EU AMLA Regulatory Update for Financial Institutions and Brokers

The EU is establishing the Anti-Money Laundering Authority (AMLA) to strengthen and centralize AML supervision across Member States. With a single rulebook and direct oversight of high-risk institutions, AMLA will significantly raise compliance expectations for financial firms operating cross-border in the EU.

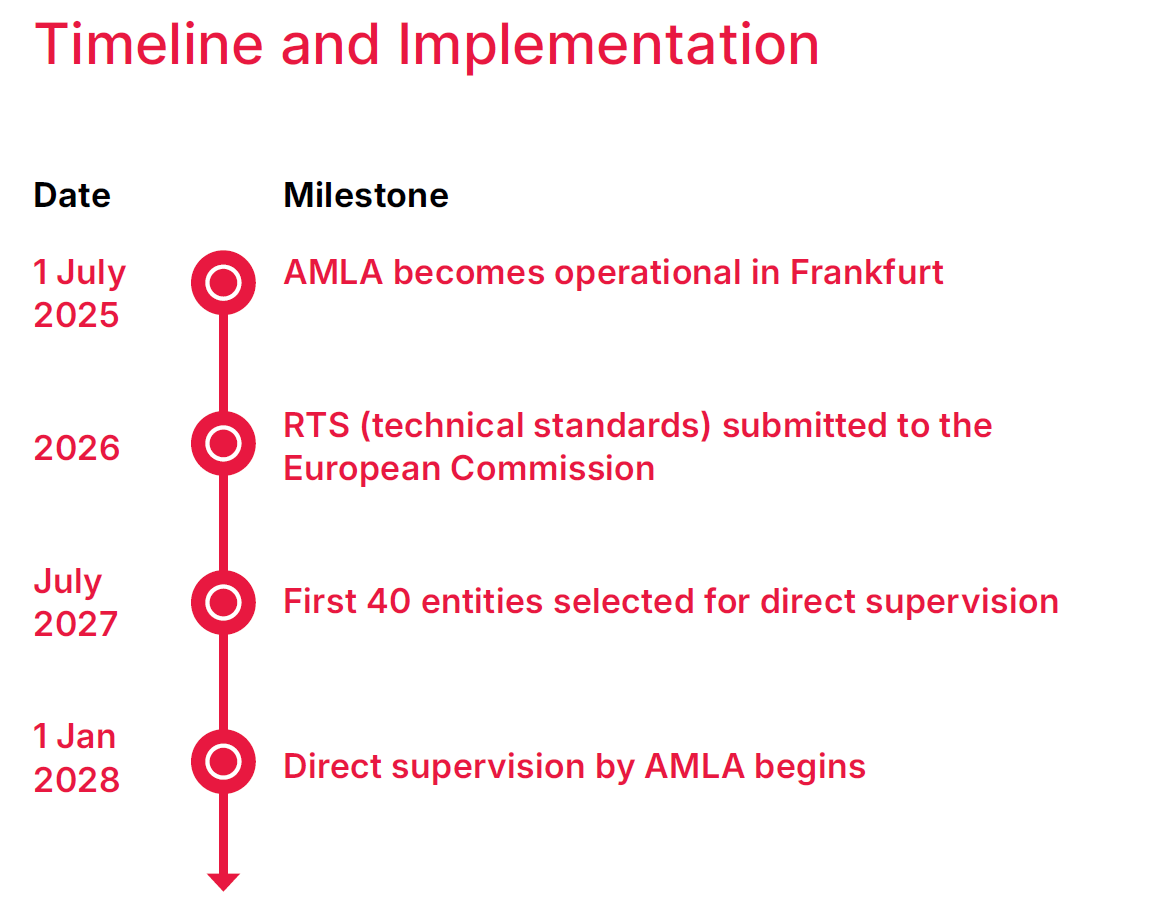

The European Union is reshaping its anti-money laundering framework with the creation of the Anti-Money Laundering Authority (AMLA), a central supervisory body that will play a key role in enforcing a unified EU-wide AML regime. Set to become operational in 2025 and to assume direct supervisory powers over high-risk institutions from 2028, AMLA will introduce consistent rules, stronger oversight, and enhanced technical standards across the financial sector. For regulated firms, including retail brokers, CFD providers, and fintech companies, this marks a significant shift, requiring more robust AML governance, strengthened compliance frameworks, and greater readiness for centralized EU supervision.

Regulation Overview

The European Union has launched its most comprehensive anti-money laundering initiative to date through the establishment of the Anti-Money Laundering Authority (AMLA), set to become fully operational on 1 July 2025 and begin direct supervision in 2028.

As part of a sweeping AML package, AMLA introduces a unified rulebook, direct supervisory powers over high-risk financial institutions, and enhanced technical standards that apply to all obliged entities—including retail brokers, CFD providers, and financial technology firms operating across the EU.

This update requires regulated firms to strengthen their AML frameworks, governance systems, and cross-border compliance operations—or risk exposure to supervisory action by either national authorities or AMLA directly.

Who Does AMLA Apply To?

AMLA applies to a wide array of financial institutions, such as:

- Retail FX and CFD Brokers operating across EU member states

- Investment Firms and Custodians handling client money and securities

- Fintechs and Payment Processors providing cross-border services

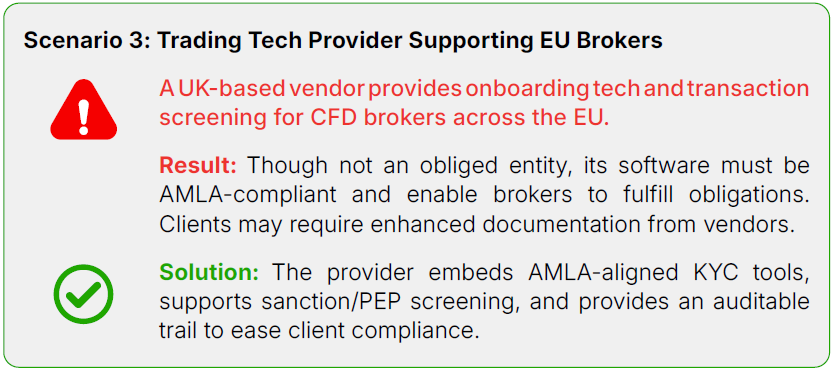

- Technology providers supporting trading infrastructure and onboarding

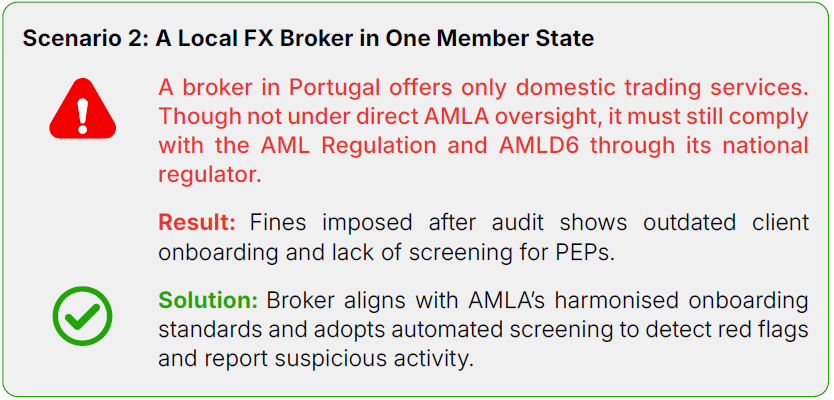

Even firms not directly supervised by AMLA will be subject to its harmonised rulebook and risk-based standards, enforced through national supervisors under AMLA coordination.

Impact Analysis: Who Is Affected and How?

| Entity Type | Impact & Requirements |

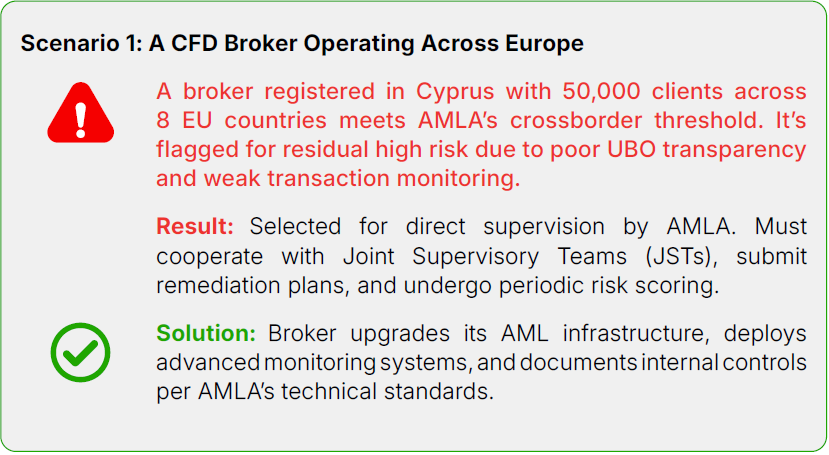

| Cross-Border FX/CFD Brokers | Potential direct supervision if active in ≥ 6 EU states with significant flows. Must comply with uniform AML rulebook and pass risk profiling. |

| Tech Providers | Expected to implement AML/CFT controls and support clients’ monitoring/reporting functions. |

Case Scenarios & Real-World Examples

Will You Be Directly Supervised by AMLA?

The EBA’s draft Regulatory Technical Standards define two steps that determine whether an entity is selected for direct AMLA supervision:

1. Cross-Border Activity Threshold

- Active in at least 6 EU Member States, including the home country

- Either ≥ 20,000 customers or ≥ €50 million in transaction flows per country/year

2. Risk-Based Scoring

- Assesses number of clients, transaction volume, AML control quality, HNW client ratio, and outsourcing

- Only firms with both wide footprint and high residual AML risk are chosen

Possible CFD Broker and Fintech Candidates:

- Saxo Bank

- Revolut

- IG Group

These firms operate across multiple EU markets, serve large retail bases, and process high-volume client flows. If controls are found insufficient, they may be subject to direct AMLA oversight starting 2028.

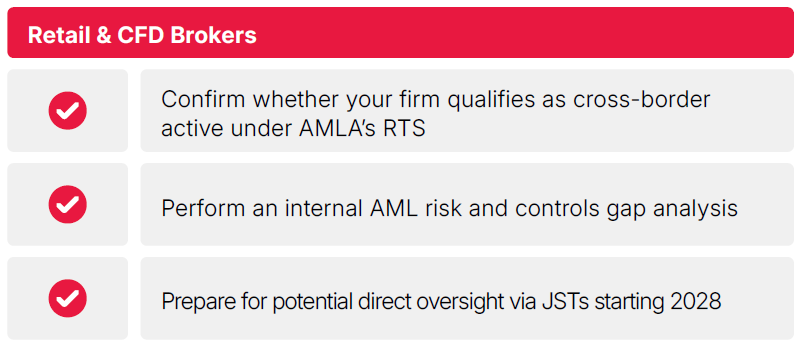

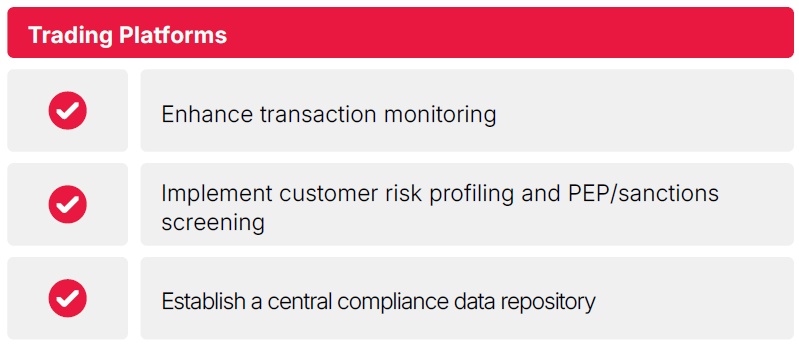

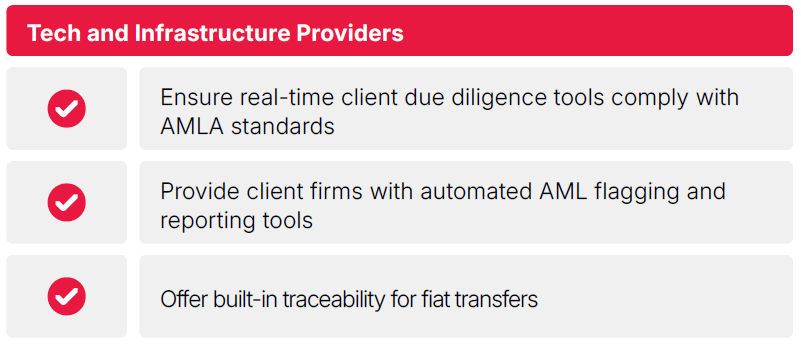

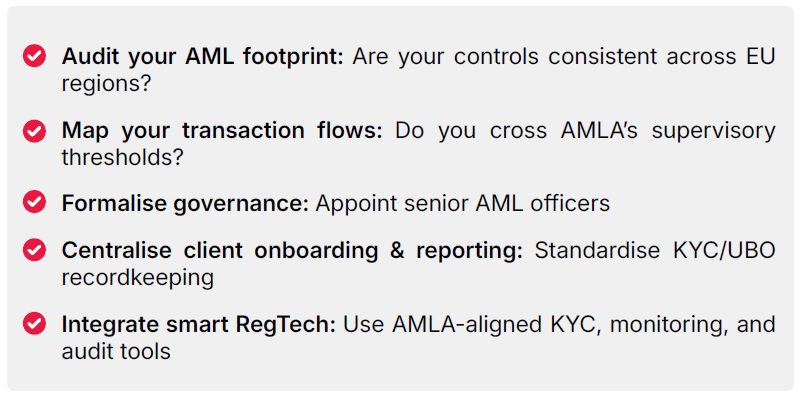

Key Compliance Actions for Your Business

Expert Opinion

“The EU’s new Anti-Money Laundering Authority (AMLA) marks a significant shift for CFD brokers and fintechs. Fragmented compliance strategies are no longer sufficient; AMLA enforces a single, harmonised framework across the EU. Local regulators will demand stricter due diligence, real-time checks on PEPs and high-risk geographies, and faster reporting of high-value transactions. Failures will mean regulatory action and fines, or direct supervision by AMLA. Manual processes won’t scale: automation, audit readiness, and cross-border transparency are now essential. Success depends on robust systems, well-trained teams, and clean data—not just to meet compliance requirements, but to build trust, and scale confidently in a tightening regulatory environment.” – Tom Gadsden, Vice President of Product Management at Shufti

“With AMLA in place, the regulatory leash on retail trading brokers and fintech firms becomes tighter. Harmonization of AML/CFT defences has been a fundamental goal of the EU for years now. But AMLA is taking it a step further. It is putting itself in the supervisor seat, especially (but not exclusively) where high-profile players, labelled ‘High-Risk, Cross-Border Entities,’ are involved. Interestingly, AMLA is also putting focus on coordinating Financial Intelligence Units (FIUs). In the AML world, everyone’s wet dream is facilitating joint analyses information exchange (AMLA is due to manage the FIU.net system) as lack of access to vital information is making the holes in the net bigger. Brokers and Fintech will probably not be that happy with it, but AMLA’s enforcement and sanctioning powers can make it a big brother you don’t want to mess with.” – Ofer Friedman, Chief Business Development Officer at AU10TIX

Takeaways

With AMLA, the EU is building a single, sophisticated AML enforcement regime that doesn’t just apply to banks. Trading brokers, CFD providers, and tech partners must be ready for both direct and indirect obligations, well before 2028. Start preparing today, or risk being caught unready when the Authority starts knocking.