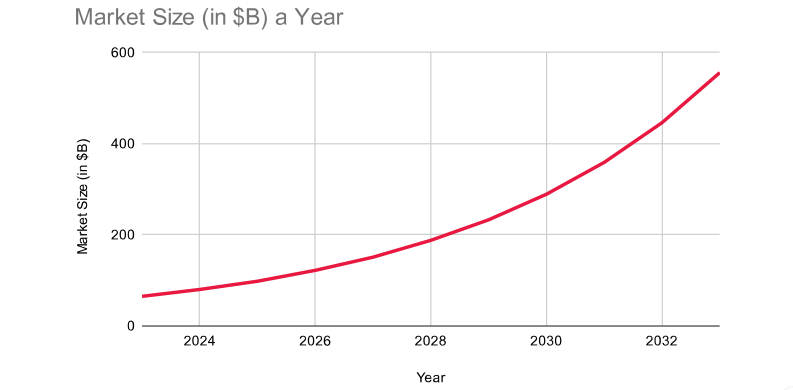

Investment firms had over a year to prepare for the MiFID II review changes. However, many players, especially smaller ones, similar to previous financial regulation implementations, waited until the last minute or still haven’t implemented the changes. Firms that invested in early implementation already report 23% operational efficiency improvements, while delayed ones struggle with 6-month operational disruptions. The key challenge for smaller brokerage houses are technology costs: consolidated tape, expanded transaction reporting, and new best execution requirements demand significant IT investments. However, the same firms complaining about costs today will compete next year against entities with unified data streams and optimized compliance processes

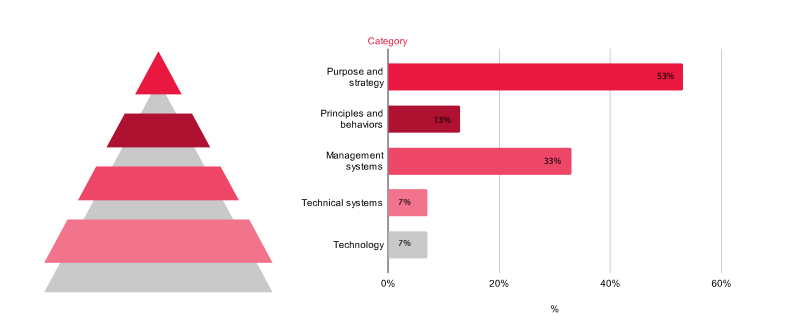

Few European Investment Firms Excel Across All Elements of MiFID II Compliance Excellence

Real-World Scenarios & Case Studies

Below are two potential real-life problems that companies subject to MiFID II / MiFIR Review may encounter. The names of products, services, and businesses are fictitious.

Case Study 1: The Consolidated Tape Integration Challenge | |||

| |||

| |||

Case Study 2: The Volume Cap Calculation Overhaul | |||

| |||

| |||

New Reality After 29 September 2025

The post–29 September 2025 landscape is unforgiving. For CFD brokers, compliance with MiFID II / MiFIR is no longer about planning, it is about demonstrating, with evidence, that rules are applied in practice.

- Firms that embraced early compliance are already operating smoothly.

- Those that delayed now face remediation, supervisory audits, and potential enforcement.

- Case studies show that conflicts (PFOF), transparency (APA reporting), and marketing (client classification) are the most immediate pressure points.

The message from EU regulators is clear: the grace period is over. MiFID II / MiFIR review compliance is now the baseline standard, not a future goal.