When ASIC Commissioner Simone Constant announced the findings of the regulator’s most sweeping review of the Australian CFD industry, she did not mince words. The 14-month investigation had uncovered compliance failures at virtually every firm it examined, prohibited margin practices at more than half the sector and a trail of investor losses running into hundreds of millions of dollars.

“Each year, thousands of Australians lose money trading CFDs and through our review we have helped put $40 million back in the pockets of more than 38,000 investors. These are complex, high-risk products, where most investors face losses, and even profitable trades can be entirely eroded by trading costs," Simone Constant, ASIC Commissioner, said.

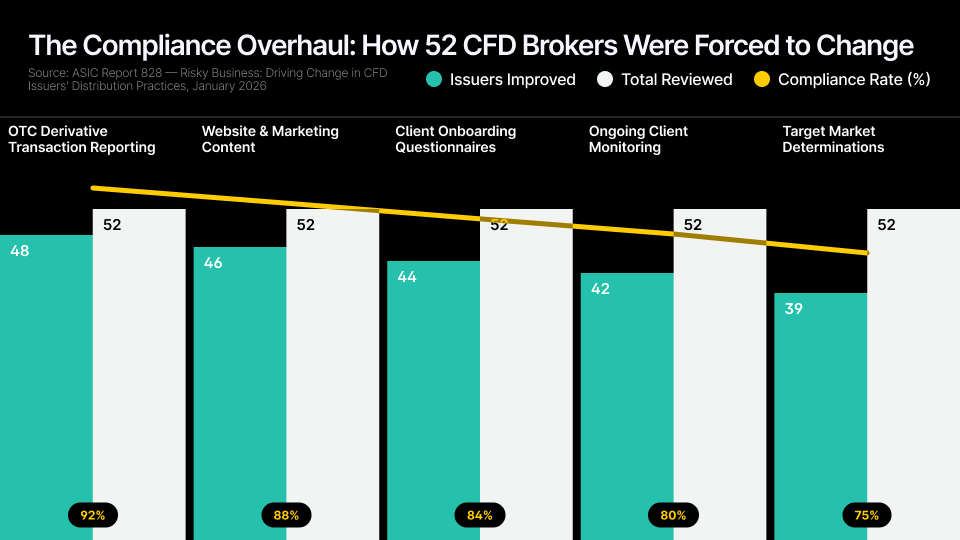

The report, titled Risky Business: Driving Change in CFD Issuers’ Distribution Practices and published on January 20, details the outcomes of a data-driven sector-wide review of 52 licensed CFD issuers conducted between October 2024 and December 2025. Its findings carry implications well beyond Australia’s borders, arriving at a moment when regulators from the UK to Europe are tightening their own grip on speculative retail products.

.png)

At the heart of the crackdown is a practice ASIC characterised as one of the most widespread and damaging compliance failures in the sector’s recent history: margin discounting.

When ASIC introduced its CFD Product Intervention Order in 2021, it imposed strict leverage limits and margin requirements designed to cap the risk retail investors could take on. But the review found that more than half the 52 issuers examined had been calculating margin on opposing long and short positions using net or largest-leg-only methods - effectively circumventing the gross margin requirement and allowing clients to build dangerously leveraged positions.

The consequences for investors were severe. According to ASIC, margin discounting resulted in excessively leveraged positions, inflated overnight funding costs, denial of margin close-out protection and sudden spikes in margin requirements when one leg of an opposing trade was closed. In response, 28 issuers refunded more than AUD $36 million in swap costs, spreads and fees to affected clients.

According to Finance Magnates Intelligence modelling, brokers offering margin discounts on opposing positions could have enabled effective leverage ratios of up to 100:1 on some instruments -far exceeding the 30:1 cap mandated for major FX pairs under the PIO. The funding cost differential alone on discounted margin accounts could reach 2–3 percentage points annualised, representing a significant hidden drag on client returns.

A Catalogue of Failures: Where Brokers Fell Short

The margin discount breach was the most financially consequential finding, but it was far from the only one. ASIC documented compliance deficiencies across every major operational pillar.

|

Compliance Area |

Firms |

What ASIC Found |

|

Transaction Reporting |

48/52 |

Over 70 million erroneous reports; only 3 issuers initially complied with unwind payment obligations; only 1 reported clean data consistently |

|

Marketing / Websites |

46/52 |

Every issuer failed to clearly label products as CFDs rather than underlying assets; overstated benefits, understated risks; some used ASIC regulation as a marketing tool |

|

Client Onboarding |

44/52 |

Self-certification questions, leading prompts, no knock-out mechanisms; one issuer stopped onboarding at ASIC’s request within days |

|

Client Monitoring |

42/52 |

Most issuers conducted little to no ongoing monitoring of client outcomes; monitoring existed only for AML purposes, not consumer protection |

|

Target Markets |

39/52 |

Vague or ambiguous definitions; failure to include income, experience or vulnerability criteria; some updated TMDs only days before ASIC meetings |

The transaction reporting failures are particularly striking. Out of 52 issuers, only one consistently reported high-quality data with no identifiable errors throughout the review period. That issuer achieved this through regular collaboration with peers, systematic reconciliations between trade repository and source systems, and close adherence to oversight guidance for delegated reporting.

The remaining 51 firms failed at various levels of severity. ASIC found missing unwind payments, under-reported derivative transactions, incorrect collateral information and minimal oversight of third-party reporting delegates. The sheer volume - 70 million erroneous reports - suggests systemic infrastructure problems rather than isolated human error.

Finance Magnates Intelligence estimates that correcting 70 million erroneous reports across the sector would require an average remediation cost of AUD $200,000–$500,000 per issuer in back-reporting, systems upgrades and delegated reporting oversight - translating to a sector-wide compliance bill of approximately AUD $10–25 million.

Who Loses Money Trading CFDs in Australia?

The client trading data ASIC collected paints a stark picture of retail outcomes. In the 2023–24 financial year, 133,674 retail clients lost money trading CFDs - representing 68 percent of all retail clients across the 52 issuers reviewed. Their combined net losses exceeded AUD $458 million, of which $73 million was attributable to fees.

For clients trading options CFDs, which ASIC described as effectively “double leveraged” products, the loss rate climbed to 85 percent. The regulator flagged that it was unclear who these products were appropriate for and signalled they would be a focus of the upcoming Product Intervention Order renewal consultation.

Perhaps most surprising was the wholesale client data. Investors classified as wholesale - typically assumed to be more sophisticated and experienced - fared even worse in absolute terms, posting AUD $738 million in net losses with a 70 percent loss rate. ASIC found that reclassifications from retail to wholesale were heavily concentrated among just five issuers, raising the possibility that some clients may have been inappropriately upgraded to access higher leverage without the associated protections.

The Enforcement Machine Accelerates

The CFD crackdown does not exist in a vacuum. It sits within a broader escalation of ASIC’s enforcement posture that has seen the regulator double investigations, nearly double court filings and secure record penalties across the financial services sector.

“We are continuing to deliver strong, visible and active enforcement outcomes. We’re doing more investigations, taking more matters to court and securing record penalties. In the last 12 months, we’ve doubled the number of new investigations and nearly doubled the number of new matters filed in court," Sarah Court, ASIC Deputy Chairwoman, commented.

Key enforcement milestones in the past year include AUD $240 million in proposed penalties against ANZ Banking Group - potentially the largest ASIC has ever levied against a single entity - and AUD $35 million from Macquarie Securities for systemic short sale reporting failures. The regulator also secured a 14-year prison sentence for fraud, the longest in ASIC’s enforcement history.

Within the CFD sector specifically, ASIC issued an interim stop order against FXCM (Stratos Trading) in December 2025 for target market determination deficiencies and commenced Federal Court proceedings against eToro in its first enforcement action under the Design and Distribution Obligations regime.

ASIC Chair Joe Longo reinforced the message in his Key Issues Outlook for 2026, citing consumers losing retirement savings through high-risk products driven by high-pressure sales tactics, advanced technology including agentic AI, and cyber resilience as core areas of concern.

What Comes Next: The PIO Question

The single most consequential question hanging over the Australian CFD industry is the fate of the Product Intervention Order, which is scheduled to expire on May 23, 2027. ASIC has confirmed it will consult with industry this year on its proposed way forward, and the findings from REP 828 will directly inform that consultation.

Three outcomes are possible. In the base case, ASIC renews the PIO on substantially similar terms, perhaps with tightened restrictions around options CFDs and margin practices. In a stricter scenario, the regulator expands the order to cover copy trading, imposes new conduct obligations around wholesale reclassification and adds real-time monitoring requirements. The most aggressive outcome - considered unlikely but not impossible - would see Australia move closer to the U.S. model, where retail CFD trading is effectively prohibited.

According to Finance Magnates Intelligence forecasts, the base case scenario of a renewed PIO with incremental restrictions carries a probability of approximately 70 percent. An expanded, stricter regime accounts for roughly 25 percent, while a complete prohibition carries less than 5 percent probability. In all scenarios, compliance costs for the sector are projected to rise by 15–40 percent over the 2026–28 period.

ASIC has also flagged two additional focus areas that will shape the regulatory landscape over the next 18 months:

- Copy trading: The regulator has identified potential concerns around lead trader supervision, fee transparency and conflicts of interest. It will engage with issuers about their copy trading services and a proposed regulatory response.

- Wholesale client classification: ASIC has commenced a targeted review after finding reclassifications from retail to wholesale were concentrated among just five issuers. Misclassification denies retail investors important protections and constitutes a breach of the law.

Beyond Australia: A Global Regulatory Convergence

While REP 828 is an Australian enforcement action, its findings echo regulatory trends unfolding across the world’s major financial jurisdictions.

In the United Kingdom, the Financial Conduct Authority published Discussion Paper 25/3 in January 2026, proposing to harmonise the regulation of speculative products including CFDs, leveraged ETPs and crypto derivatives under a risk-based framework. In Europe, ESMA continues to enforce its own product intervention measures, which served as the original template for both the FCA’s and ASIC’s leverage restrictions.

Three themes carry cross-border relevance. First, the regulatory focus is shifting from product-label compliance to conduct-based outcomes: regulators want to see that products are reaching appropriate clients, not just that disclosure boxes are ticked. Second, transaction reporting quality is emerging as a primary enforcement lever. ASIC’s discovery of 70 million erroneous reports mirrors similar concerns raised by the FCA and ESMA around derivatives transparency data. Third, the bar for client onboarding is rising globally, with self-certification, leading questions and inadequate knock-out mechanisms no longer acceptable under any major framework.

Finance Magnates Intelligence analysis of regulatory convergence across ASIC, FCA and ESMA suggests that within 18–24 months, the effective compliance standard for multi-jurisdictional CFD brokers will converge toward the strictest common denominator - meaning firms that build to the highest standard now will face significantly lower marginal compliance costs as individual jurisdictions tighten their requirements.

The Bottom Line

ASIC’s REP 828 is the most comprehensive regulatory intervention in the Australian CFD sector’s history. The scale - 52 firms reviewed, AUD $39 million in remediation, 70 million erroneous reports corrected, six licences cancelled - sends an unambiguous message: compliance is no longer a cost of doing business. It is the business.

For brokers operating in Australia, the immediate imperative is clear: audit margin practices, fix transaction reporting, upgrade onboarding questionnaires and implement genuine ongoing monitoring. For multi-jurisdictional firms, the lesson is broader: the regulatory direction of travel in Australia, the UK and Europe is converging, and firms that invest in compliance infrastructure now will gain a durable competitive advantage over those that treat regulation as an exercise in minimum viable compliance.

The Product Intervention Order renewal consultation, expected later this year, will define the next chapter of CFD regulation in Australia. The industry’s conduct in 2026 will determine whether that chapter is one of managed evolution or imposed transformation.