The Regulatory Tightening Begins

On 12 January 2026, CySEC issued a clear signal that the era of regulatory costs remaining static is over. With the issuance of two consultation papers, CP-2026-01 on investment firm fees and CP-2026-02 on PRIIPs regulation fees, the regulator outlined plans to fundamentally restructure how it funds its supervisory operations.

CySEC Chairman Giorgos Theokharides summarized the broader regulatory direction in his statement: "2026 marks a new phase for capital markets in Europe and Cyprus. In 2026 we will strengthen our supervisory checks and focus on the behavior of CIFs towards their clients."

This tightening reflects a European-wide trend. After years of regulatory rule-making (2015-2025), European supervisors are now transitioning from drafting phase to enforcement and compliance verification phase. For Cyprus-based CFD brokers, this means more audits, stricter oversight, and higher compliance costs.

Key Changes to Investment Firm Fees

CySEC's consultation paper proposes changes across three distinct categories:

- initial application fees,

- annual supervision fees,

- notification fees for material changes.

The impact on CFD brokers varies dramatically by business model.

Initial License Fees - The Most Dramatic Jump

The most significant shock appears in the extension of existing CIF licenses. Currently, extending a CIF license costs €3,500 as a flat fee. Under the new proposal, this becomes €8,000 per investment service (130% increase). For a typical CFD broker offering multiple services (dealing on own account, portfolio management, execution of orders), this could represent €24,000-€40,000 in extension fees.

Basic CIF licenses for standard investment services increase modestly from €7,000 to €8,000 per service (14% increase). However, if you offer multiple services, costs scale quickly. A broker offering services 1, 2, 4, and 5 (reception/transmission, execution, portfolio management, investment advice) would pay €32,000 instead of €28,000.

The most punitive increase targets market infrastructure operators. Licenses for MTF (Multilateral Trading Facility) and OTF (Organized Trading Facility) operations jump from €25,000 to €30,000 (20% increase). For CFD brokers operating proprietary matching systems, this creates a meaningful cost barrier.

Algorithmic Trading: A Compliance Tax

If your CFD operations include algorithmic trading functionality, CySEC now doubles the fee from €2,000 to €5,000. This 150% increase signals CySEC's intention to price algorithmic trading as a premium compliance area requiring dedicated supervision - a regulatory trend we see across EU jurisdictions.

Application and Notification Fees: The Underestimated Costs

Less publicized but operationally significant, CySEC is increasing numerous ancillary fees:

- Board member changes: €2,000 to €2,500 per person (25% increase)

- Branch establishment applications: €3,000 to €5,000 (66.7% increase)

- Tied agents registration: €3,000 to €5,000 (66.7% increase)

Clearing/settlement agreements for MTFs: €3,000 to €5,000 (66.7% increase)

For multi-jurisdictional CFD brokers with branches in EU member states or extensive tied agent networks, these costs accumulate quickly. A broker with two branches and a network of tied agents might face €20,000-€30,000 in combined application fees.

Material Changes: The New Notification Regime

CySEC proposes substantial changes to how brokers notify the regulator about operational changes. This framework matters because it determines what requires pre-approval versus post-fact notification.

Pre-Implementation Assessment (CySEC approval required before proceeding):

- Client strategy changes - transitioning from professional-only to retail clients or expanding to third countries | €1,000-€2,000

- Service model changes - modifying execution chains, safekeeping arrangements, or introducing complex financial instruments | €2,000-€5,000

- Outsourcing critical functions - delegating investment services, compliance, risk management, or internal audit | €5,000

Post-Implementation Notification (report within 15 days):

- Other material changes - any modifications not requiring pre-approval | €200 per change, max €1,000 per notification

Why This Matters? For CFD brokers planning operational changes - whether expanding clientele, modifying execution venues, or outsourcing functions like compliance - the new regime creates friction and delays. More critically, the costs incentivize brokers to batch changes efficiently to stay within the €1,000 cap for post-fact notifications.

Annual Supervision Fees: Scale-Based Increases

CySEC's annual supervision fee structure now more explicitly ties fees to entity complexity and risk profile. While detailed figures for each CIF category weren't disclosed in the initial consultation (CySEC uses confidential risk assessments), the proposed approach is clear: larger, more complex operations pay proportionally higher fees.

For a typical small CFD broker (1-3 employees, single investment service), annual supervision fees likely increase 15-20% from current baselines. For medium-sized brokers with multiple services and professional client bases, expect 20-25% increases. Large brokers with retail operations, multiple venues, and algorithmic trading capabilities could see 25-30% increases.

This tiering reflects European regulatory philosophy: risk-based pricing where firms posing greater systemic or consumer risk subsidize the regulator's supervision of those risks.

.png)

A Regulatory Gap Filled: CFD Brokers as PRIIPs Manufacturers

The second consultation paper introduces entirely new fees targeting entities under Regulation (EU) 1286/2014 on Packaged Retail and Insurance-based Investment Products (PRIIPs). While PRIIPs traditionally covered mutual funds and insurance-linked products, regulatory evolution has expanded the definition to include complex CFD structures, index-tracking products, and structured notes.

Proposed Annual Fees:

- PRIIPs Manufacturers: €8,000 per year

- PRIIPs Distributors/Advisors: €4,000 per year

- Performing both roles cumulatively: €12,000 per year

Who Pays? Any CIF under CySEC supervision that manufactures packaged products or provides investment advice/distribution for such products. For CFD brokers, this typically applies if you create structured products pegged to indices, commodities, or exotic underliers, or if you actively market third-party investment products to retail clients.

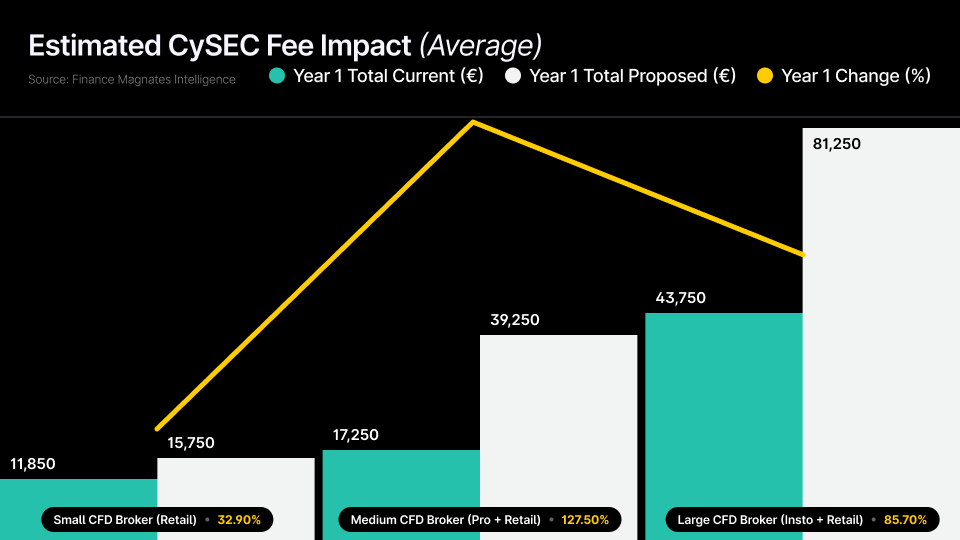

Budget Preparation: What You'll Pay in 2026+

The table below illustrates projected compliance costs across three typical CFD broker profiles, from entry-level retail operators to large multi-venue institutions.

|

Cost Category |

Small CFD Broker (Retail) |

Medium CFD Broker (Pro + Retail) |

Large CFD Broker (Insto + Retail) |

|

Initial / extension license fee |

€8,000 |

€15,000–€20,000 |

€30,000–€40,000 |

|

Annual supervision fee |

€2,500–€3,500 |

€6,000–€8,000 |

€12,000–€15,000 |

|

Algorithmic trading add-on |

— |

— |

€5,000 |

|

Material changes / notifications |

€500–€1,000 |

€1,500–€2,000 |

€3,000–€4,000 |

|

PRIIPs fee |

€4,000 (distributor) |

€8,000 (manufacturer) |

€8,000 (manufacturer) |

|

Board member changes (annual avg) |

— |

€5,000 (2/year) |

€7,500–€10,000 (3–4/year) |

|

Branch / tied agent applications |

— |

— |

€5,000–€10,000 |

|

Year 1 total |

€15,000–€16,500 |

€35,500–€43,000 |

€70,500–€92,000 |

|

Ongoing annual (years 2+) |

€7,000–€8,500 |

€20,500–€23,000 |

€40,500–€54,000 |

These figures represent Finance Magnates intelligence estimates based on CySEC's consultation papers; actual costs may vary depending on individual firm circumstances and final regulatory decisions.

What CFD Brokers Must (or Can) Do Now?

Medium-Term Preparation (March–June 2026)

- Operational Restructuring (if fee increases exceed 10–15% threshold): Narrow investment service scope to reduce per-service licensing costs. Consolidate branch operations under single license to minimize extension fees. Evaluate outsourcing arrangements to lower capital and supervision requirements

- Compliance Infrastructure Investment: Deploy automated client categorization systems (retail vs. professional) to manage notification costs. Implement documentation tracking for material changes. Build PRIIPs KID template management for product manufacturers

- Pricing Analysis (typical cost absorption patterns):

- Small brokers: absorb 50–75%, pass 25–50% to clients

- Medium brokers: split increases 50/50 with clients

- Large brokers: absorb 75–100% due to scale advantages

Strategic Options for CFD Brokers (2027+)

|

Option |

Best For |

Key Actions |

Cost Implication |

Trade-offs |

|

A: Remain in Cyprus |

Brokers with scale & EU client focus |

Absorb fee increases, optimize service mix, leverage EU passporting |

Higher ongoing fees but no migration cost |

Pay premium for EU access & regulatory credibility |

|

B: Migrate to Lower-Cost Jurisdiction |

Fee-sensitive firms with international clients |

Relocate to FCA (UK/EU clients), DFSA (Dubai - global), or Seychelles (low-cost) |

€20,000–€50,000 migration + setup |

Lose EU passporting (except FCA), potential reputational impact |

|

C: Hybrid Model |

Multi-service brokers with diverse offerings |

Keep Cyprus CIF for core services, add alternative licenses for crypto/exotics |

Dual licensing costs but optimized per service |

Operational complexity managing multiple regulators |

Preparation Matters

For CFD brokers, this transition brings both challenges and opportunities:

- Challenges: Compliance costs rising 20-30% annually create margin pressure, forcing operational efficiency improvements or client pricing adjustments.

- Opportunities: Higher fees reduce new competitor entry, benefiting established operators who can absorb costs. Enhanced supervision credibility may improve Cyprus's regulatory reputation, attracting quality brokers away from lower-cost but less-regulated jurisdictions.

The regulatory tightening that Chairman Theokharides promised for 2026 is materializing through both operational oversight increases and financial mechanism changes. Brokers who anticipate these changes, prepare financially, and adapt operationally will navigate this transition more successfully than those caught by surprise.