Cayman Islands Regulatory Update for Virtual Asset Service Providers

Effective 1 April 2025, the Cayman Islands’ updated VASP rules require licensing for virtual asset custodians and trading platforms, strengthen governance and registration requirements, and align the regime with global AML, cybersecurity, and consumer protection standards.

The Cayman Islands has significantly updated its virtual asset regulatory framework through the Virtual Asset (Service Providers) (Amendment) Regulations, 2025, effective 1 April 2025. Marking Phase Two of the VASP regime, the reforms introduce mandatory licensing for virtual asset custodians and trading platforms, strengthen governance and registration requirements, revise fee structures, and align the jurisdiction with global AML, cybersecurity, and consumer protection standards.

Regulation Overview

The Cayman Islands has introduced a significant overhaul of its virtual asset regulatory framework with the Virtual Asset (Service Providers) (Amendment) Regulations, 2025. Effective from 1 April 2025, this reform marks the beginning of Phase Two of the jurisdiction's VASP legislative framework.

These changes introduce mandatory licensing requirements for entities providing virtual asset custody services or operating virtual asset trading platforms in or from the Cayman Islands. They also update registration obligations for all other VASP categories, enhance corporate governance mandates, and refine fee structures. The amendments align the Cayman Islands with global best practices for anti-money laundering (AML), cybersecurity, and consumer protection.

Who Do the VASP Amendments Apply To?

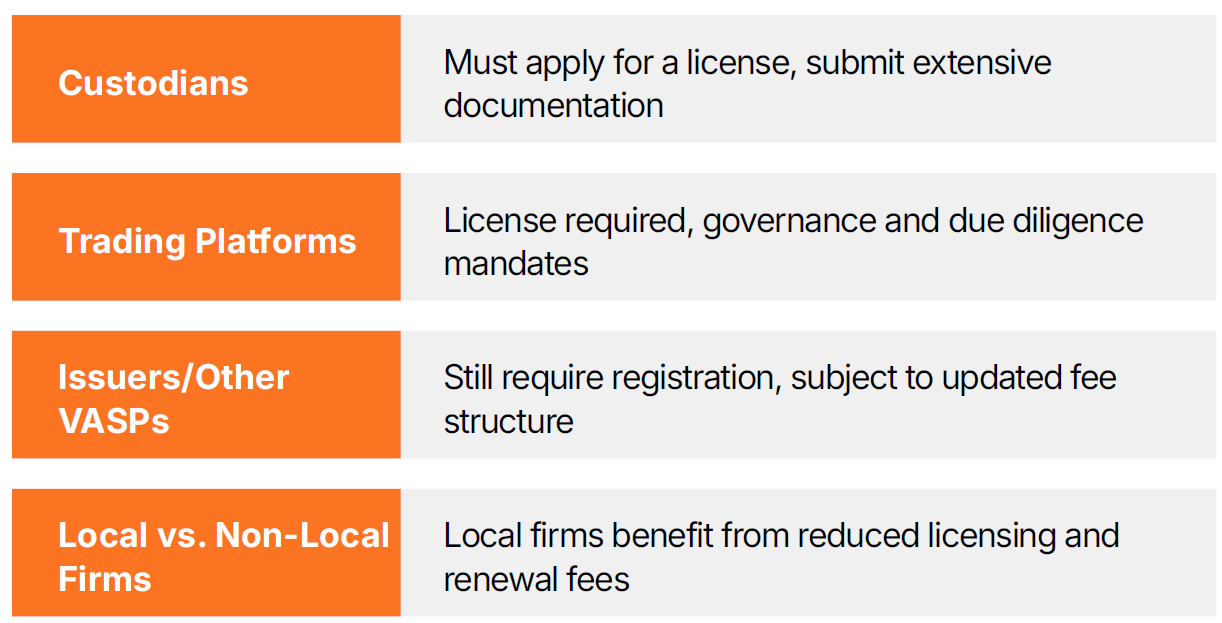

The amended framework applies to a wide range of virtual asset service providers, including:

●Virtual Asset Custodians: Firms that safekeep or administer digital assets or their control mechanisms.

●Trading Platform Operators: Entities that facilitate exchanges between virtual assets and fiat or other digital assets on behalf of third parties.

●All Other VASPs: Entities engaged in issuance or transfer of virtual assets still require registration under the Act.

Entities performing both licensable and registrable activities will require only a license, not both.

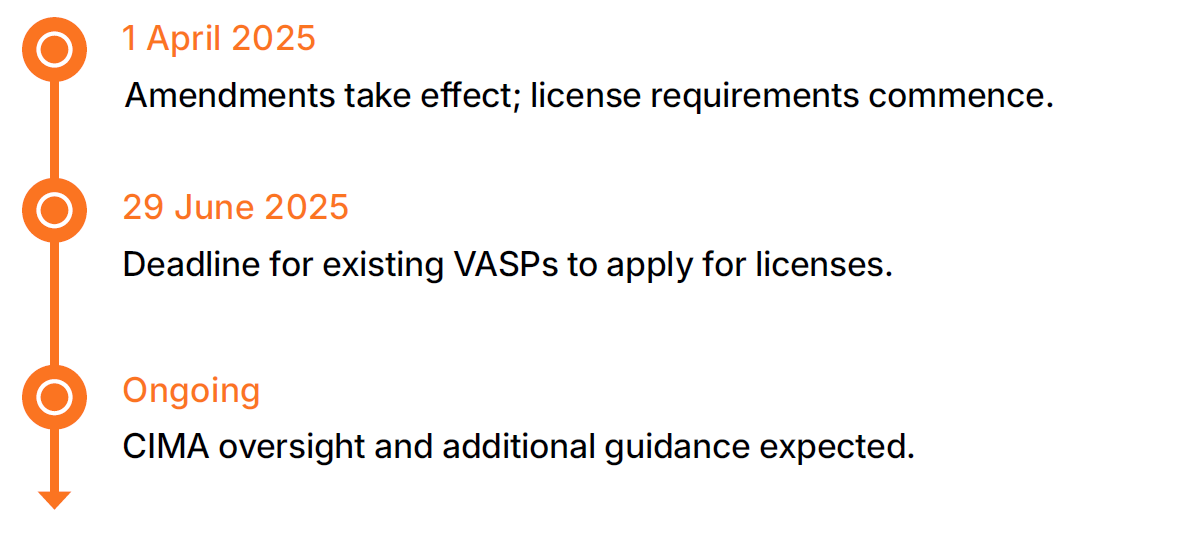

Timeline and Implementation

Impact Analysis: Who Is Affected and How?

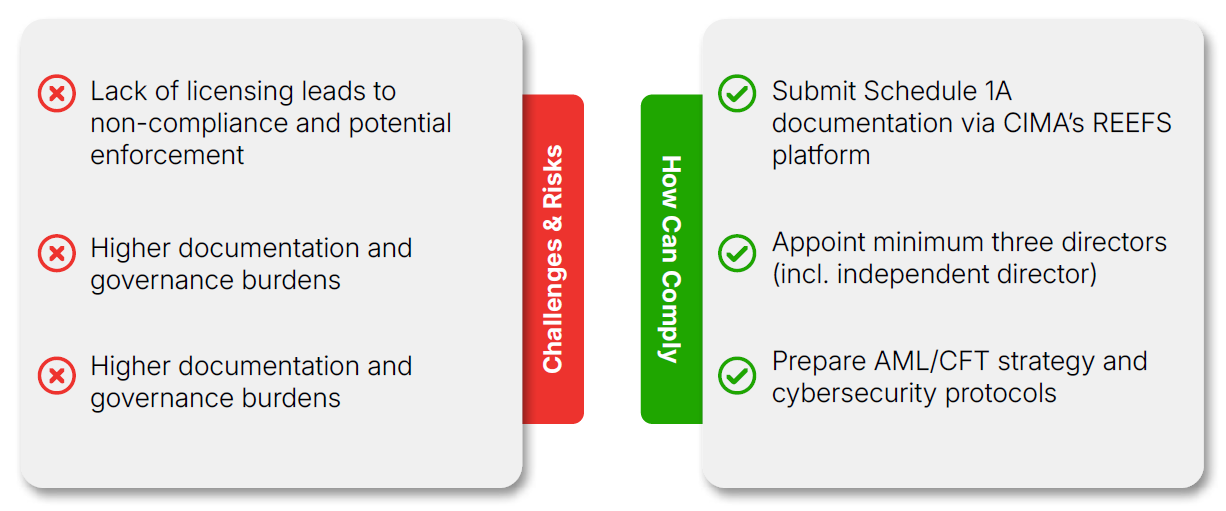

How Your Business Can Comply If You Are Regulated by CIMA

Custody Service Providers:

●Provide asset segregation statements

●Outline cybersecurity, risk, and insurance strategies

●Identify qualified directors with relevant experience

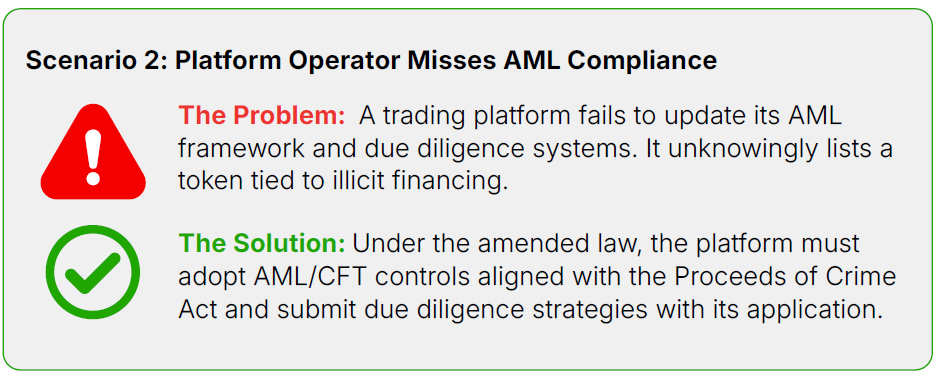

Trading Platform Operators:

●List supported virtual assets and confirm trading revenue forecasts

●Provide disclosures and due diligence methods for listed assets

●Address price manipulation and market integrity strategies

Issuers & Other VASPs:

●Complete updated registration forms

●Provide revenue projections and compliance plans

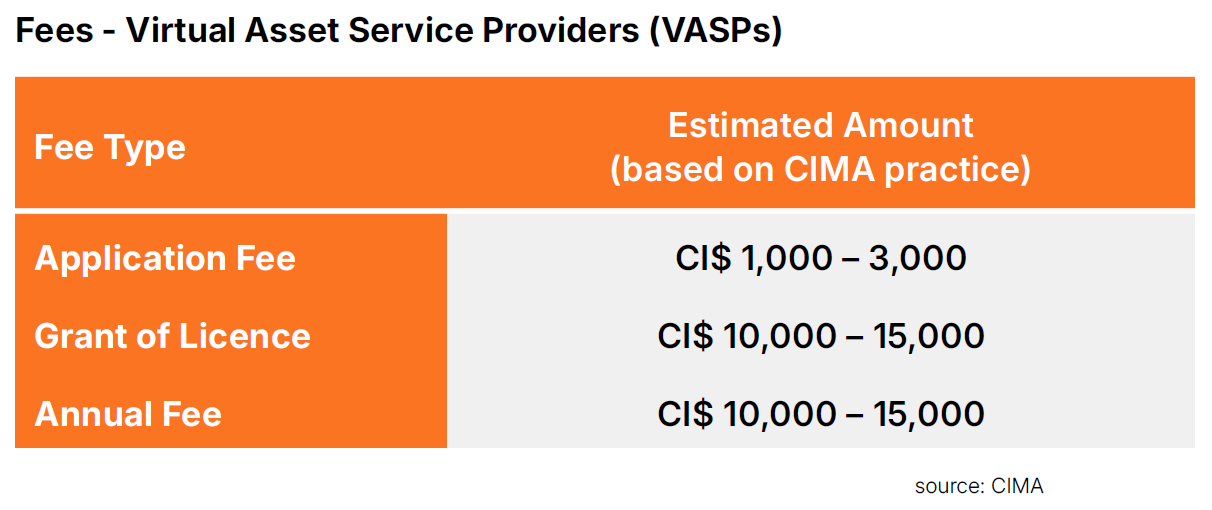

●Understand revised fee structures

Expert Opinion

“The Cayman Islands’ AML/CFT Phase Two registration strategy, first and foremost, aligns with the FATF's risk-based framework, which highlights that regulatory demands should match the risks associated with various types of Virtual Asset Service Providers (VASPs) and their operations. There’s a strong focus on adhering to AML/CFT regulations, which include essential practices like customer due diligence (CDD), keeping thorough records, and reporting any suspicious transactions (STR) before a license is granted."- John Murillo, Chief Dealing Officer of B2BROKER

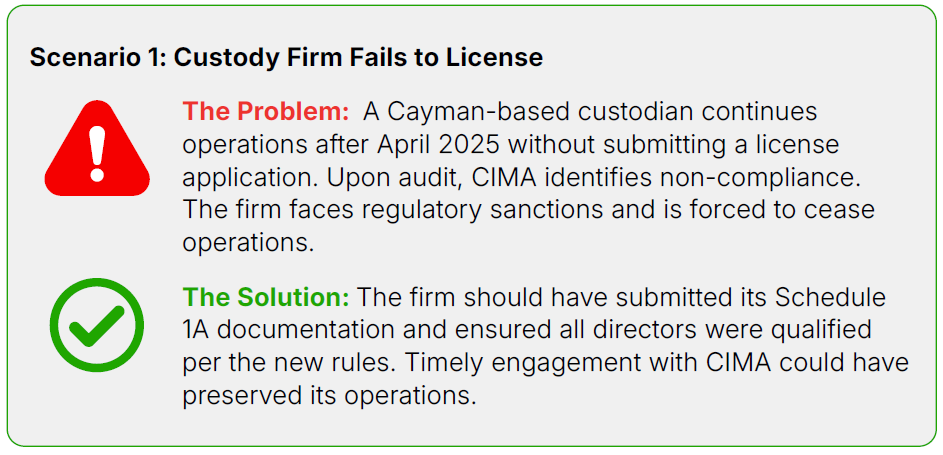

Real-World Scenarios & Case Studies

Implications of Cayman VASP Amendments for Other Offshore Jurisdictions

Lessons from VASP Implementation: Why This Matters

●Licensing is now mandatory for key VASP categories

●Governance reforms ensure transparency and oversight

●Tiered fees encourage participation from small and local firms

●Non-compliance carries significant enforcement risk

●Early planning, document preparation, and regulatory engagement are essential

By strengthening its VASP framework, the Cayman Islands enhances global trust in its virtual asset ecosystem and aligns its regime with evolving international standards on digital finance and financial crime prevention.

What’s Changing?

●Cayman Islands shifted from basic registration to mandatory licensing for key VASP activities (custody & trading platforms).

●Introduced detailed compliance, governance, and AML/CFT requirements.

●Aligns with FATF and EU MiCA — raises the bar for offshore regulatory standards.

What This Means for Other Offshore Hubs

●Jurisdictions like BVI, Seychelles, Isle of Man may face pressure to tighten rules or risk falling behind.

●Potential for regulatory arbitrage to shrink as more offshore regulators adopt licensing models.

●Global standardization is accelerating — light-touch regimes may not last.

Should Crypto Firms Be Concerned?

● Yes, if they’re regulated in offshore zones with minimal oversight.

●Firms could face increased scrutiny, banking challenges, or lose institutional credibility.

●Sudden changes in local rules could disrupt operations if unprepared.

How to Prepare: Actionable Takeaways

- Conduct internal compliance audits: Would you pass Cayman’s new standards?

- Review governance: Do you have independent directors, documented controls?

- Strengthen AML/CFT and cybersecurity protocols.

- Prepare licensing-ready documentation (business plans, client asset segregation, risk policies).

- Monitor regulatory updates in your jurisdiction — change is likely coming.