Major CFD brokers have already retreated. Exness halted new Indian client onboarding mid-2025 despite India representing 30% of its global traffic. FBS suspended all marketing activities after exiting the market entirely. Indian authorities raided Zara FX offices and froze bank accounts as part of an expanded enforcement push.

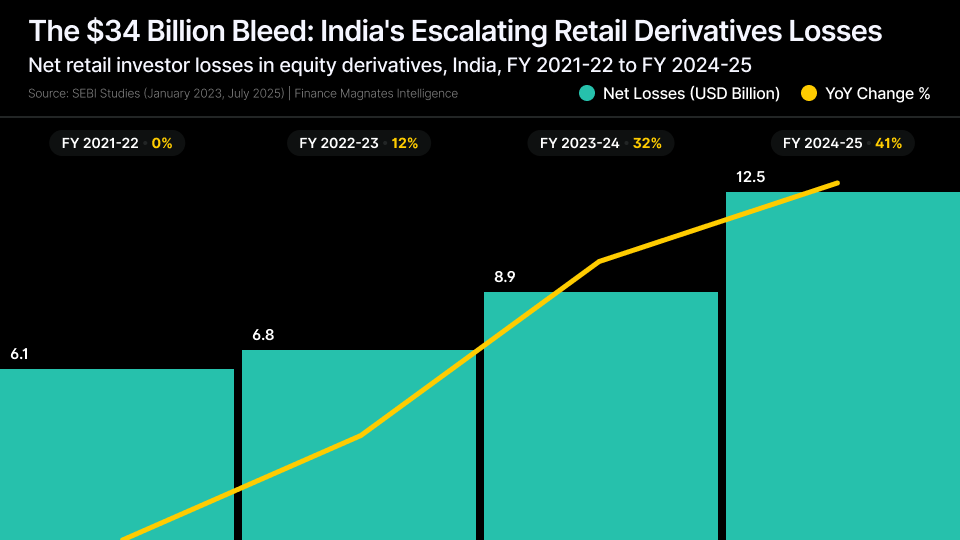

The reason: 91% of individual futures and options traders lost money in the fiscal year ending March 2025, according to new data from the Securities and Exchange Board of India. The regulator tracked 9.6 million unique retail participants and discovered that net losses jumped 41% year-over-year to 1.05 trillion rupees ($12.5 billion).

According to Finance Magnates Intelligence analysis, India's regulatory response represents the most comprehensive assault on retail speculation anywhere in the world - and the tools SEBI deployed have no equivalent in Western markets yet. That may be about to change.

The Numbers Behind the Crackdown

|

Metric |

Figure |

Context |

|

Retail loss rate |

91% |

Higher than UK (80%), Australia (68%), Europe (74-89%) |

|

Total losses FY22-FY25 |

$34 billion |

Cumulative over four years |

|

FY25 losses alone |

$12.5 billion |

Up 41% year-over-year |

|

Unique traders studied |

9.6 million |

Top 13 stockbrokers |

|

Volume collapse |

83% |

Monthly options contracts, peak to trough |

|

India's global share |

70%+ |

Of all index options contracts worldwide |

Finance Magnates Intelligence

The loss rate is particularly alarming because India's exchange-traded derivatives carry lower leverage than the over-the-counter CFDs that Western regulators worry about. The gap suggests structural market design problems rather than just product features.

.png)

"SEBI data shows that increased trading activity did not translate into better outcomes. A significant portion of total losses stemmed from positions held through weekly expirations, where volatility is amplified and retail traders are most vulnerable," according to the regulator's findings.

SEBI's Unprecedented Regulatory Arsenal

Over 20 months starting mid-2024, SEBI rolled out restrictions that went far beyond anything attempted in developed markets:

Product-Level Interventions:

- Tripled minimum contract sizes from 5-10 lakh rupees to 15-20 lakh rupees

- Eliminated most weekly options expiries, restricting to Nifty 50 and Sensex only

- Mandated upfront collection of option premiums

- Introduced dynamic margin requirements

- Banned Jane Street for alleged index manipulation

Tax-Based Deterrents:

- July 2024: Increased securities transaction tax by ~60%

- February 2026: STT jumped another 150% on futures, 50% on options

Market Structure Changes:

- Capped intraday net exposure at 5,000 crore rupees per entity

- Blocked new exchanges from offering derivatives without cash equity markets first

- Implemented mandatory pre-trade loss disclosure popups

- Intensified finfluencer crackdown (only 2% are SEBI-registered advisors)

The immediate impact was devastating. Monthly options volumes collapsed from 397 million contracts in October 2024 to just 68 million by February 2025. The Futures Industry Association reported that global exchange-traded derivatives volume fell 42.5% in Q1 2025, with India's crackdown as the primary driver.

Budget 2026 Delivers Final Blow

The latest strike came February 1 when Finance Minister Nirmala Sitharaman announced massive securities transaction tax increases.

.png)

Brokerage stocks crashed during the Budget speech. Groww fell 11% as the finance minister spoke. The government projected 73,700 crore rupees in additional tax revenue and justified the hike by noting that derivatives volume exceeds 500 times GDP.

According to Finance Magnates Intelligence estimates, a trader executing 10 Nifty futures contracts daily will face roughly 75,000 rupees ($900) per month in additional STT costs from April. For high-frequency trading firms, many previously profitable strategies become unviable at the new rates.

"At this point of time, we are not contemplating any measures and whatever framework that we have put in place, that will continue," SEBI Chairman Tuhin Kanta Pandey said February 4, signaling the regulator considers its campaign complete for now.

Brokerages Hemorrhage Clients as Business Models Break

The crackdown decimated India's discount brokerage sector, offering a preview of what CFD firms might face if Western regulators adopt similar approaches:

|

Broker |

Client Loss |

Revenue Impact |

Strategic Response |

|

Groww |

600,000 (Jan-Aug 2025) |

-17% |

Stock fell 11% on Budget day |

|

Angel One |

450,000 (2025) |

-25% |

Revenue diversification push |

|

Zerodha |

Not disclosed |

Significant |

Pivoting to MTF; loan book ₹5,000 Cr |

|

Top 10 aggregate |

>10% decline |

Sector-wide compression |

Industry structural reset |

Finance Magnates Intelligence

Plus500 moved to enter India's regulated derivatives market earlier in 2025, buying a local broker for $20 million - timing that now looks questionable given the regulatory environment.

Finance Magnates Intelligence forecasts that the April STT increase will trigger a further 15-25% decline in retail derivatives volumes during the second quarter. Brokerages dependent on futures and options commissions face 10-20% earnings compression in fiscal 2026-27.

Why CFD Brokers Should Pay Attention

India's toolkit extends far beyond what Western regulators have deployed against CFDs. According to Finance Magnates Intelligence analysis, three tools have no direct equivalent in developed markets:

1. Transaction Tax as Behavioral Deterrent

- STT makes high-frequency strategies uneconomical

- Revenue impact is secondary to volume suppression

- No Western jurisdiction uses tax policy this aggressively

2. Mandatory Pre-Trade Loss Disclosure Popups

- Goes beyond website warnings to point-of-sale intervention

- Forces traders to acknowledge statistics before each trade

- More invasive than FCA or ASIC requirements

3. Expiry Restrictions to Specific Contracts

- SEBI eliminated daily/weekly expiries except on two indices

- Product bans based on tenor, not just leverage

- Western regulators focus on leverage caps, not contract design

Global Comparison: SEBI vs Western Regulators

|

Dimension |

SEBI (India) |

ASIC (Australia) |

FCA (UK) |

|

Retail loss rate |

91% |

68% (all), 85% (options) |

~80% |

|

Tax as deterrent |

STT up to 0.15% |

None |

None |

|

Product bans |

Weekly expiry limits |

Binary options only |

Binary options only |

|

Algo oversight |

Mandatory kill switches |

Limited |

Limited |

|

Finfluencer rules |

Active crackdown |

Not addressed |

Partial (SM4) |

|

Loss disclosure |

Pre-trade popup |

Website only |

Website only |

Finance Magnates Intelligence

"We have often stated that equity derivatives play a

crucial role in capital formation, but we must ensure quality and balance. We

will consult with stakeholders on ways to improve the tenor and maturity

profile of derivative products," Pandey said in August 2025, signaling

SEBI's preference for longer-dated products over ultra-short-dated speculation.

Unregulated CFDs Face Fresh Pressure

The tax increases create a perverse incentive. Earlier this month, observers warned that higher trading taxes on exchange-traded derivatives might push traders toward unregulated CFD platforms that don't charge STT.

SEBI has simultaneously ramped up identification tools. The regulator launched a verification system to help retail investors distinguish authorized intermediaries from unauthorized entities, though CFDs remain unregulated in India and fall outside SEBI's direct jurisdiction.

The dual pressure - making regulated products uneconomical while cracking down on unregulated alternatives - leaves international CFD brokers with few good options in the Indian market.

The Blueprint Goes Global

India's loss data substantially exceeds comparable Western figures:

- India (exchange-traded): 91% loss rate

- UK (OTC CFDs): 80% loss rate

- Australia (OTC CFDs): 68% overall, 85% for options CFDs

- Europe (OTC CFDs): 74-89% across markets

The gap is striking because India's products carry lower leverage than OTC CFDs - suggesting that when Western regulators start tracking exchange-traded derivatives outcomes, the numbers may be equally bad.

Australia's ASIC is currently reviewing its product intervention framework for CFDs. The UK's Financial Conduct Authority has opened consultations on speculative products. ESMA continues periodic product intervention reviews across Europe.

According to Finance Magnates Intelligence analysis, the transaction tax approach is the most likely candidate for cross-border adoption. Politicians facing budget pressures may find the dual benefits - revenue generation plus volume suppression - politically attractive.

What Comes Next for Brokers

Finance Magnates Intelligence identifies three strategic implications for CFD firms:

Immediate (Q1-Q2 2026):

- Model STT-equivalent impacts on your business

- Stress-test revenue under 50-80% volume decline scenarios

- Audit marketing partnerships against emerging finfluencer standards

Medium-Term (H2 2026-2027):

- Develop longer-tenor product offerings aligned with regulatory preferences

- Invest in real-time position monitoring and automated controls

- Prepare for mandatory loss disclosure at point of sale, not just websites

Strategic (2027+):

- Cross-jurisdictional readiness: India's toolkit will influence Western reforms

- Institutional pivot: HNW and institutional segments become primary growth

- Data transparency: Be prepared to share granular client outcome data with regulators

The Indian crackdown offers an unambiguous lesson: regulators armed with loss data will act, and the toolkit extends well beyond leverage limits and marketing restrictions.

Demand Proves Resilient Despite Crackdown

Despite 20 months of escalating measures, retail participation has started rebounding. Monthly options volumes recovered from the February 2025 low of 68 million contracts to roughly 190 million by late 2025. The recovery was driven by larger surviving participants rather than new retail entrants, but it demonstrates that underlying demand for speculation remains deeply entrenched.

SEBI's data revealed an uncomfortable structural reality: institutional investors consistently profit at retail traders' expense. Proprietary trading desks and foreign portfolio investors collectively earned what retail participants lost, raising fundamental questions about market fairness.

The regulator found that a significant portion of total losses stemmed from positions held through weekly expirations, where volatility spikes and retail traders are most exposed. Index options accounted for roughly 95% of all derivatives volume by retail traders - instruments that appear cheap due to low premiums but carry extreme leverage.

India's transformation into the world's largest derivatives market happened fast. The National Stock Exchange accounts for more than 70% of all index options contracts traded worldwide. Average daily derivatives trading reached $31 billion - more than double the cash equity market's $14 billion. The volume-to-GDP ratio exceeded 500:1, an order of magnitude larger than any comparable jurisdiction.