Advancing EU Capital Markets: Integration Pathways for 2025 and Beyond

The European Commission’s targeted consultation aims to advance the Capital Markets Union by reducing regulatory fragmentation and cross-border barriers, making it easier for companies to raise capital and for investors to access EU-wide investment opportunities.

The European Commission is advancing its long-standing Capital Markets Union agenda through a targeted consultation aimed at deepening the integration of EU capital markets. By addressing persistent challenges such as regulatory fragmentation, supervisory inconsistencies, post-trading inefficiencies, and limited retail investor participation, the initiative seeks to remove cross-border barriers to investment. The overarching objective is to create a more efficient, resilient, and unified single market that enables businesses to raise capital more easily and allows investors to access opportunities across the European Union.

Regulation Overview

The integration of EU capital markets is a cornerstone of the European Union’s vision for a Capital Markets Union (CMU). In an environment where fragmented rules, national barriers, and uneven supervisory practices limit cross-border investments, the European Commission is taking a bold step forward. Its recent Targeted Consultation on the Integration of EU Capital Markets seeks to accelerate convergence, foster efficiency, and strengthen financial stability by uniting Europe’s capital markets into a seamless single market.

This initiative is a continuation of the CMU agenda launched in 2015, with a sharpened focus on addressing long-standing issues—ranging from post-trading inefficiencies and supervisory fragmentation to limited retail investor participation. The goal: remove barriers that hinder capital flows across EU borders, making it easier for companies to raise funds and for investors to access investment opportunities across the Union.

Who Is This Initiative For?

The consultation is relevant to a wide array of financial actors and institutional stakeholders, including:

- Investors and Asset Managers

- Banks and Investment Firms

- Market Infrastructures (CSDs, CCPs, exchanges)

- Supervisory and Public Authorities

- Corporates and SMEs

- Brokers, crypto exchanges, and fintech firms

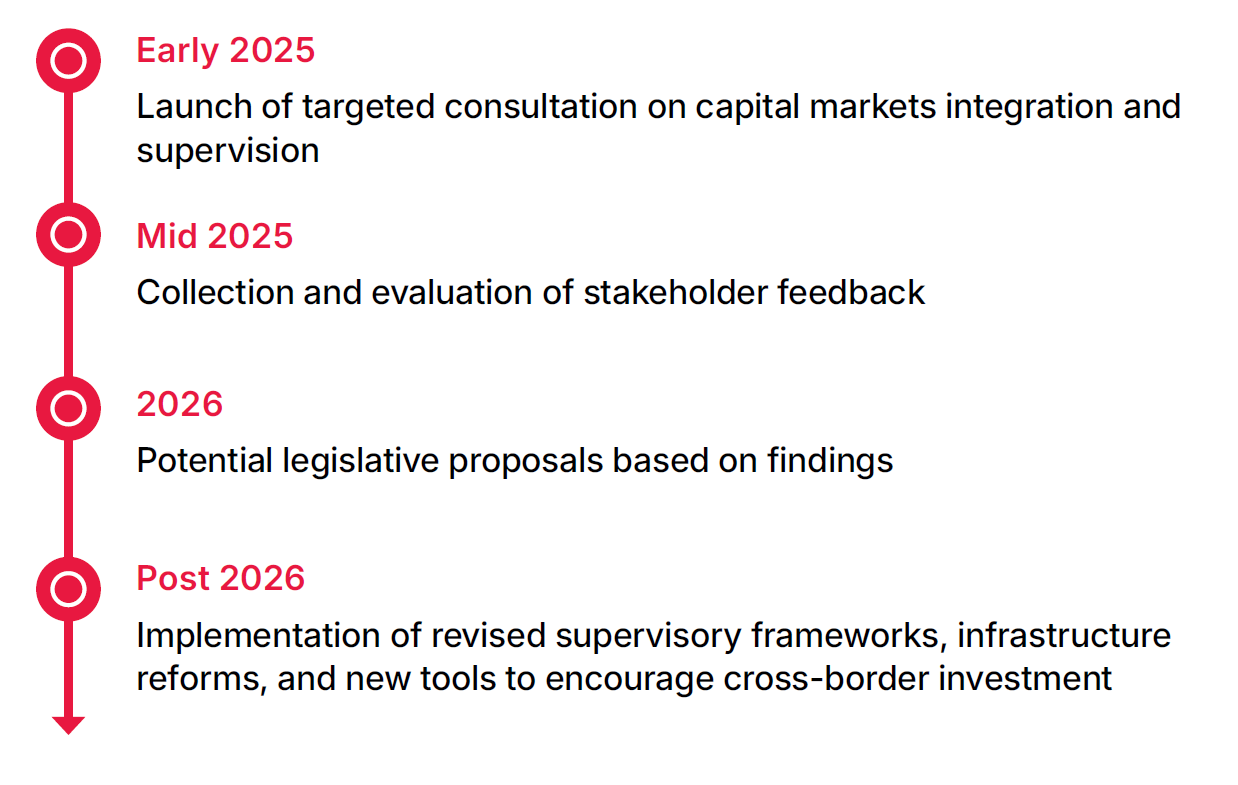

Timeline and Policy Roadmap

The consultation period is part of a broader timeline leading into 2025, when concrete actions and legislative proposals are expected to emerge. While exact enforcement dates depend on the policy path chosen, the following sequence outlines key milestones:

What the Consultation Covers: Key Themes and Topics

The questionnaires released as part of the consultation offer insight into the EU’s areas of focus. They explore:

- Barriers to Cross-Border Investment

- Market Fragmentation

- Retail Investor Participation

- Post-Trading Systems

- Supervisory Coordination

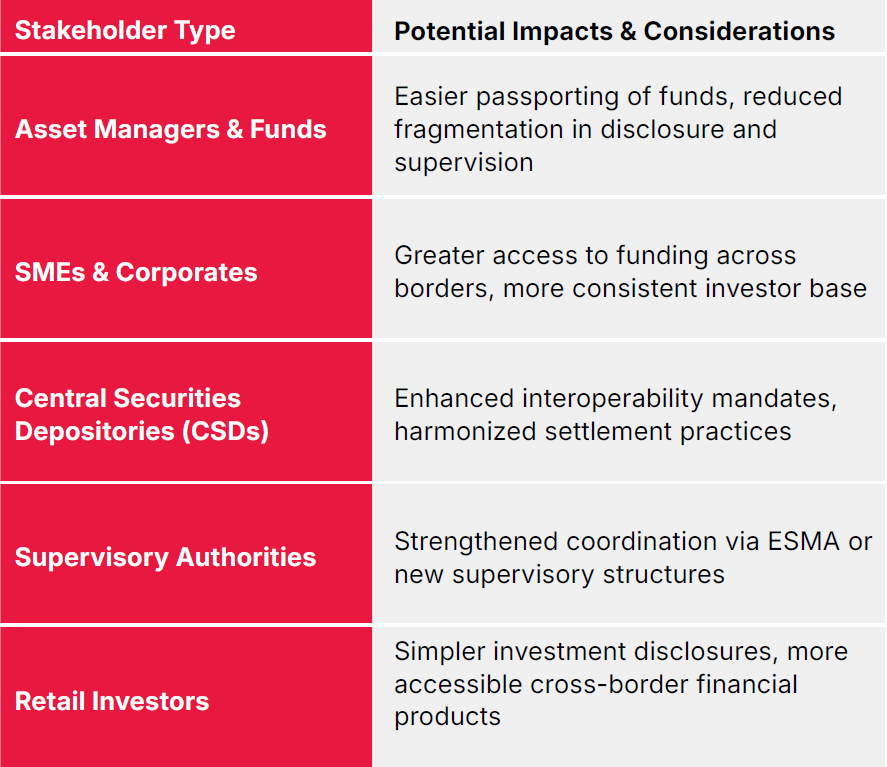

Impact Analysis: Who Is Affected and How?

The consultation’s policy outcomes will have wide-reaching consequences for market participants and institutions, including:

Barriers to Integration: Core Challenges

❌ Regulatory Divergence

- National gold-plating of EU directives causes inconsistency in application

- Fragmented supervision results in uneven enforcement

❌ Market Infrastructure Inefficiencies

- Incompatibilities between CSDs delay settlement and raise costs

- Complex cross-border account structures limit scale and liquidity

❌ Retail Access & Confidence

- Lack of financial literacy, high product complexity, and limited trust hinder retail engagement

❌ Tax and Legal Obstacles

- Withholding tax procedures are cumbersome and vary across jurisdictions

- Legal uncertainty around investor protection deters cross-border transactions

Policy Directions Under Review

The EU is weighing several policy options through the consultation, including:

- Greater Role for ESMA (possibly centralized supervision)

- Pan-European Market Infrastructure Tools (e.g. CSD interoperability)

- Tax Simplification Initiatives (e.g. relief-at-source standardization)

- Enhanced Data Transparency (via EU-wide access points like ESAP)

- Retail Investor Boosting Measures (e.g. comparability tools, simplified disclosures)

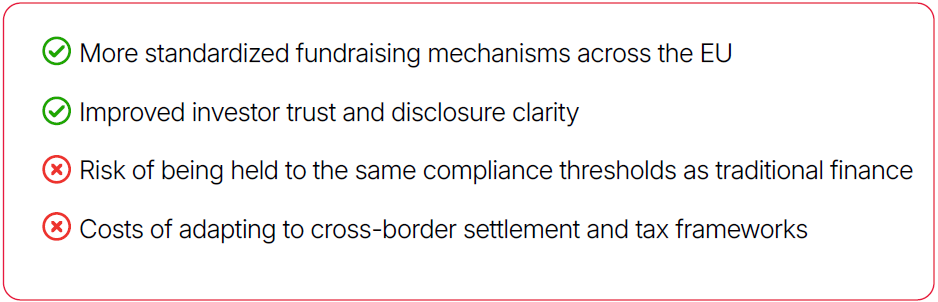

What Capital Markets Integration Means for Specific Market Participants

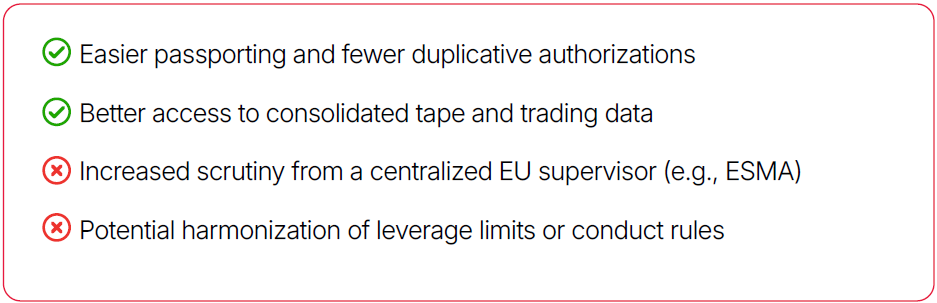

For Brokers

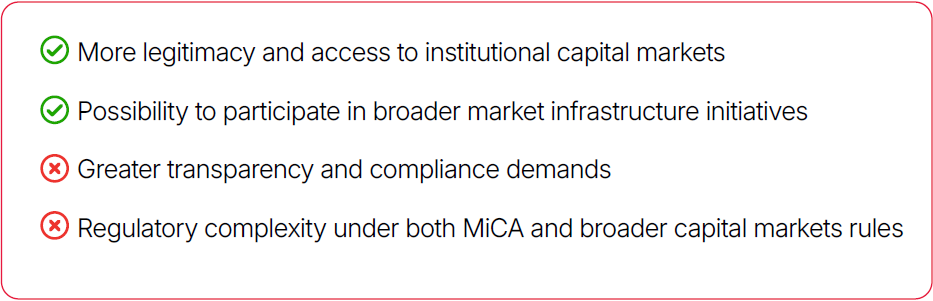

For Crypto Firms

For Fintech/Payment Firms

Expert Opinion

“Currently, Europe is actively working on creating a common financial space, but so far there are many different approaches and unresolved issues. The first is which products can be offered to customers. Despite the general EU directives, brokers play a different role in different countries. For example, in Cyprus, they operate quite independently, while in other countries, such as Germany, they are often closely linked to banking structures.And in this case, one of the pressing issues is how to distinguish between banking products (for example, deposits) and investment products.[…] We must not forget that the unification of financial markets is also a way for Europe to strengthen its position against the background of the United States. The Americans have always actively defended their market, and now Europe is also moving in this direction and building its own strong and independent financial system.”-Julia Khandoshko, CEO of broker Mind Money

“Amid global economic uncertainty and political instability abroad, EU legislators are embracing a stronger pro-European stance. In this context, building a unified and self-reliant financial market is a logical strategic move.

The EU Capital Markets strategy aims to support this vision by improving households’ access to higher-return investment opportunities, thereby stimulating economic growth. Diversified cross-border investment incentives are expected to emerge from this proposal.

This overall good intention shall be treated with caution by the regulators, as it may pave the way for an unexpected result otherwise. Centralized supervision by ESMA over major trading infrastructures and exchanges should bring more consistent oversight. Thus, more challenges will be faced by the risk and compliance functions in financial institutions.“ - Eva van der Leer, Senior Risk Officer at FINOM.

Key Takeaways

- Monitor outcomes of the EU consultation for changes impacting cross-border licensing or market access

- Prepare for possible ESMA-led or centralized supervision reforms

- Engage in discussions on market infrastructure, including CSD reforms and the consolidated data tape, to evaluate impacts on execution and post-trade services

- Advocate for proportionate regulatory solutions to ensure smaller firms aren't unduly burdened

- Consider how harmonized retail investor rules might affect product design, leverage, or marketing